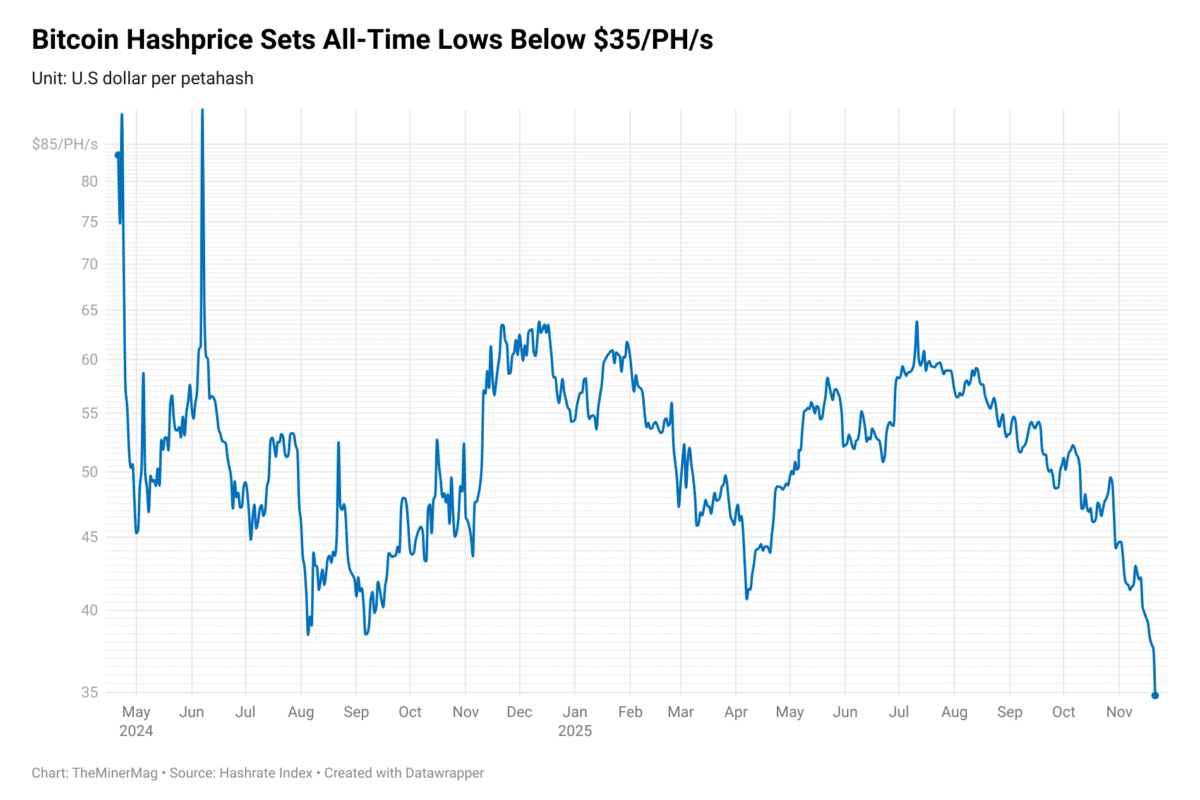

Miner Weekly: Bitcoin Mining Profitability Hits Chill Zone as Hashprice Set for Five-Month Low

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Bitcoin is hovering above $110,000, but miner profitability continues to erode.

