Bitcoin Mining Difficulty Poised to Rebound as Hashrate Recovers Above 900 EH/s

Bitcoin’s mining difficulty is projected to rise by around 6% in the upcoming adjustment on Friday, largely reversing the 7.48% drop recorded two weeks ago, network data shows.

The increase reflects a strong rebound in network hashrate, which has climbed back above 900 EH/s on the seven-day average, which signals that many miners curtailed during the U.S. summer heatwaves have returned to the network, at least for now.

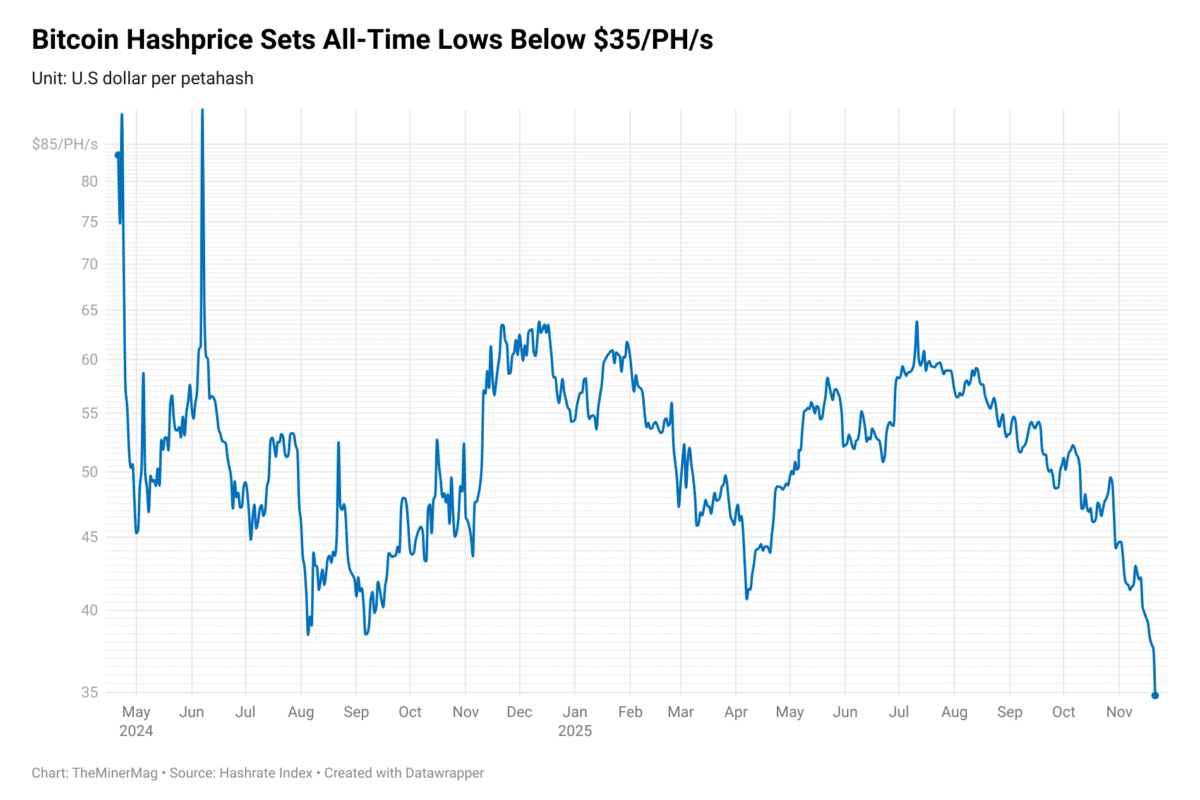

The surge in hashrate is already weighing on hashprice, a key revenue metric that tracks miner earnings per unit of computing power. With Bitcoin’s market price hovering around $108,000 and transaction fees remaining sluggish, the hashprice is expected to retreat to below $55 PH/s, down from a recent recovery high of $58/PH/s. Unless fee activity picks up or BTC prices rally further, miners may struggle to sustain profitability at current levels.

The tightening economics come as several mining companies are reassessing their exposure to Bitcoin mining altogether. Bit Digital recently announced it had completed its transition to an Ethereum-based treasury strategy, selling off its Bitcoin holdings and winding down its mining segment.

Meanwhile, Core Scientific—once the largest Bitcoin miner in North America—is in the process of being acquired by AI cloud company CoreWeave in an all-stock deal. While Core Scientific will retain its data center footprint, the company has signaled it may potentially divest its self-mining operations as part of its pivot toward hosting high-performance computing workloads.