Miner Weekly: Four Companies Control 20%+ of Bitcoin Hashrate

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

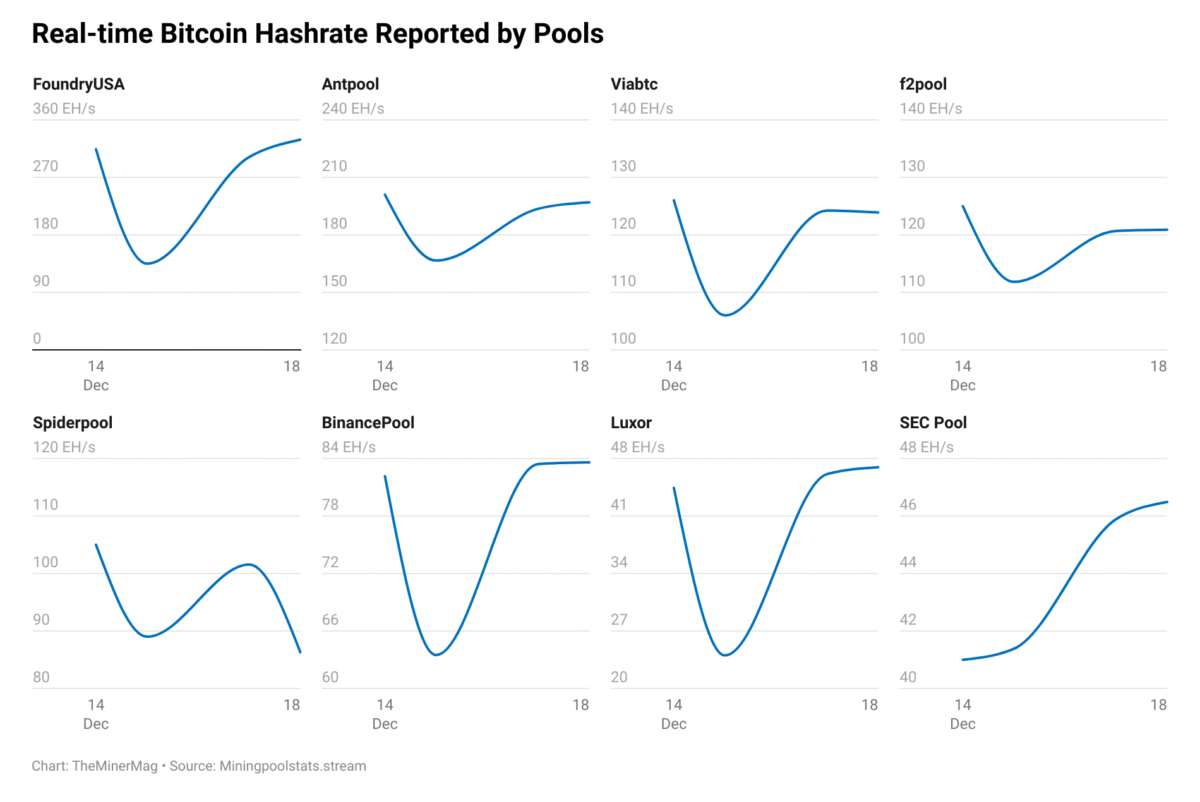

After months of slow growth and subdued activity, the U.S. public Bitcoin mining sector appears to be roaring back to life—and not quietly. In just over a week, three of the industry’s largest players—CleanSpark, Cango, and IREN—each announced they have surpassed 50 EH/s of installed hashrate. Not far behind, MARA, currently the largest mining operation, declared an ambitious new target to hit 75 EH/s by the end of this year, supported by machine orders already in place.

