Miner Weekly: ASIC Titan Bows to Cooling Demand in Bull Market Twist

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

If you were around during previous bull markets, you likely remember the steep price premiums on mining equipment during bitcoin’s gold rush. Back in 2017, for example, Bitmain sold millions of Antminer S9 units, generating $2.5 billion in revenue that year and another $2.7 billion in just the first half of 2018. At the time, a single S9 could fetch hundreds of dollars per terahash per second.

This cycle, however, tells a different story.

In a marked departure from past bitcoin bull cycles, the latest market upswing has not translated into pricing power for ASIC manufacturers. Instead, the balance of power appears to be tilting toward bitcoin miners, who are now securing hardware deals on more favorable terms—including discounted BTC payments and embedded financial options—despite BTC surpassing the $100,000 mark.

Recent transactions by major public mining companies illustrate this reversal, suggesting a more cautious and disciplined capital environment among mining firms and signaling weak demand for hardware expansion—even amid price strength.

Hut 8, CleanSpark, HIVE Strike Favorable Deals

In April 2025, CleanSpark exercised a previously negotiated purchase option to acquire 13,200 machines for roughly $76.6 million. The payment, made in 691 BTC, was structured at a 15% premium to spot price at the time—translating to a fair value of $66.8 million and a spot assumption of around $96,600 per BTC. The deal included an option for CleanSpark to repurchase the same amount of bitcoin at a fixed price of $110,900, effectively providing the miner with a BTC call option at a time of rising market prices. See the full story from TheMinerMag here.

Hut 8 similarly took advantage of flexible terms in its 30,000-unit Antminer S21+ deal with Bitmain. The company pledged 968 BTC—now worth over $100 million—but the implied cost per terahash remains around $15/TH/s, a significant discount relative to Bitmain’s advertised $21.5/TH/s price tag. Like CleanSpark’s deal, Hut 8 retained a redemption right, allowing it to buy back the pledged bitcoin within three months of shipment.

Additionally, HIVE said on Thursday that it pledged a portion of its bitcoin treasury at a market price of $87,000 to settle the purchase of new ASIC mining equipment while securing an option to repurchase the bitcoin at the same price.

During the quarter, HIVE strategically deployed a portion of its bitcoin treasury to acquire next-generation ASIC mining equipment through a special agreement. The Company pledged bitcoin to settle the purchase at a market price of US$87,000 per BTC and secured an option to repurchase the equivalent amount of bitcoin at the same price—allowing HIVE a unique opportunity to capture potential upside in BTC price appreciation.

A Sharp Contrast to Bull Market Norms

These transactions stand in stark contrast to previous bull markets, where hardware prices surged far ahead of intrinsic value and miners routinely paid steep premiums. During the 2021 cycle, for example, Antminer S19 series machines were sold at more than 3x their initial launch price, with units changing hands for $80 to $100/TH/s as BTC broke past $60,000. At the time, spot delivery premiums and prepaid orders became standard, with miners frequently placing bulk orders months in advance without volume discounts or financial flexibility.

Even in late 2017 and early 2021, it was not uncommon for new-generation miners to fetch premiums of 2-4x over the prevailing launch price, especially when supply was constrained. Manufacturers often demanded full prepayment in USD or tether, and few if any options were offered for BTC payments—let alone discounted or option-like structures.

