Miner Weekly: Bitcoin Miners Break Months-Long HODL Trend

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

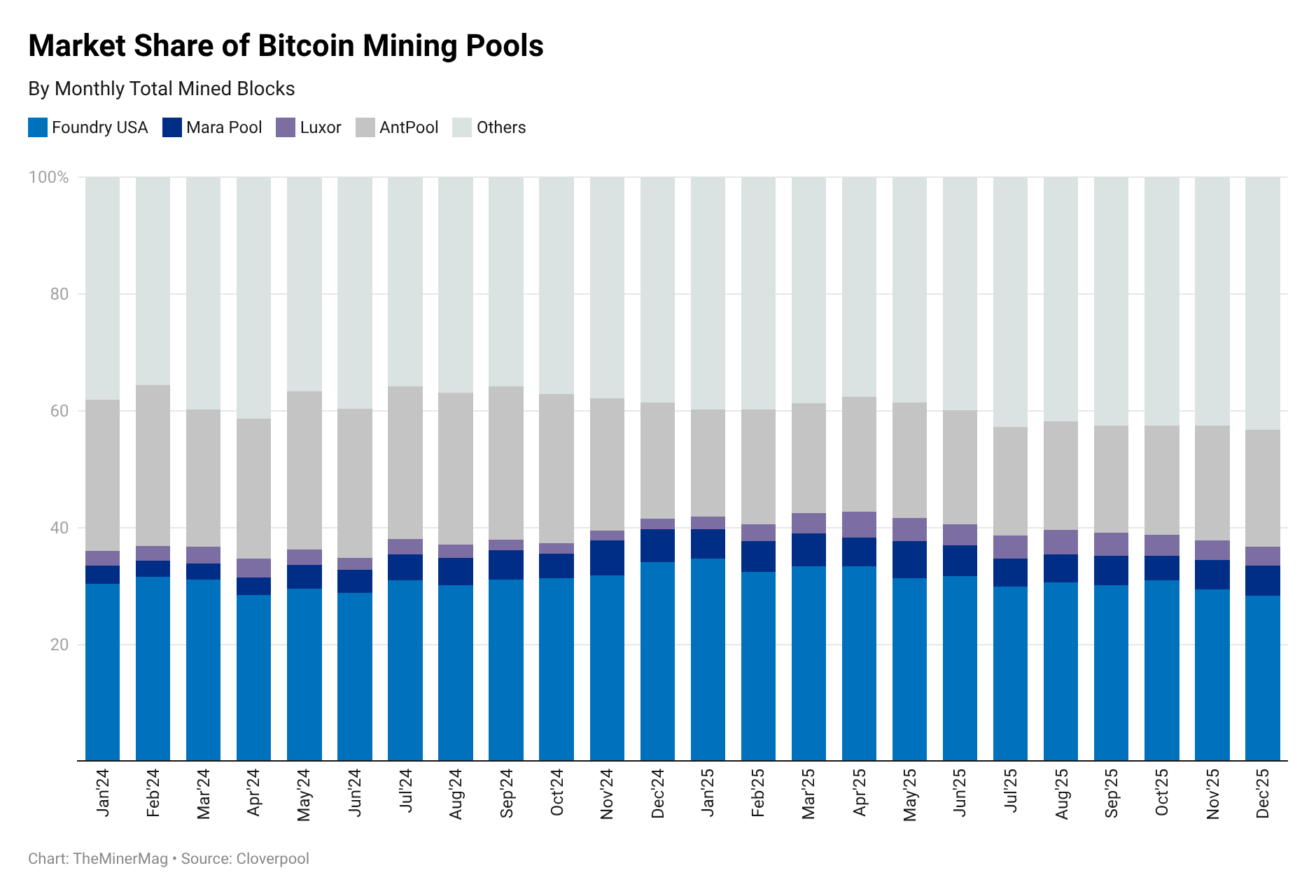

A new trend is emerging among publicly listed bitcoin mining companies: more are starting to sell. According to TheMinerMag’s monthly tracking of 15 mining companies, preliminary data for April shows that firms are liquidating a larger share of their production—an apparent reversal from the accumulation strategies favored last year.

TheMinerMag used to track 19 companies, but Stronghold got merged into Bitfarms, while Bit Digital, Argo, and Terawulf no longer issue monthly updates.

So far, eight companies have published their April production updates. Collectively, they sold about 70% of their mined bitcoin during the month—the highest sell-through ratio since January 2024.

Riot Platforms and CleanSpark notably changed course in April. Both had been holding almost 100% of their production in previous months. Riot ended that streak by selling slightly more than it mined during the month—over 100%—while CleanSpark liquidated approximately 65% of its BTC production. Both companies also recently entered into bitcoin-backed loan facilities to make use of their bitcoin reserves.

The uptick in bitcoin sales reflects tightening economics as hashprice remains at $50/PH/s. As more firms report April figures in the coming weeks, the extent of the shift away from accumulation (or “hodl”) could become even clearer.

