Miner Weekly: Four Miners Produce One in Five Bitcoins – July Scorecard

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

For much of the past two years, the public bitcoin mining sector has been defined by one number — deployed hashrate. Companies raced to announce ever-larger fleet expansions, locking in hosting deals, power capacity, and purchase agreements for the latest generation of ASIC miners.

But the July production figures from four of the industry’s largest players — MARA, CleanSpark, Cango and IREN — show that the hashrate expansion war is giving way to a new contest: getting the most out of what you already have.

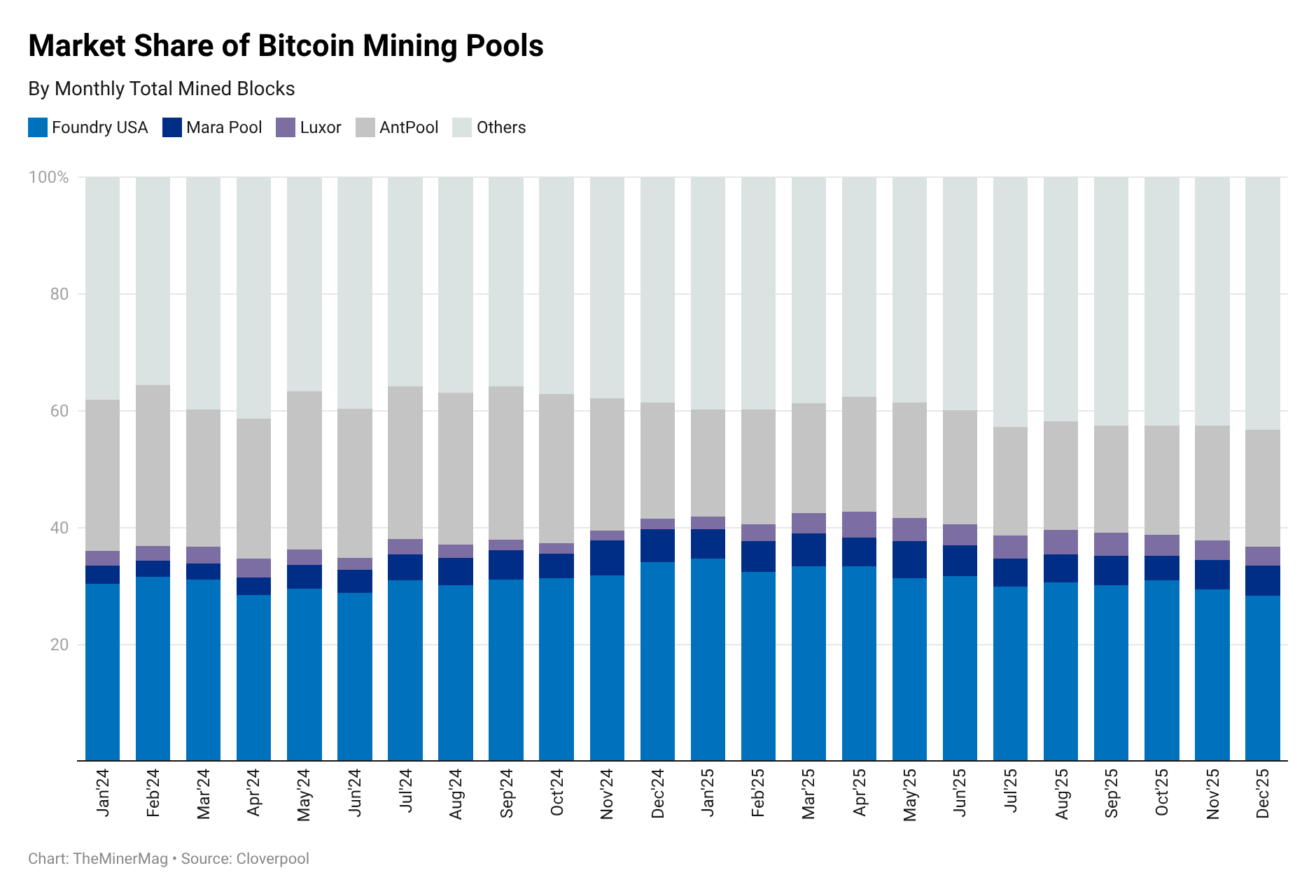

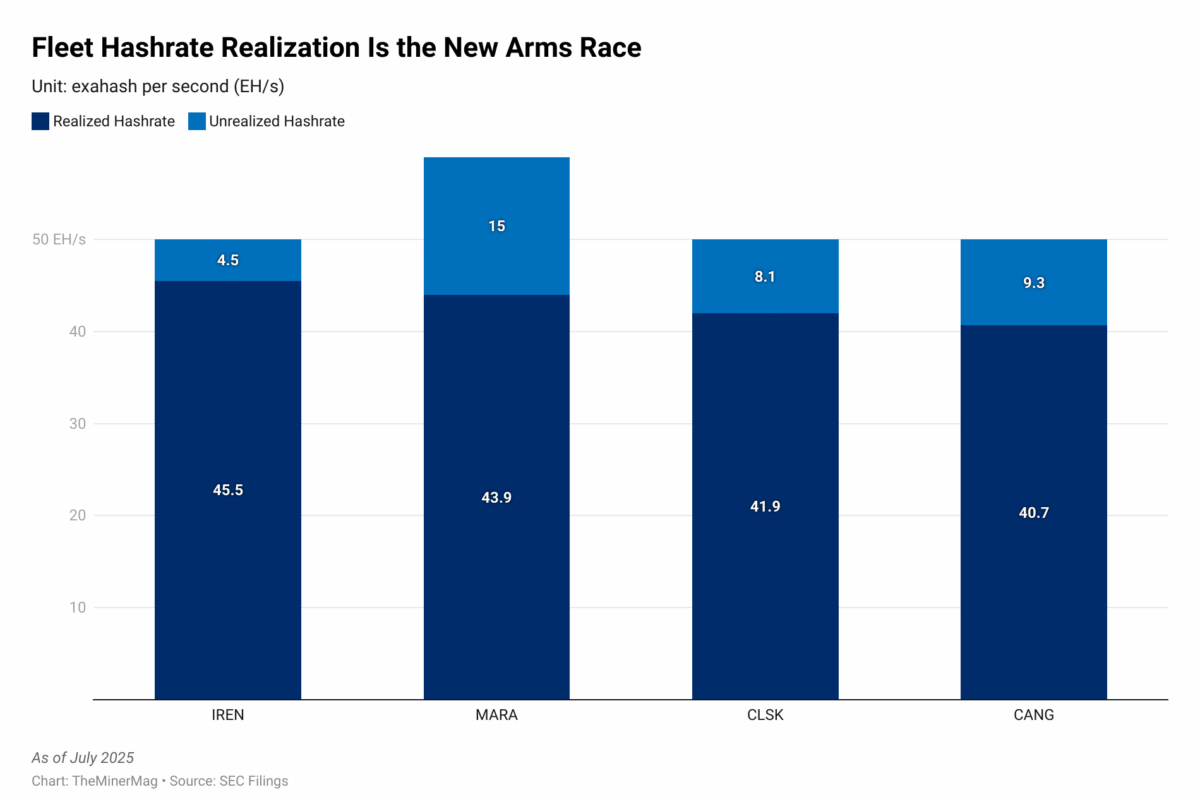

On paper, the four companies are in the same league. All reported 50 EH/s or more in deployed hashrate last month, with MARA topping the group at 58.9 EH/s, followed by CleanSpark, Cango and IREN each at 50 EH/s. In practice, however, the amount of that capacity actually producing bitcoin — known as realized hashrate — varied.

IREN came out on top, converting its 50 EH/s deployment into an implied realized hashrate of 45.5 EH/s. That was enough to produce more bitcoins in July than MARA, despite MARA’s substantially larger deployed fleet. MARA’s realized capacity came in at 43.9 EH/s, CleanSpark’s at 41.9 EH/s, and Cango’s at 40.7 EH/s.

Cango’s realization rate was hampered by timing — it only completed the acquisition of its additional 18 EH/s to reach 50 EH/s midway through July. Even so, the data underscores a growing performance gap between companies that can keep their machines online and productive, and those that struggle with downtime, curtailment, or deployment delays.

Despite three of the four realizing less than 90% of their fleets in July, their combined production accounted for 19.07% of all bitcoin block rewards that month — the highest monthly share they’ve ever achieved. With seasonal power curtailments likely to ease after the summer, their combined share could easily break the 20% mark in the coming months. That would mean one in every five bitcoin mined globally comes from just four public companies.