Capex Cutbacks Reshape Market Dynamics

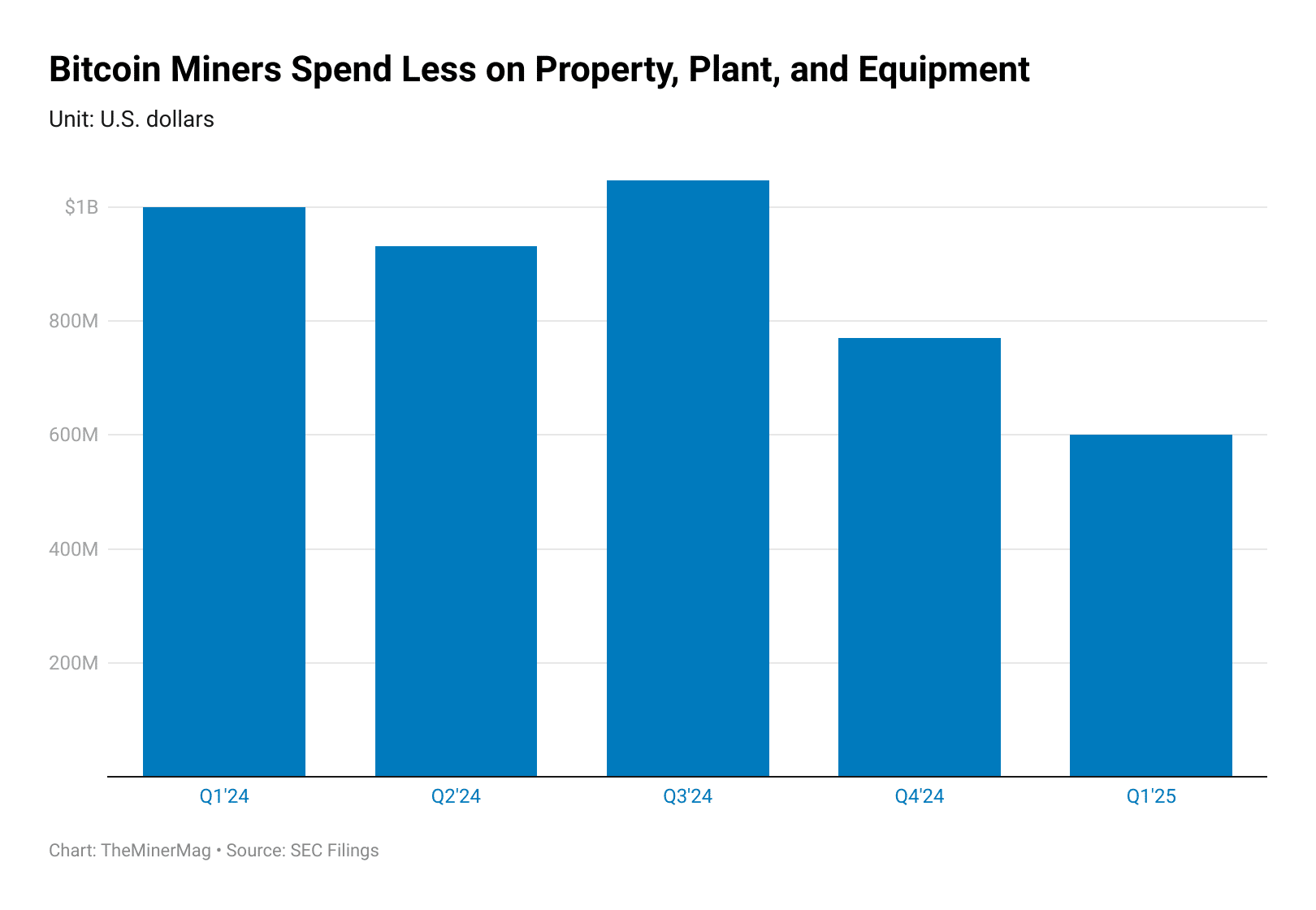

Driving the shift is a broader contraction in capital spending. Data from TheMinerMag shows that aggregate net PP&E investments from eight major public mining companies fell to just $600 million in Q1 2025, down from $770 million in Q4 2024 and nearly $1 billion in previous quarters. Importantly, some of that capex has flowed into high-performance computing (HPC) and AI infrastructure, rather than traditional bitcoin mining buildout.

This reduction in hashrate-related capex reflects multiple pressures: a post-halving decline in hashprice, elevated network competition, and a more disciplined approach to growth amid volatile margins. As a result, hardware manufacturers, facing softening demand and rising inventory, are showing a new willingness to negotiate.

The Bottom Line

The CleanSpark, Hut 8 and HIVE deals signal a pivotal moment: Bitcoin mining hardware vendors are no longer commanding the premiums and prepayments that once defined bull market dynamics. Instead, the current cycle has seen well-capitalized miners wielding greater leverage—extracting discounted pricing, negotiating for optionality, and preserving BTC liquidity through creative structuring.

For ASIC manufacturers, the message is clear: in a market where hashprice compression is biting and miner capital discipline is rising, pricing power is no longer a given—even when Bitcoin is setting new highs.

Regulation News

- Malaysia’s Largest Energy Firm Reports 300% Rise in Crypto-Linked Power Theft – Decrypt

Hardware and Infrastructure News

- Bitdeer Ramps up Realized Bitcoin Hashrate by 67% with SEALMINERS – TheMinerMag

- CleanSpark Buys Miners With Bitcoin in Sign of Shifting ASIC Market Power – TheMinerMag

- Bitfarms Halts Bitcoin Mining in Argentina Amid Power Supply Suspension – TheMinerMag

- HIVE Targets 18 EH/s with Bitcoin-Backed Miner Purchases – TheMinerMag

Corporate News

- Core Scientific Announces Departure of Board Member Todd Becker – Link

- IREN Challenges $100M US Tariff Reassessment Over Bitcoin Miner Imports – TheMinerMag

- POW.RE Announces Strategic Acquisition of Block Green to Expand Bitcoin Financial Services – Link

Financial News

- Bitcoin miners MARA and CleanSpark post higher Q1 revenues, but both lose money – The Block

- Bitcoin Miner MARA Stock Surges Despite Earnings Miss as Analysts Applaud Cost Cutting – CoinDesk

- TeraWulf Q1 loss widens amid rising costs, falling revenue – CoinTelegraph

- Hut 8 reports $134m Q1 loss amid Trump-backed American Bitcoin focus – Data Center Dynamics

- Trump-affiliated mining firm American Bitcoin to go public via merger with Gryphon Digital – The Block

Feature

- Bitcoin OP_RETURN War Explained – The Mining Pod