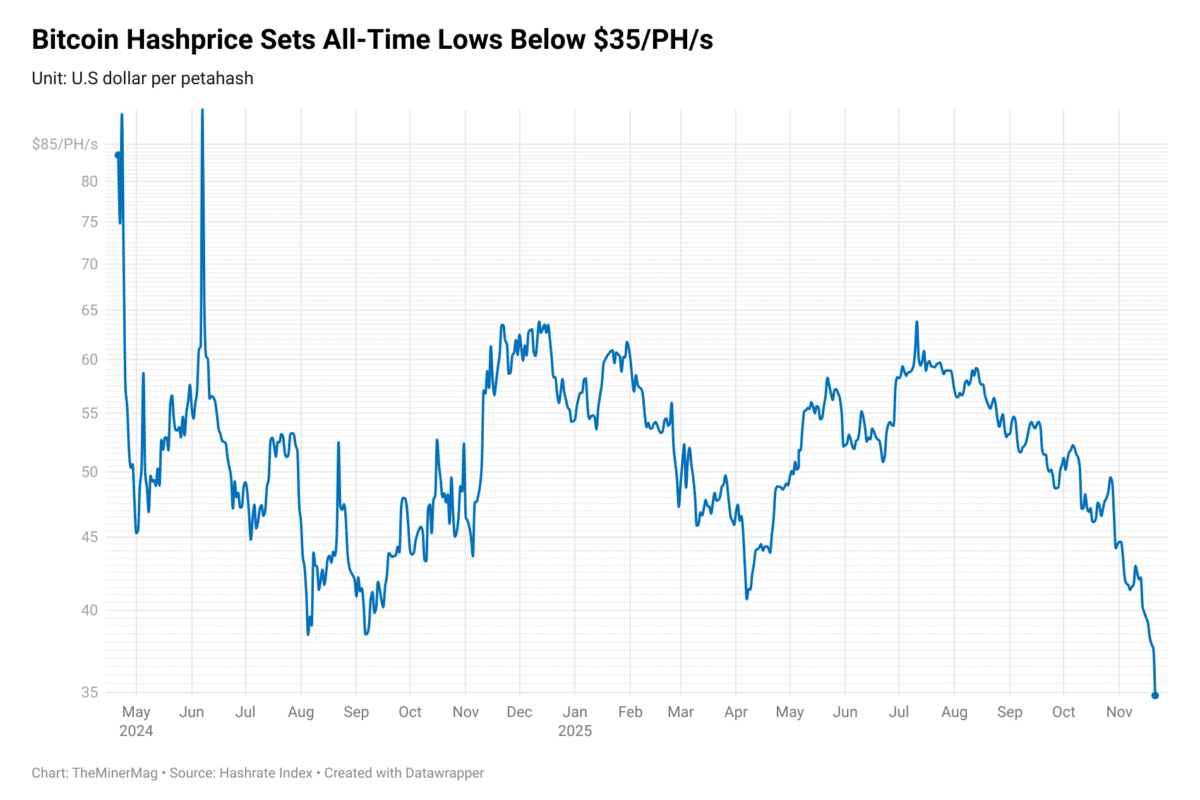

Bitcoin Hashprice Sinks to 14-Month Low Below $40/PH/s as BTC Falls to $95K

Bitcoin’s mining economics tightened further over the past week as hashprice fell to its lowest level in more than a year, pressured by a sharp decline in bitcoin’s price and a still-elevated network hashrate.

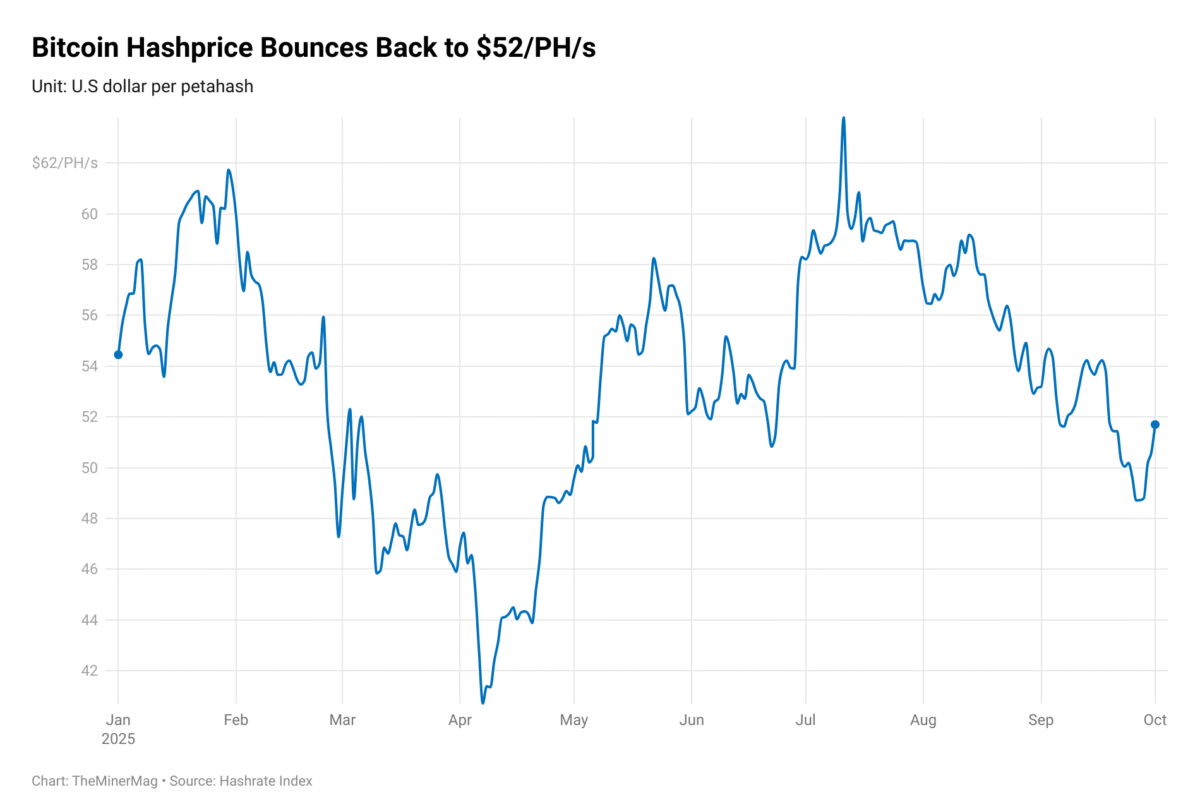

Public data shows that the hashprice dropped to roughly $39 PH/s per day, a level last seen on September 6, 2024. The metric, which measures the daily revenue miners earn from block subsidies and transaction fees relative to their hashrate, has now breached the lower bound of its post-halving range.

The slide coincided with bitcoin’s broader market pullback. The asset fell to around $95,000 in recent trading, effectively erasing its year-to-date gains after an extended period of volatility across crypto and equities. Mining stocks ended last week’s trading with a loss of over $25 billion, or a 20% correction since their mid-October peak.

Despite the price slump, network competition has remained intense. Bitcoin’s seven-day moving average hashrate is still hovering near 1.1 zettahash per second (ZH/s), sustaining its record-high level even as profitability sinks. The combination of lower price and stubbornly high hashrate has accelerated the compression in mining margins.

With current economics approaching levels that challenge even some of the newest fleets, miners enter the back half of November facing a familiar squeeze: falling revenue, rising competition and limited levers to offset the impact without cutting costs or curbing output.