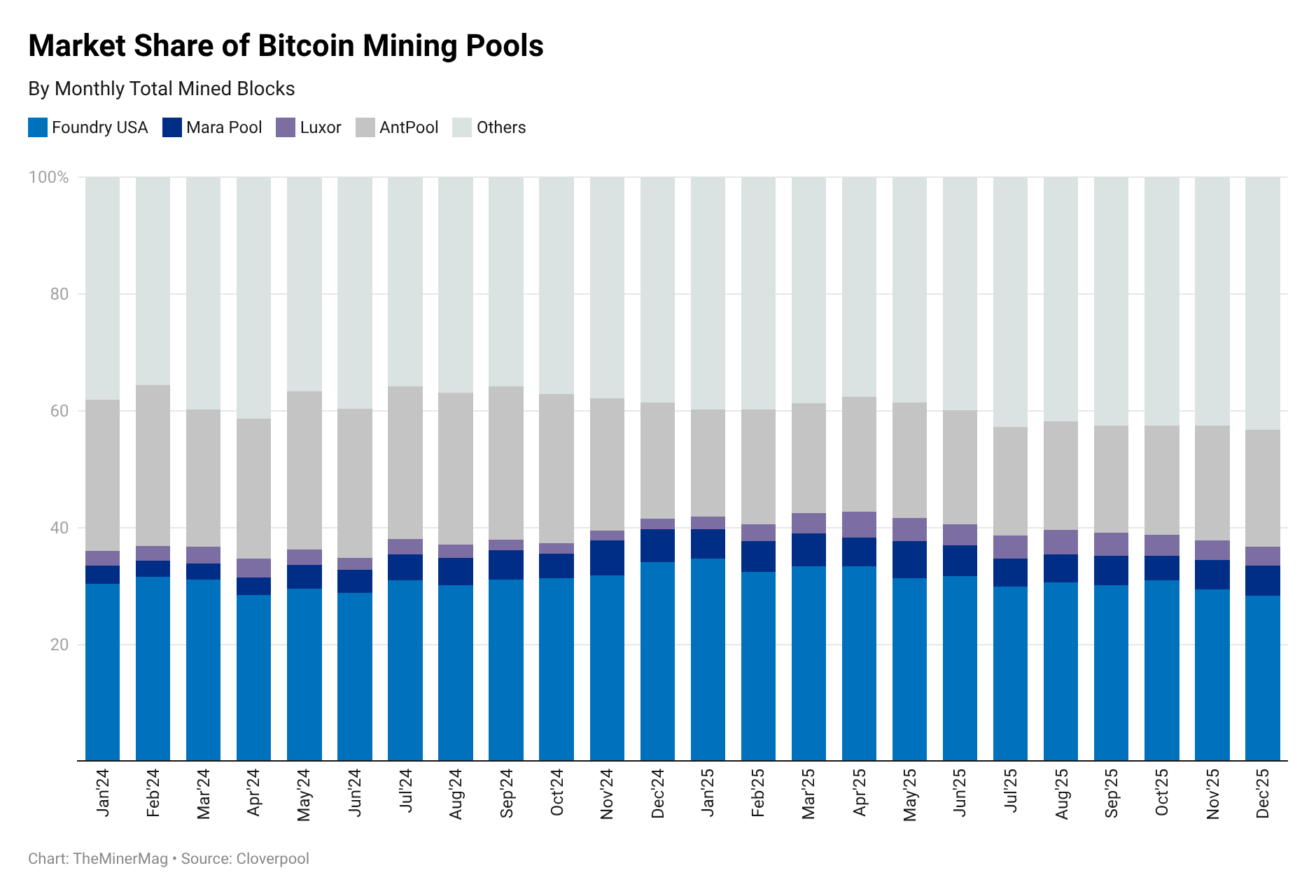

Taken together, the four firms now control over 200 EH/s, equivalent to more than 20% of the current Bitcoin network, and matching the network’s entire hashrate at the peak of the last bull cycle in late 2021. It’s a striking signal that the arms race is not only back on—it may never have really stopped.

