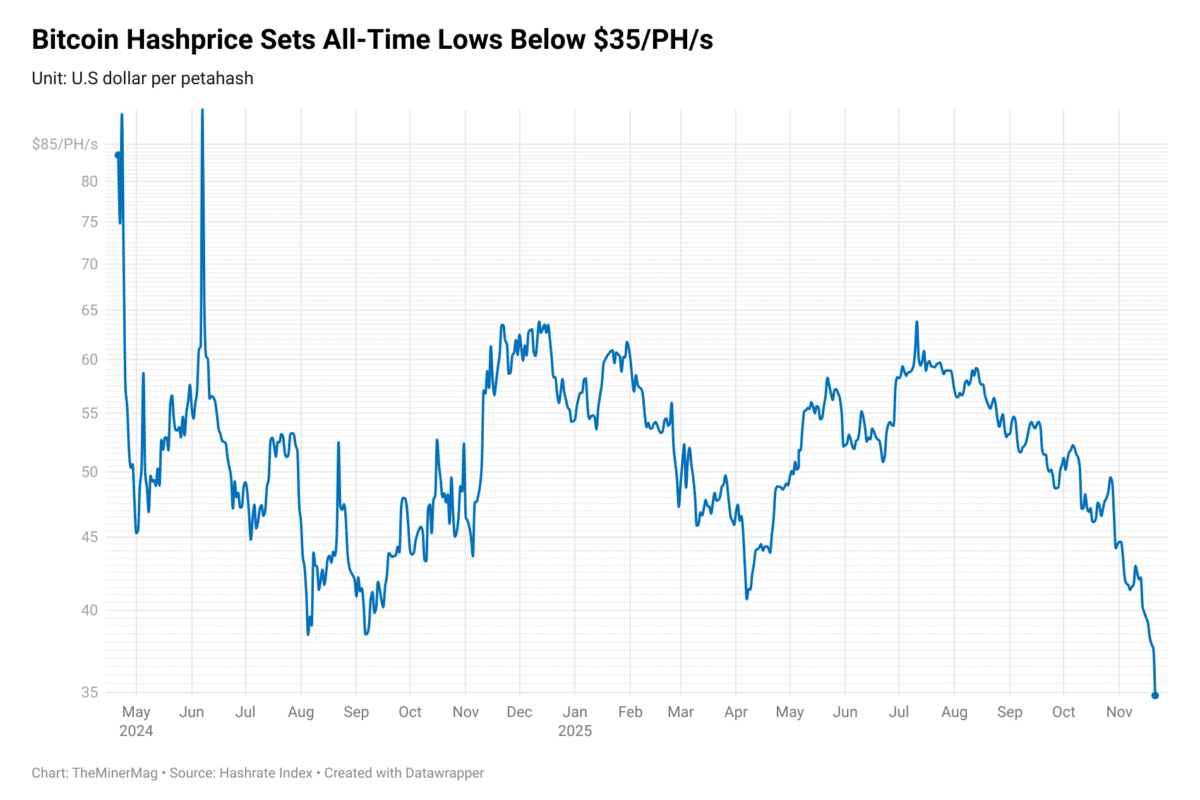

Bitcoin Hashprice Falls to Record Low as Network Hashrate Shows Early Signs of Pullback

Bitcoin’s hashprice has fallen to a new all-time low below $35 per petahash per second (PH/s), hit by the combination of bitcoin’s price drop and persistently high network difficulty.

BTC is trading near $83,000 as of Saturday, down more than 30% from its all-time high last month. The decline has wiped out all year-to-date gains and pushed mining economics deeper into the red. The slump comes on top of record hashrate and difficulty levels set earlier this month, which have further reduced the amount of bitcoin miners can produce per unit of hashrate.

However, there are now early signs that miners are beginning to scale back. Bitcoin’s seven-day moving hashrate average has slipped from about 1.124 zettahash per second (ZH/s) in mid-November to roughly 1.06 ZH/s, suggesting some operators may have already unplugged hardware as margins tighten.

At the current pace of block production, the network is on track for a negative difficulty adjustment of roughly 2% in about four days. The adjustment could deepen if hashrate continues to fall in the coming days.

The latest contraction in mining profitability follows months of low transaction-fee revenue and a rapid post-halving expansion in deployed hashrate since last year, leaving operators more exposed to market-driven swings in hashprice.