Bitcoin Mining Difficulty Set for Largest Drop Since December 2022

Bitcoin’s mining difficulty is poised for its steepest downward adjustment since December 2022, with estimates pointing to a decline of around 6% in about three days.

Network data indicates the projected drop follows a retreat in the seven-day moving average hashrate, which has fallen to 820 EH/s after peaking above 900 EH/s earlier this month.

If realized, the adjustment would mark the largest easing of mining conditions since the December 2022 bottom of the last bear market, offering some near-term relief to miners grappling with historically low hashprice levels.

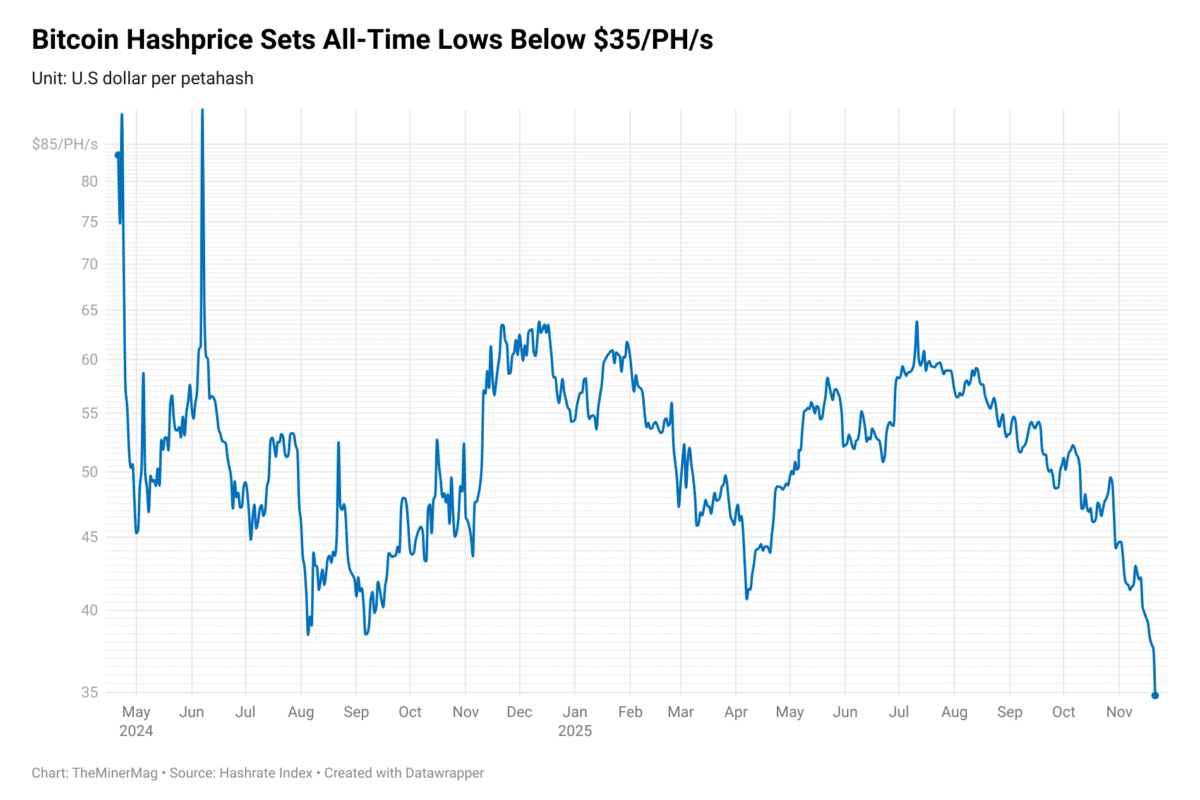

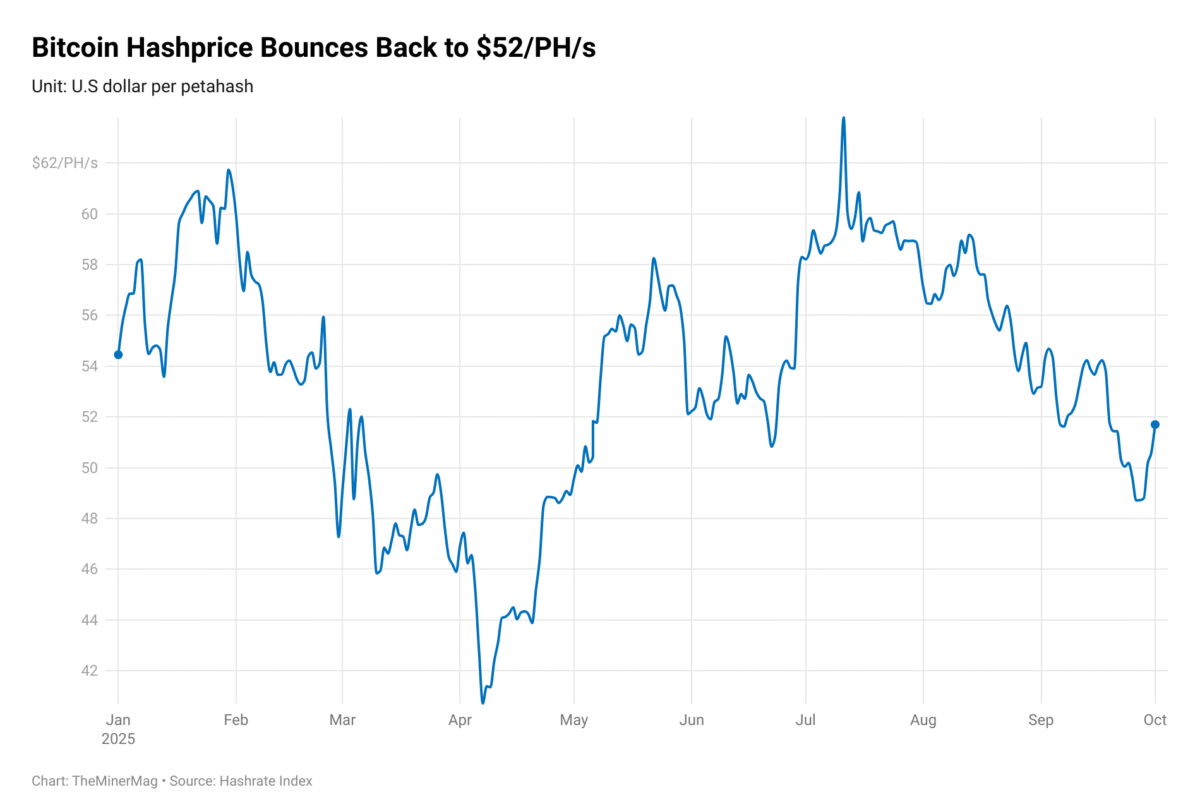

Bitcoin’s hashprice—the measure of expected miner revenue per unit of hashrate—recently fell into the low $40/PH/s range, its lowest point since mid-September 2024. A combination of factors—including a broader market sell-off, plummeting transaction fees, and record-high mining difficulty—has squeezed miner margins across the board.

However, Bitcoin’s recent rebound above $95,000 has begun to improve mining economics. If the current price level and the expected difficulty drop hold, hashprice could recover to around $50/PH/s, offering a partial rebound from recent lows.

The upcoming difficulty adjustment reflects a pullback in mining competition, as lower-efficiency machines have gone offline amid the bleak hashprice environment. The resulting drop in hashrate and corresponding difficulty decrease could help stabilize miner revenue per unit of hashrate, at least in the short term.

Still, long-term profitability remains uncertain. Hashprice continues to hover near break-even levels for many mid-tier operators. The post-halving landscape has accelerated Bitcoin liquidation among public miners and spurred a shift toward diversified business models, including high-performance computing and AI hosting.