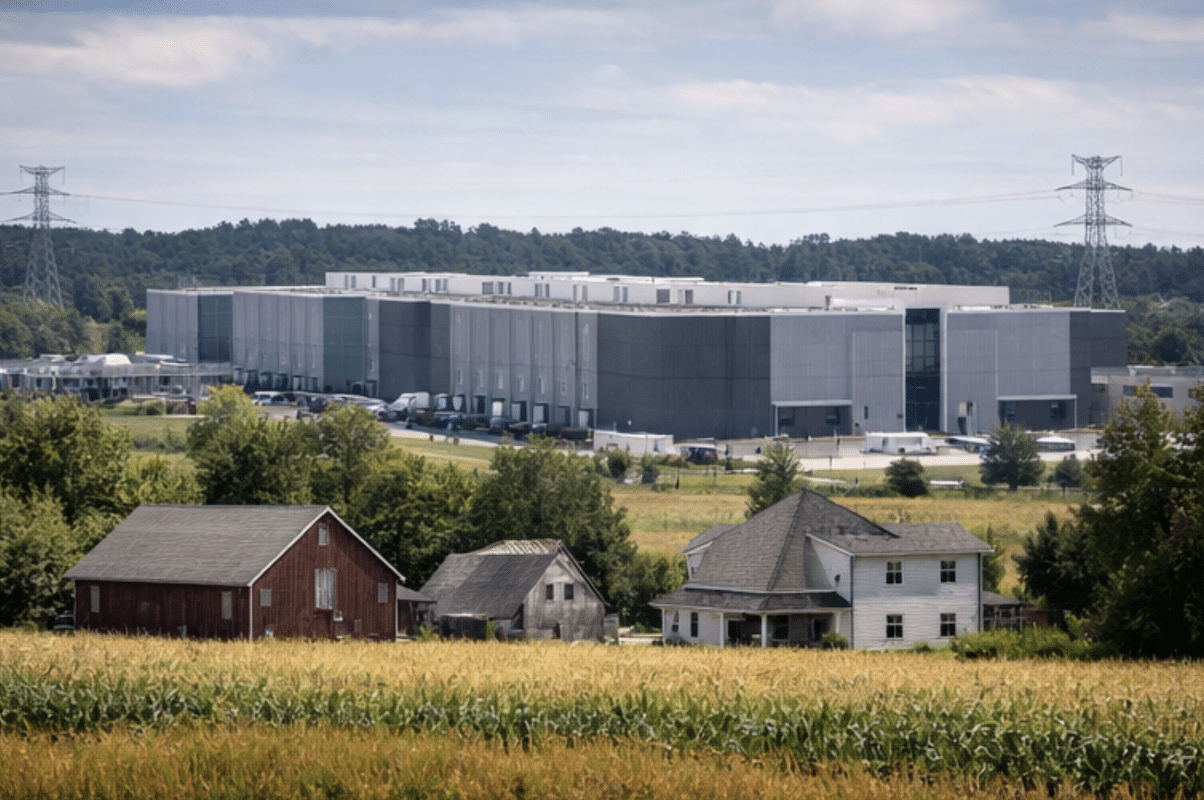

Each of the miners arrived at this threshold through a distinct route. CleanSpark crossed the 50 EH/s line by staying the course on its infrastructure expansion strategy. And so is IREN, which reached the milestone organically by the development of its Childress site in Texas, where 650 megawatts are now energized. However, IREN likely won’t join any further arms race as it previously noted that it would halt hashrate expansion to focus on AI infrastructure once it hits the 50 EH/s mark.

Cango, on the other hand, took a more unconventional route. The company, which pivoted from its legacy auto-financing business, has rapidly built its mining footprint by acquiring energized hashrate from Bitmain-affiliated entities. Its most recent deal added 18 EH/s of on-rack capacity to its previous 32 EH/s, pushing it above the 50 EH/s mark by ceding its ownership to Bitmain’s Antalpha. Effectively, Bitmain has taken its 50 EH/s mining assets public by using Cango as a shell.

MARA, already the largest public miner by nameplate capacity, didn’t announce a new milestone—but instead set the bar even higher. In its June update, the company said it aims to hit 75 EH/s by year’s end, supported by a pipeline of over 3 gigawatts of infrastructure and machine orders already placed. MARA has largely held its capacity steady near 55 EH/s for the first half of the year, but its latest comments suggest that a fresh ramp-up is imminent, involving new deliveries from partners like Auradine, in which MARA holds an equity stake.

While these four dominate the current leaderboard, a number of smaller public miners are also scaling aggressively. Cipher Mining is on track to exceed 23 EH/s this year following expansions at its Black Pearl site in Texas. HIVE Digital projects it will reach 25 EH/s through ongoing buildouts in Paraguay by the U.S. Thanksgiving. And American Bitcoin—a proprietary mining unit of Hut 8 backed by the sons of U.S. President Trump—has already raised $220 million in private equity to pursue its goal of 25 EH/s, though it has yet to disclose a timeline.