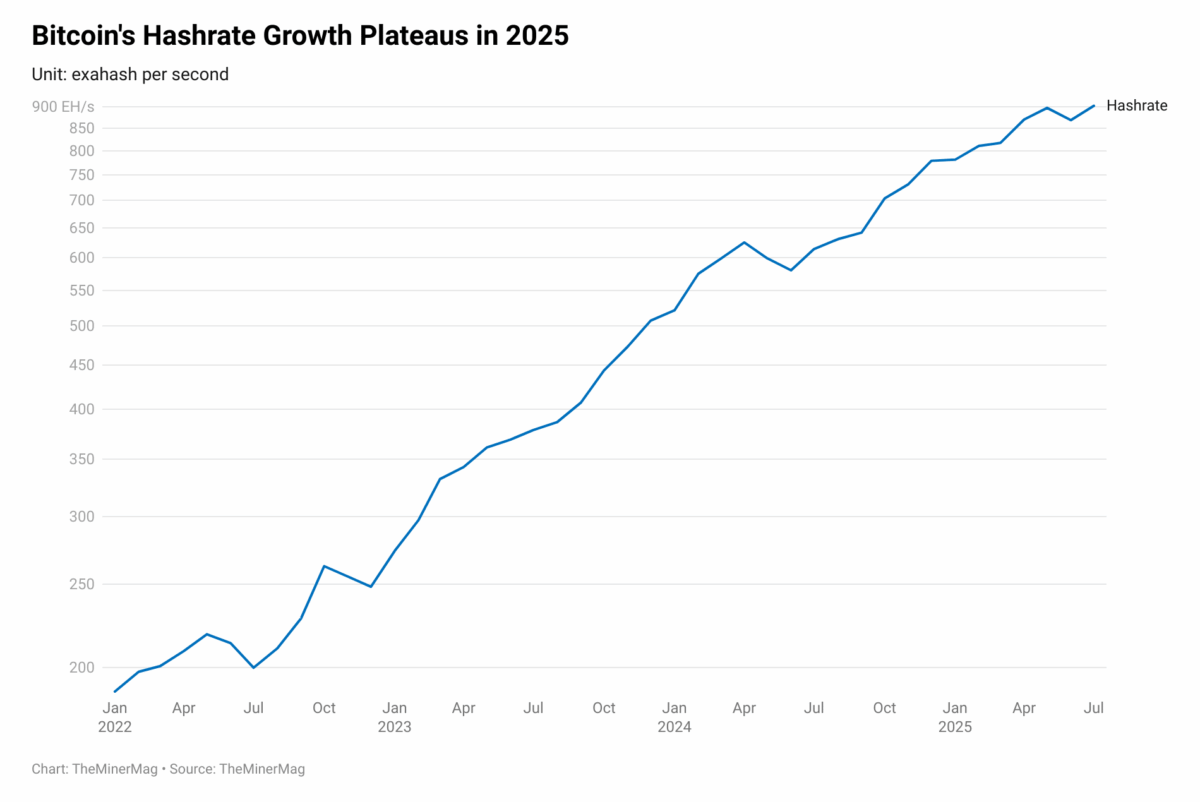

The shift in focus is driven by a changing macro picture for the network itself. Bitcoin’s monthly average hashrate has grown just 15% so far this year, from 780 EH/s in January to 902 EH/s in July. That’s a plateau compared to the explosive growth seen in prior cycles, and a sign that the industry’s collective buildout may be hitting the limits of available power and infrastructure — at least in the short term.

Regulation News

- Two California Men Charged With Illegally Exporting AI Chips to China – Decrypt

Hardware and Infrastructure News

- Cipher, Cango Boost Bitcoin Mining Output as Network Hashrate Hits New Record – TheMinerMag

- IREN Tops MARA in July Bitcoin Production with Record Realized Hashrate – TheMinerMag

- Greenidge to Sell Mississippi Bitcoin Mine for $3.9M Amid Ongoing Financial Struggles – TheMinerMag

Corporate News

- Trump-Backed American Bitcoin Nears Public Listing as Gryphon Sets Merger Vote Schedule – TheMinerMag

- BIT Mining Buys $5M SOL to Launch Validator in Shift From Bitcoin Treasury – TheMinerMag

- Bitfarms Announces Partnership with T5 Data Centers to Advance HPC/AI Development at Panther Creek Campus – Link

- MARA, Riot Diverge on Bitcoin Mining Financing in Q2 – TheMinerMag