Bitcoin Hashprice Drops to Seven-Month Low, Pressuring Mining Margins

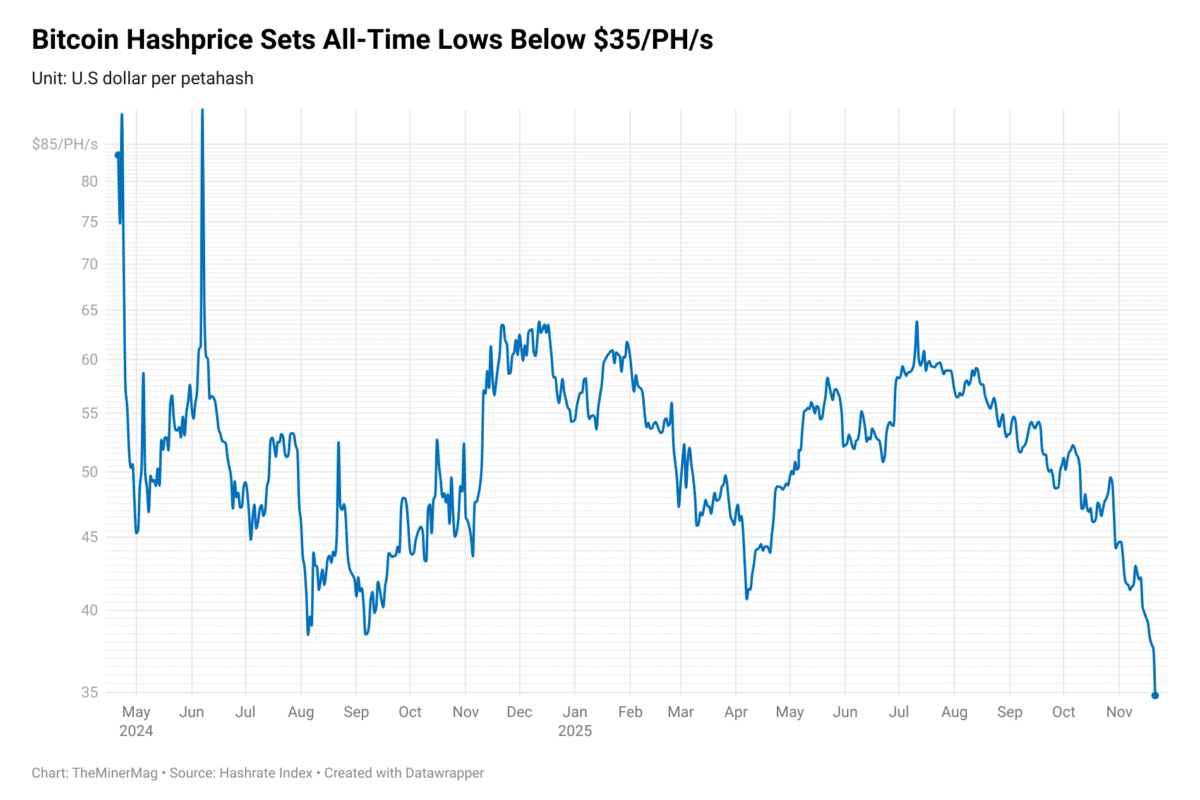

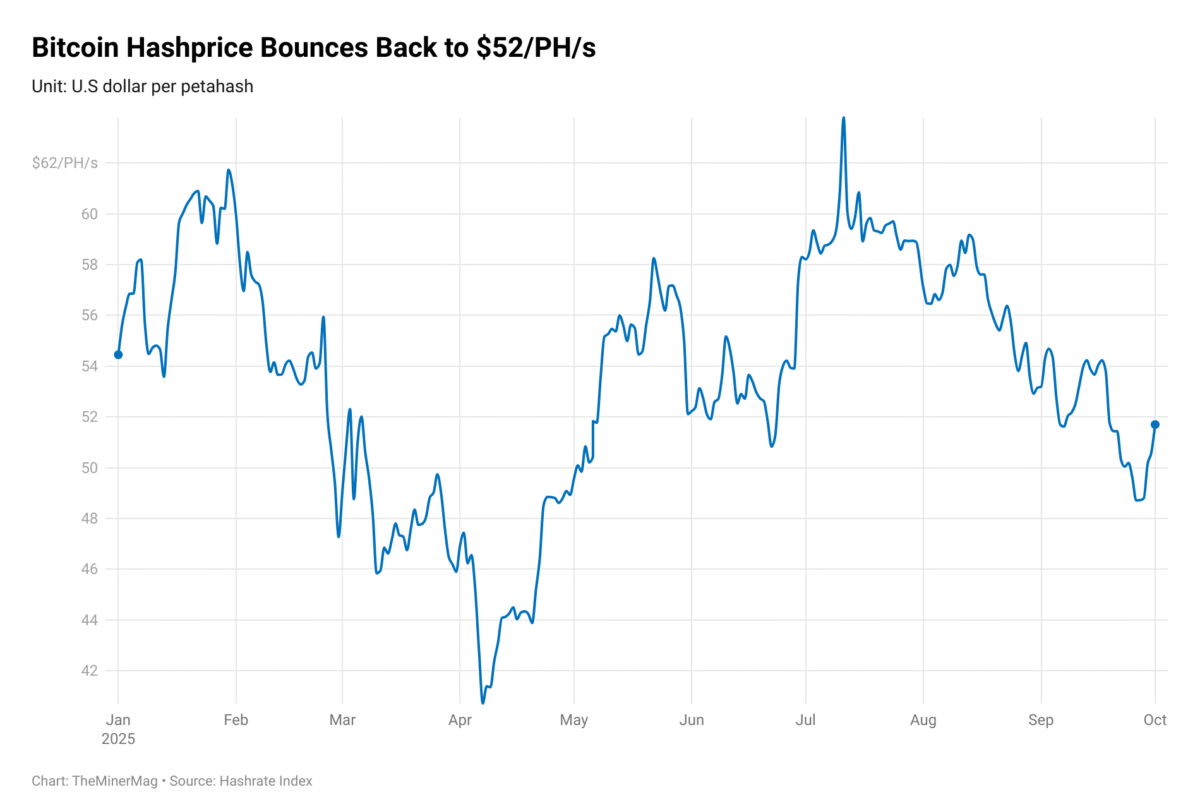

Bitcoin’s hashprice—a key mining revenue metric—fell below $40/PH/s on Monday before rebounding slightly to $41/PH/s on Tuesday, marking its lowest level since mid-September.

Data from Hashrate Index shows that the decline has erased the entire U.S. election rally, which had pushed hashprice above $60/PH/s during the fourth quarter.

The drop coincided with a broader sell-off in global markets that intensified over the weekend and into Monday, following U.S. President Donald Trump’s announcement of sweeping global tariffs.

Bitcoin’s market price slumped alongside other risk assets, plunging to as low as $75,000 on Monday, further pressuring miners’ earnings.

Hashprice represents the daily revenue a miner can expect per unit of hashrate and is influenced by both Bitcoin’s market price and network difficulty.

At $41/PH/s, the current hashprice is nearing—or even falling below—the fleet-wide hashcost, or breakeven point, for several major mining firms. This suggests that parts of the industry may now be operating at a gross loss.

Hashcosts vary across companies based on factors such as energy rates, machine efficiency, and operational scale. Still, a prolonged hashprice at current levels could force some miners to shut down machines or scale back operations to reduce cash burn.

The downturn adds another layer of stress to a sector already grappling with thinning margins and rising competition. Some large, publicly traded miners are also exploring alternative uses for their power capacity, including potential conversion to high-performance computing (HPC) hosting.