Bitcoin Hashprice Remains Flat After Moderate Difficulty Uptick

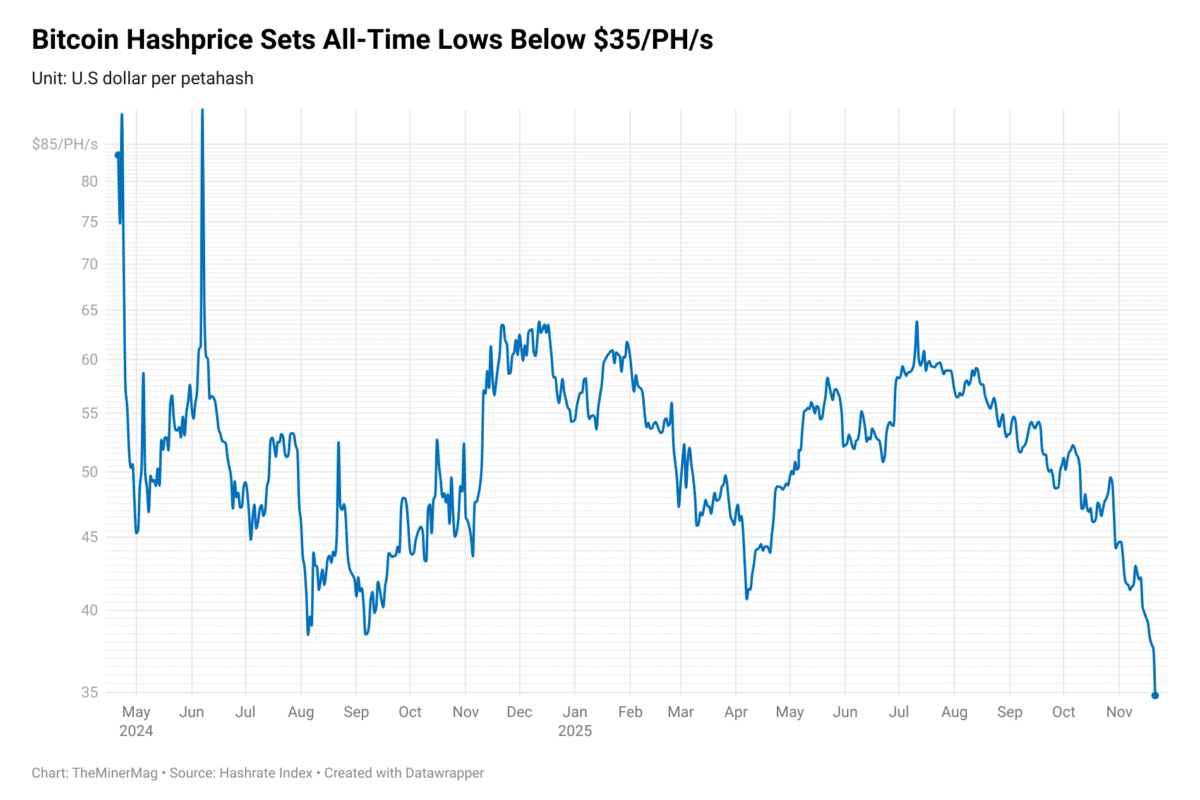

Bitcoin’s hashprice—the daily revenue per unit of hashing power—has remained flat at around $48 per petahash per second (PH/s), following a modest 1.4% increase in network difficulty on Sunday.

Network data shows that Bitcoin’s difficulty rose after the seven-day average hashrate fell below 800 exahashes per second (EH/s), erasing much of the temporary surge to 840 EH/s observed since the previous epoch began on March 9.

The hashrate decline in recent days coincided with a broader market sell-off, which saw Bitcoin’s price drop to $80,000. This caused the hashprice to dip to as low as $44/PH/s on March 11.

Although hashprice has since recovered to $48/PH/s, it remains below the $50 mark, putting pressure on operators running older-generation machines such as the Antminer S19 XP and S19 Pro.

Revenue for the S19 XP and S19 Pro has now declined to $0.088 and $0.067 per kilowatt-hour, respectively, due to the recent hashprice slump. Operators with electricity costs at or above these levels would be mining at a gross loss—likely contributing to the recent hashrate decline.

Further compounding the issue is the ongoing drop in Bitcoin transaction fees. So far in March, transaction fees have accounted for just 1.12% of total block rewards, positioning the month to be the lowest in this metric since January 2022.