Only three companies so far —MARA, Cango and BitFuFu—fully retained their mined bitcoin last month. In MARA’s case, the firm has continued to fund operations through equity markets rather than dipping into reserves. It filed for a new $2 billion at-the-market equity offering in March, reinforcing its commitment to a full hodl strategy. BitFuFu, on the other hand, had a small increase of 61 BTC, resulting from its proprietary mining and bitcoin inflow from cloud mining customers.

Cango’s situation is more nuanced. The company entered into a master loan agreement with Antalpha, pledging its mined bitcoin as collateral to borrow cash for hosting payments to Bitmain. Given Cango’s ongoing transformation into a mining proxy for Bitmain via Antalpha’s proposed takeover bid, following its divestiture from auto-financing operations, the loan deal amounts to an intercompany transaction. In effect, Bitmain/Antalpha is the one holding the bitcoin mined by Cango.

Read more: Bitmain’s Secret Mining Proxy? The Cango Connection

Hardware and Infrastructure News

- Bitfarms Joins Peer Bitcoin Miners in Halting Hashrate Expansion, Citing HPC Focus – TheMinerMag

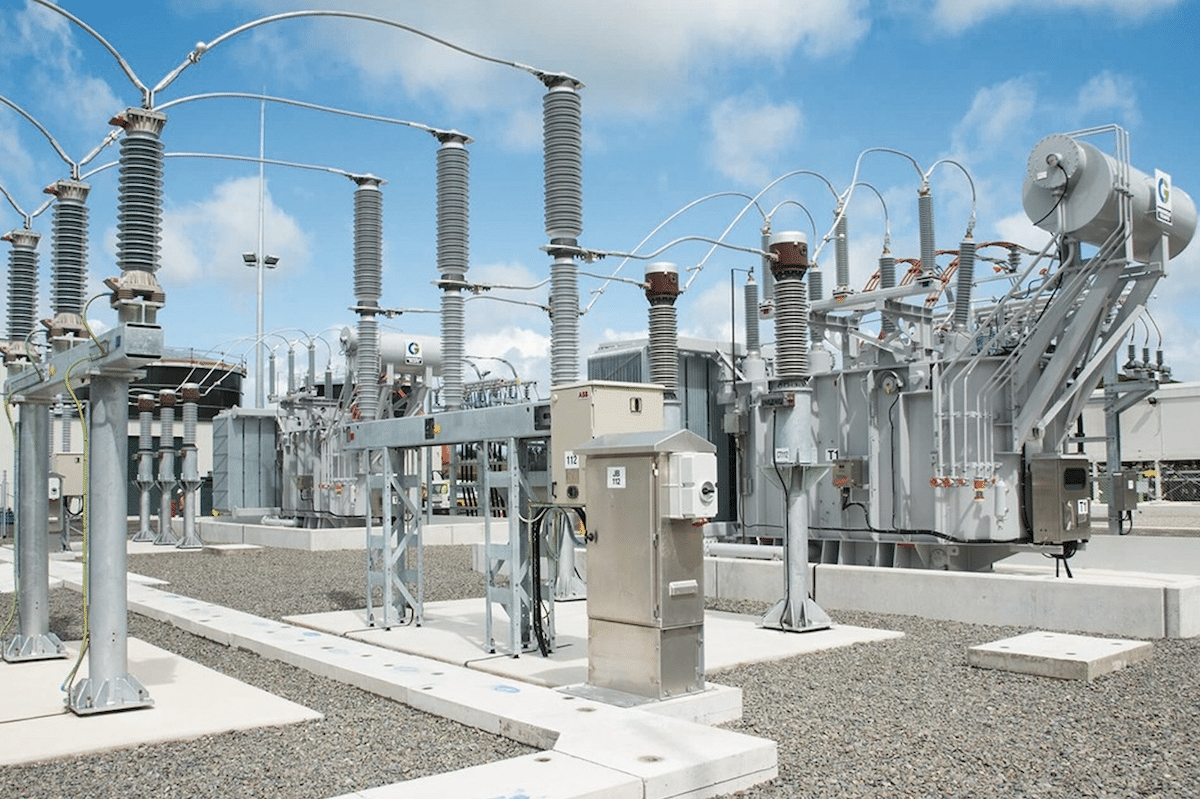

- Cipher to Energzies 2.5 EH/s Bitcoin Hashrate as Texas Buildout Progress Accelerates – TheMinerMag

- IREN Closes Gap with CleanSpark as Realized Bitcoin Hashrate Jumps 25% in April – TheMinerMag

Corporate News

- CleanSpark Faces Local Pushback Over Proposed Bitcoin Mine in Tennessee – TheMinerMag

- Tether May Invest $25M in Antalpha’s Bitcoin Mining IPO – TheMinerMag

- Riot Sells Bitcoin Production for First Time in 15 Months – TheMinerMag

- Synteq Digital Announces Acquisition of Crunchbits, Accelerating its Expansion into HPC Data Center Services – Link

Financial News

- Bit Digital Eyes $500M ATM as Bitcoin Mining Economics Tighten – TheMinerMag

- Benchmark calls Canaan a ‘potent long-term play’ in bitcoin mining, sets $3 price target – The Block

Feature

- Spain and Portugal blackout blamed on solar power dependency – FT