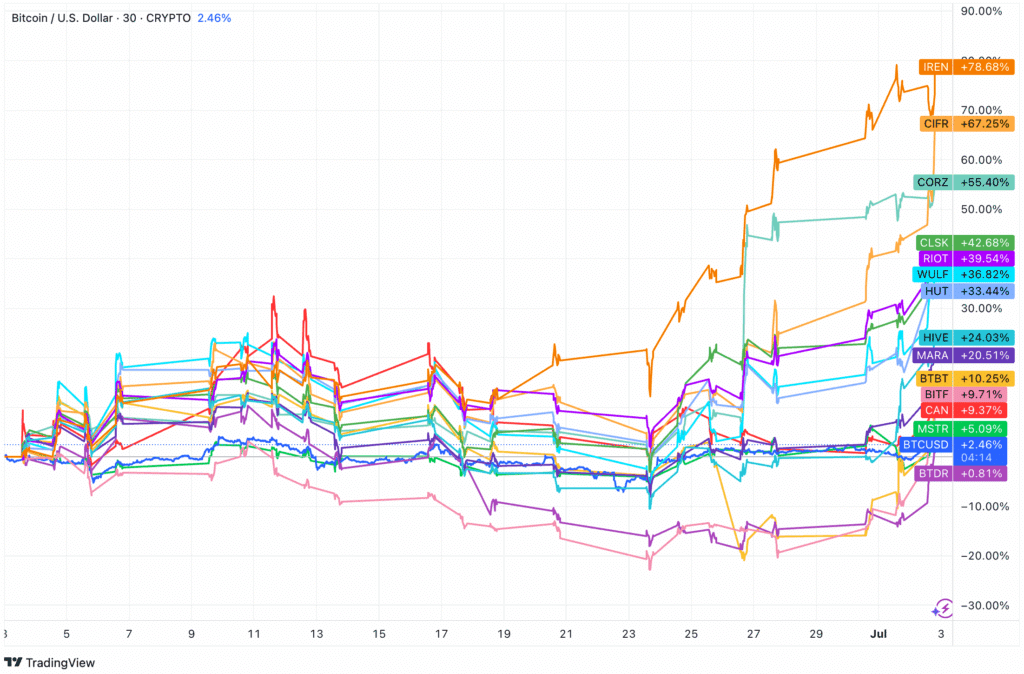

Alongside this hashrate escalation, another race is unfolding—this one on Wall Street. Over the past month, Bitcoin mining stocks have rallied sharply, significantly outperforming BTC itself, as shown in the chart below.

Miners are not just scaling hashrate; they’re also vying to become the top-performing equity in the sector. IREN has led the charge with a +78% gain in June, followed closely by Cipher (+67%) and Core Scientific (+55%). CleanSpark, Riot, and Hut 8 also posted gains between 30%–45%, with Marathon up just over 20%. Bitcoin, by comparison, has moved up just 2.5% during the same period.