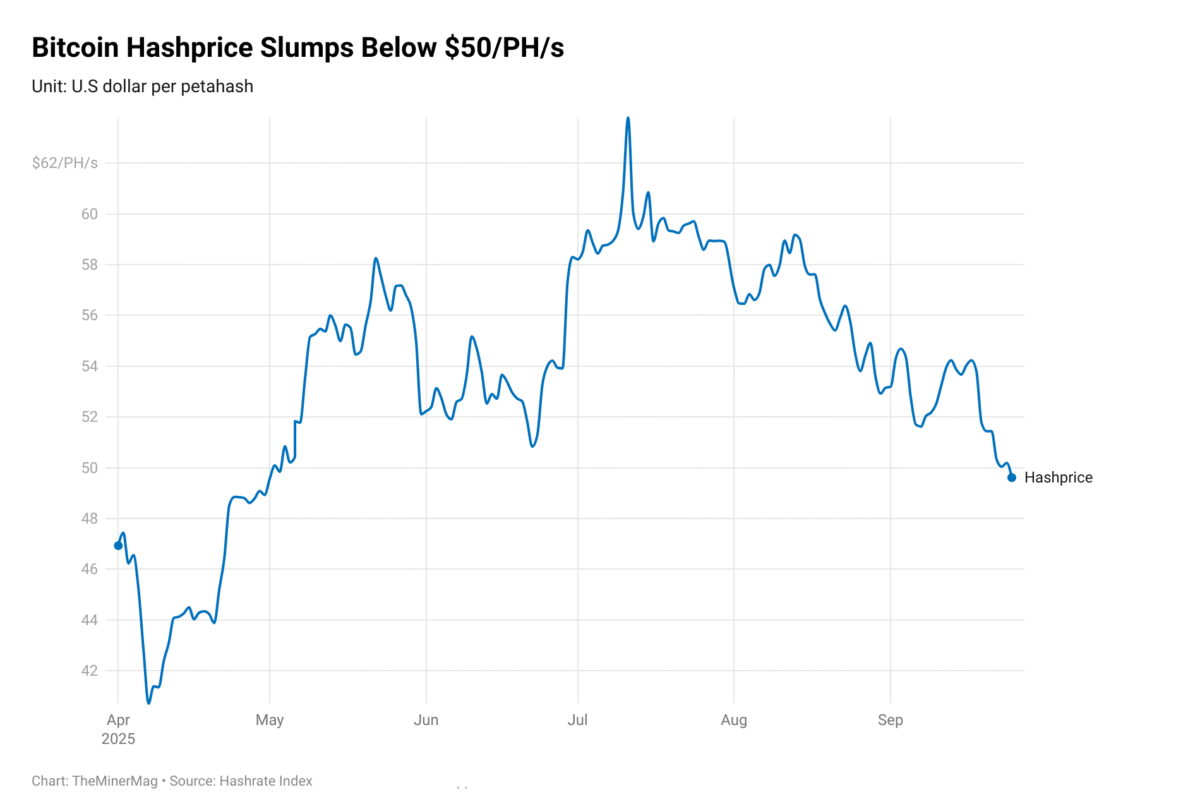

This week, hashprice — the revenue earned per petahash per second — fell below $50/PH/s for the first time since April. If current projections hold, it could soon dip below $46/PH/s, a level last seen when bitcoin was priced closer to $90,000. That contrast underscores a sharp rise in network competition that’s offsetting even historic BTC price levels.

The seven-day average hashrate has now climbed above 1.1 zetahash per second, up more than 10% since earlier this month when it first crossed the 1 ZH/s milestone. With another 6% difficulty increase expected in about six days, miners are staring down tighter margins — especially as fee income remains negligible.

So far in September, transaction fees have contributed less than 0.9% of total bitcoin mining rewards, continuing a trend of historically low fee activity since the halving. Without a spike in mempool congestion or demand for blockspace, fees are offering little cushion to offset declining subsidies.

At the same time, hardware supply continues to grow. MicroBT this week launched a U.S.-based online storefront offering domestically assembled WhatsMiners, backed by a 10,000-unit monthly production capacity. The move echoes efforts by Bitmain, Bitdeer, and Canaan to onshore manufacturing and push rigs into the post-halving market.

Amid the squeeze, public miners are starting to diversify more openly.

- Cipher Mining signed a 10-year, $3 billion HPC colocation agreement with Fluidstack, allocating 168 MW of critical IT load at its Barber Lake site. The deal reflects a growing shift from bitcoin-exclusive compute to high-performance infrastructure for AI and cloud workloads.

- CleanSpark, historically a vocal “pure-play” bitcoin miner, expanded its Coinbase-backed credit line by $100 million, explicitly citing plans to invest in HPC infrastructure — a notable departure from its previous messaging.

As hashprice trends lower despite high BTC prices, the dual-track mining model — balancing bitcoin and HPC — is fast becoming the new normal.

A Reality Check From the Courts

As public miners chase new compute narratives, a lawsuit filed this week has offered a stark reminder of how distorted expectations once were in bitcoin mining’s previous investment boom.

The FTX Recovery Trust filed suit against Genesis Digital Assets (GDA) in Delaware bankruptcy court, seeking to recover $1.15 billion in transfers that Sam Bankman-Fried made to the miner using allegedly misappropriated customer funds from FTX and Alameda.

The complaint accuses GDA of inflating financial projections and providing misleading figures that helped secure the investments. According to court filings, GDA shared unaudited forecasts in July 2021 projecting:

“Annual revenue of $349 million in 2021, $952 million in 2022, $1.857 billion in 2023, and $2.446 billion in 2024. GDA projected EBITDA of $275 million in 2021, $724 million in 2022, $1.376 billion in 2023, and $1.727 billion in 2024.”

Those numbers proved far from reality. No public bitcoin miner — whether vertically integrated or operating under a colocation or asset-light model — has ever generated more than $1 billion in annual revenue. The closest were MARA with $650 million in 2024 and Core Scientific with $640 million in 2022.

The FTX-GDA lawsuit is a time capsule of 2021’s exuberance — when hashprice regularly topped $400/PH/s and mining was pitched as an endlessly scaling cash machine. That fantasy is now colliding with today’s math: hashprice at $46/PH/s, fees below 1%, and miners needing to squeeze every watt and diversify every megawatt to stay competitive — even with bitcoin above $110K.

Hardware and Infrastructure News

- Bitcoin Difficulty Hits Another All-Time High—Here’s What It Means for Miners – Decrypt

- IREN Stock Soars as GPU Fleet Doubles to 23,000 Units – TheMinerMag

- HIVE Surpasses 20 EH/s with Deployment of ASICs at Phase 3 Valenzuela facility in Paraguay – Link

Corporate News

- AI Startup Nscale came out of nowhere and is blowing away Nvidia CEO Jensen Huang – CNBC

- MicroBT Opens US Online Shop With 10,000 WhatsMiner Monthly Production Capacity – TheMinerMag

- CleanSpark Loosens Pure-Bitcoin Focus With Coinbase Loan Expansion for HPC Push – TheMinerMag

- FTX Trust sues Genesis Digital over $1.15B transfers – Blockworks

Financial News

- Cipher Taps Google-Backed $3B AI Hosting Deal, Plans $800M Notes Offering – TheMinerMag

- CleanSpark Taps Two Prime for $100M Bitcoin-Backed Loan at ~7.7% Interest – TheMinerMag