Bitcoin Mining Stocks Rebound After Trump Pauses Tariff Plans

U.S. bitcoin mining stocks surged on Wednesday following news that the Trump administration will implement a 90-day pause on global tariffs.

Shares of major publicly traded bitcoin mining companies posted double-digit gains after officials confirmed the temporary suspension of new trade measures, easing investor concerns that had triggered a broad market sell-off earlier in the week.

The White House announcement helped reverse a sharp downturn in the digital asset sector, which had been caught in the crossfire of broader market fears over a potential global trade war. Bitcoin prices also rebounded to $82,000 after dipping to a local low of $75,000 earlier this week.

Mining stocks—which are closely tied to bitcoin’s price and investor sentiment around regulatory policy—had declined sharply in recent days amid uncertainty over how tariffs might affect equipment supply chains and energy markets.

Bitfarms and Bitdeer led the rally with gains of more than 20%, although the sector saw modest declines during early trading hours on Thursday.

The U.S. bitcoin mining industry, which relies heavily on imported hardware and is sensitive to global energy prices, remains particularly vulnerable to trade uncertainty. Any disruption to ASIC miner supply chains or increases in energy costs could significantly squeeze operator margins.

So far, the Trump administration has not indicated whether bitcoin mining or cryptocurrency-specific components would be targeted in future trade actions.

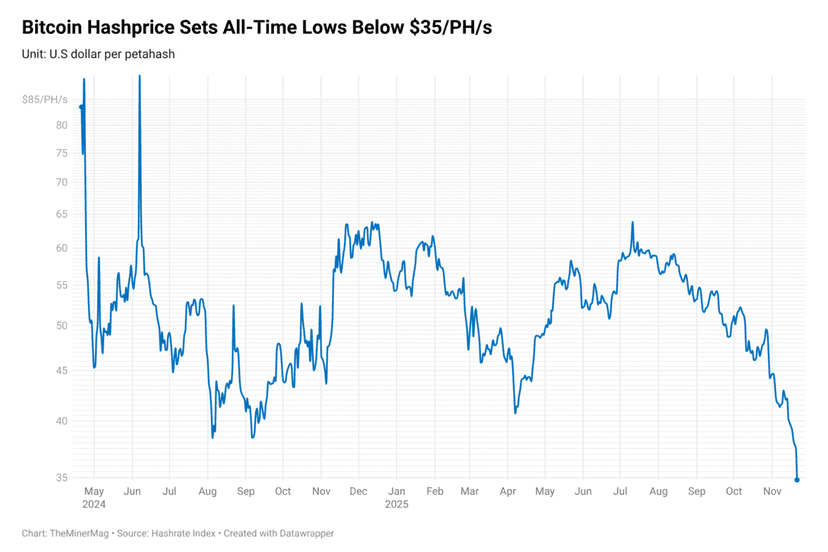

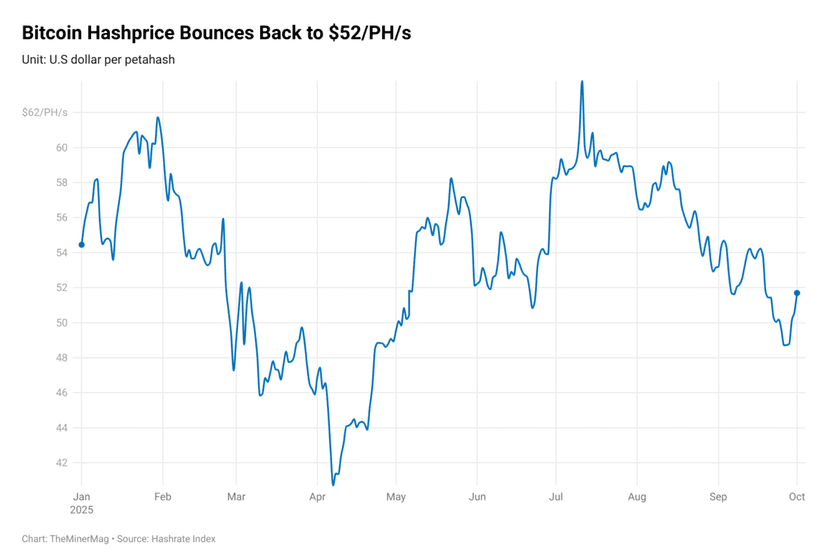

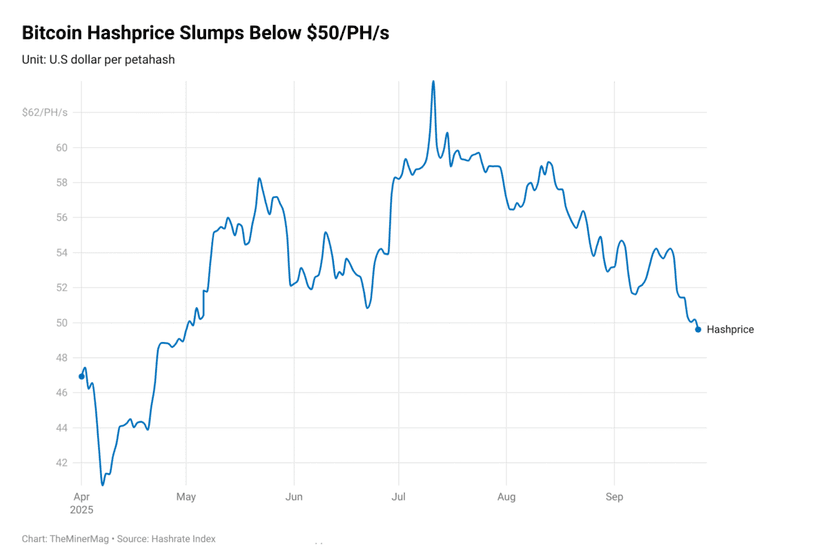

While Wednesday’s rebound brought some relief to miners and investors, recent market volatility has pushed Bitcoin’s hashprice to new lows below $40/PH/s, increasing pressure on operational margins—even for large-scale mining companies.

Year-to-date, bitcoin mining stocks have significantly underperformed Bitcoin itself, shedding around $20 billion in combined market capitalization from recent highs.