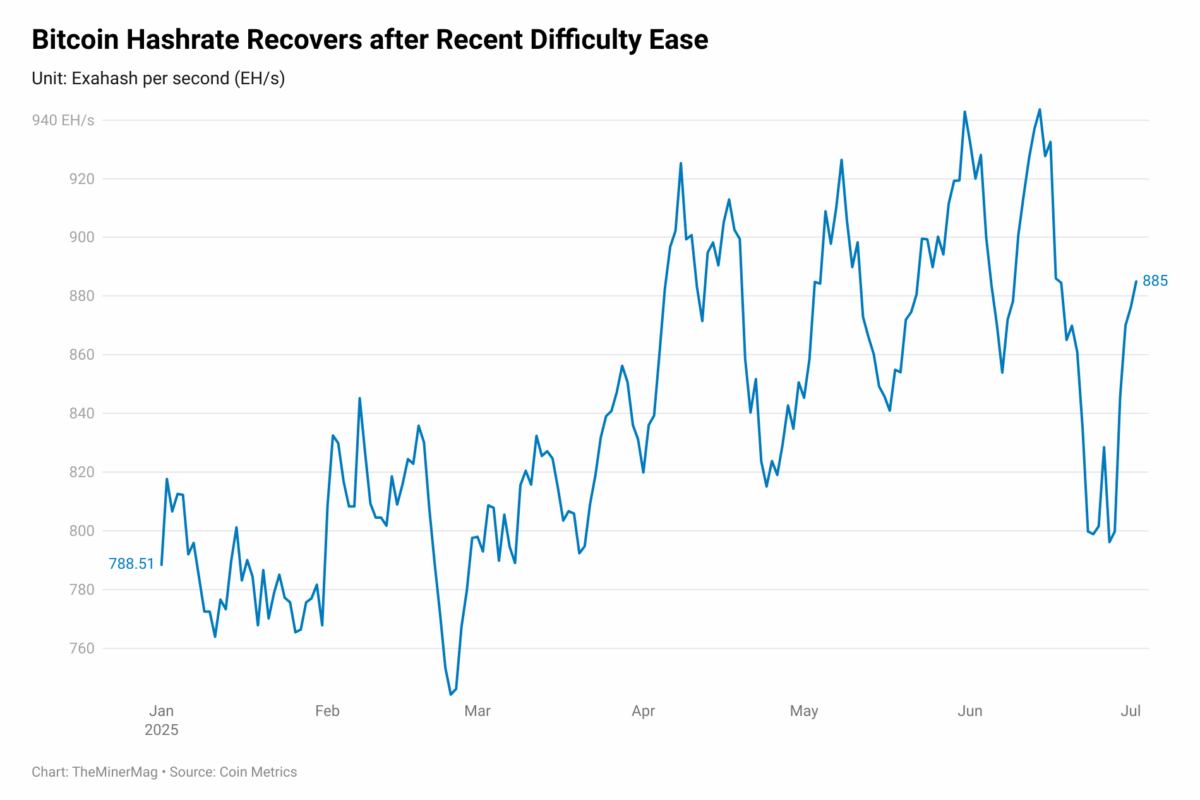

This wave of growth underscores an increasingly consolidated and capital-intensive Bitcoin mining landscape. With hashprice still under pressure and transaction fees remaining low, smaller or less efficient miners may struggle to keep pace. While the recent sharp drop in difficulty offered a brief reprieve, the network’s average hashrate has since rebounded and pushed average block production to around 9.4 minutes. If this upward trend continues, mining difficulty could return to its all-time high in the next 10 days.

Regulation News

- ‘Kill shot’: GOP megabill targets solar, wind projects with new tax – Politico

Hardware and Infrastructure News

- Cango Finalizes 18 EH/s Mining Acquisition, Surpasses 50 EH/s as Antalpha Ties Deepen – TheMinerMag

- Bitcoin Hashprice Nears 5-Month High After Record Difficulty Drop since China Ban – TheMinerMag

- IREN Joins Bitcoin Mining Peers in Surpassing 50 EH/s Milestone – TheMinerMag

- Compass Mining Energizes New 4.5 MW Site in Iowa in Partnership with DIGTB – Link

- Summer Curtailments Slash Bitcoin Production for US Miners Amid Grid Pressures – TheMinerMag

Corporate News

- CoreWeave in Talks to Buy Core Scientific: The Wall Street Jounral

- CleanSpark Hires Planning Commissioner Amid Outcry Over Proposed Bitcoin Mine in Tennessee – TheMinerMag

- Argo Stock Crashes Over 60% Amid Bitcoin Mining Restructuring to Avert Insolvency – TheMinerMag

- Oil spill at Bitcoin mining facility sparks water safety concerns near Seneca Lake – WHAM

- MARA Targets 75 EH/s by Year-End with Bitcoin Miner Orders in Place – TheMinerMag

- Riot Liquidates Another 6.4M Bitfarms Shares to Reduce Stake to 12.3% – Link

- Hut 8 signs five-year capacity contracts with Ontario grid operator for gas-fired power plants – The Block

- Trump Sons-Backed American Bitcoin Raises $220M to Fuel Hashrate Expansion – TheMinerMag

Feature

- A Remote Himalayan Kingdom Bet Big on Bitcoin Mining. So Far, It Has Paid Off – The Wall Street Journal