Miner Weekly: Public Miners Go Quiet as Bitcoin Hashprice Cools, Arms Race Stalls

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

One under-the-radar shift over the past few months: public bitcoin miners have quietly stopped telling us how much bitcoin they mine each month.

It’s a notable reversal from a habit that really solidified after the 2020 halving. Back then, Riot, Bitfarms and Marathon Digital were the ones pushing out monthly production press releases—hashrate, bitcoin mined, treasury balance, the whole package. It was pitched as transparency, but it was also a way to flex. Every month became a scoreboard in the ASIC arms race, often accompanied by breathless announcements of tens of thousands of rigs on order.

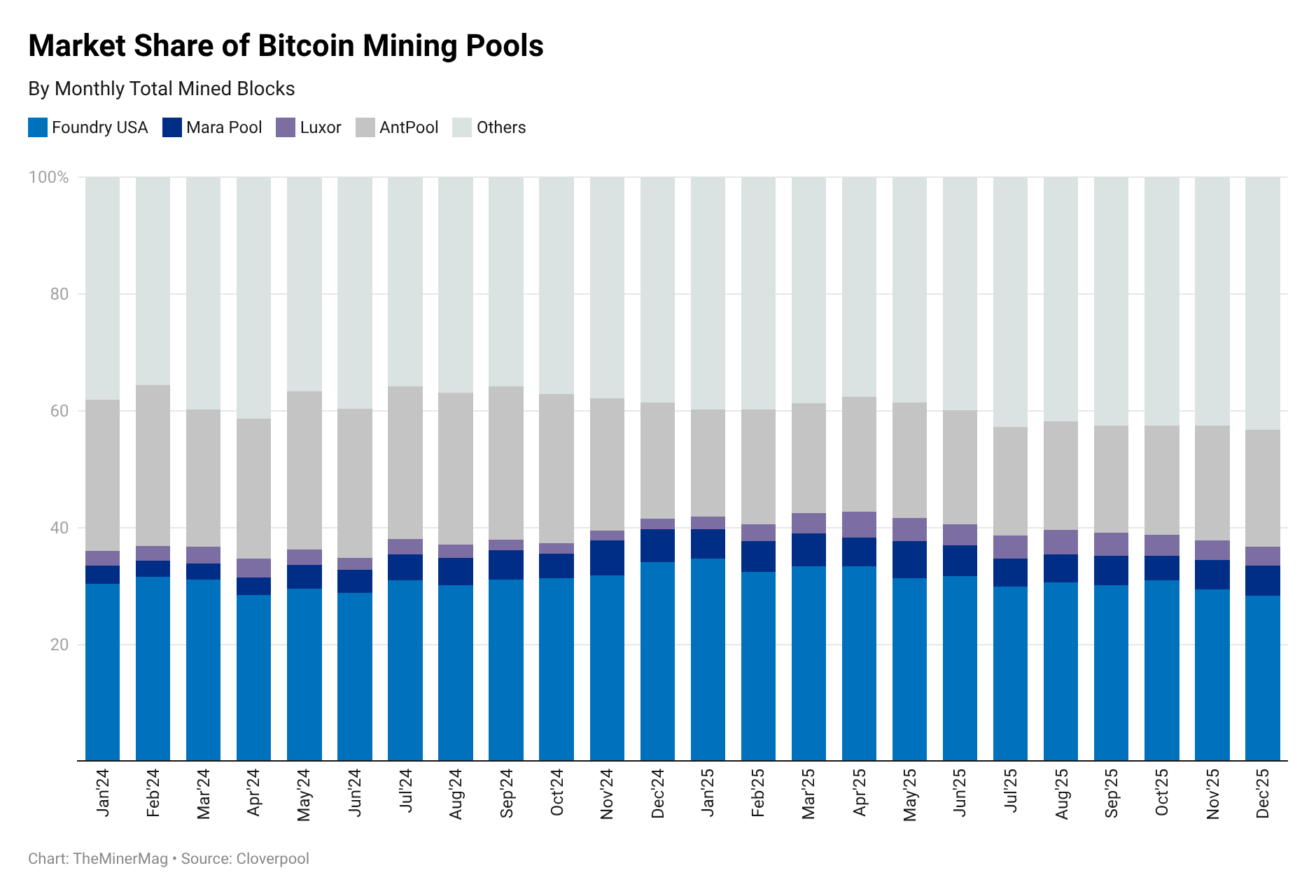

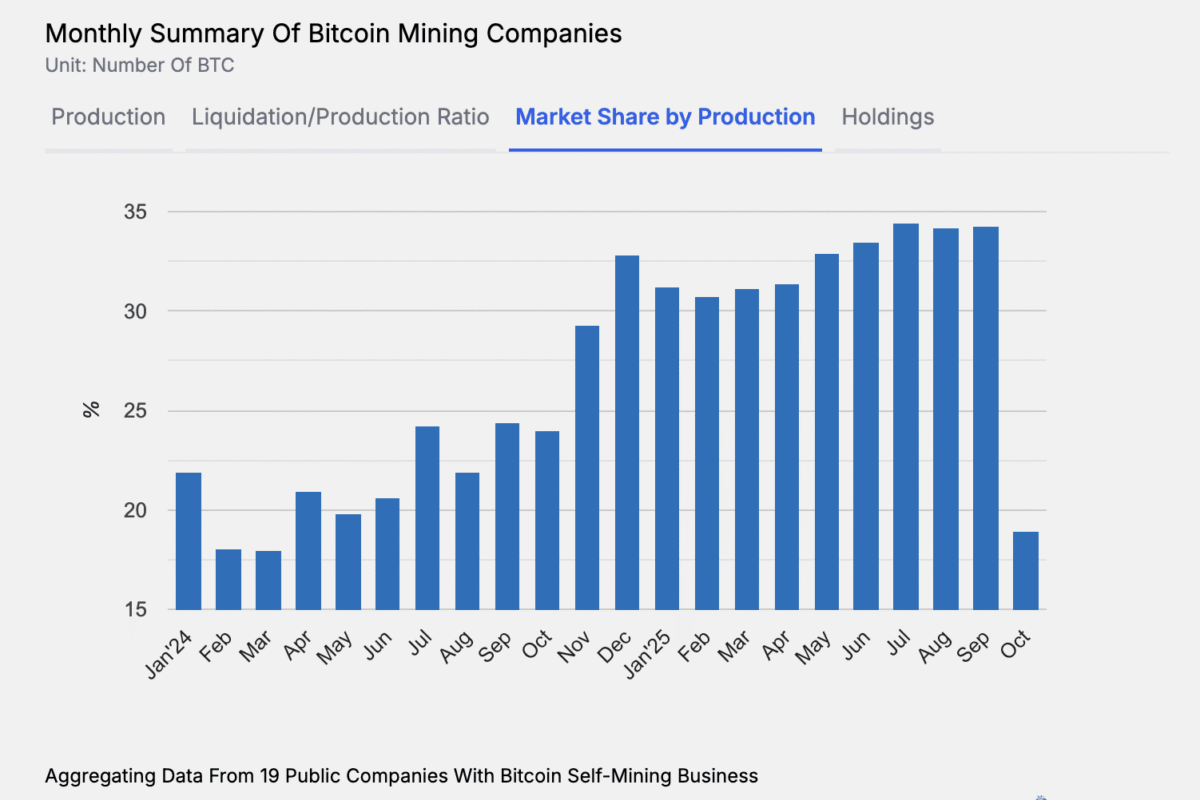

As more miners went public and the hardware race heated up, the cadence spread. At its peak, more than 34% of global bitcoin production could be traced through monthly updates. We highlighted that in a previous issue.

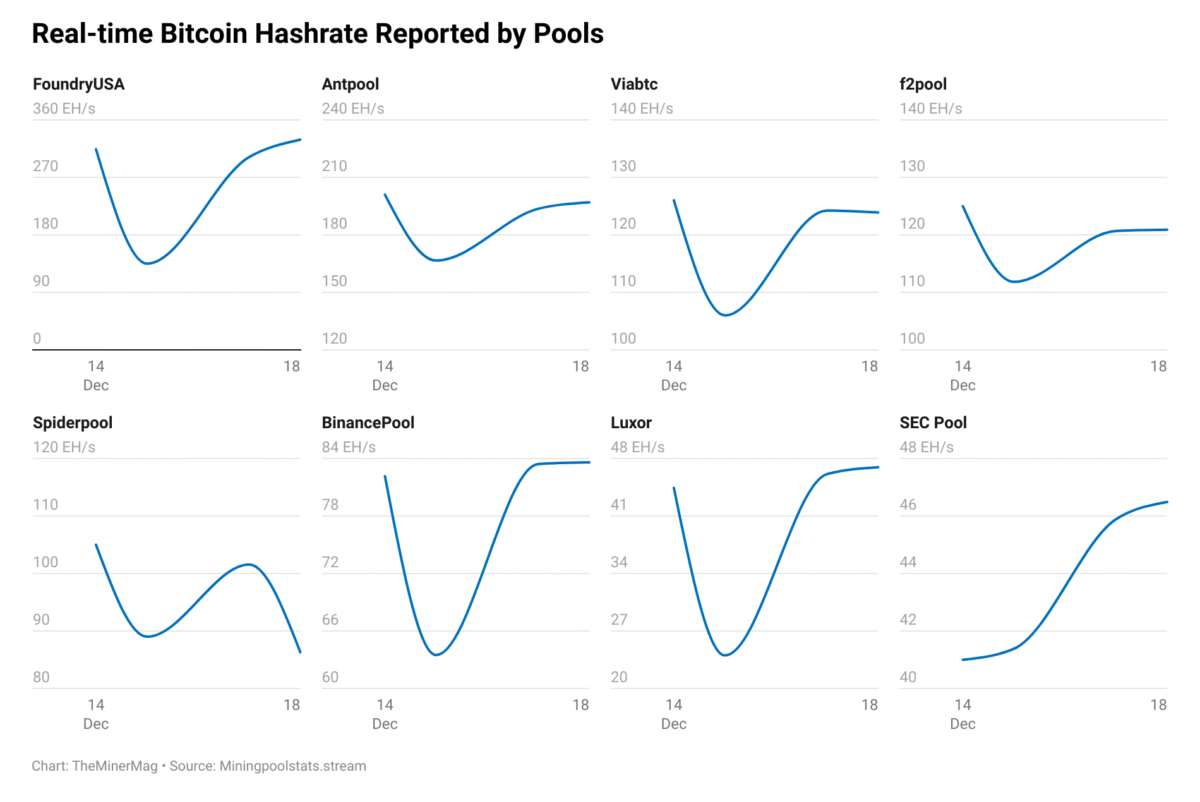

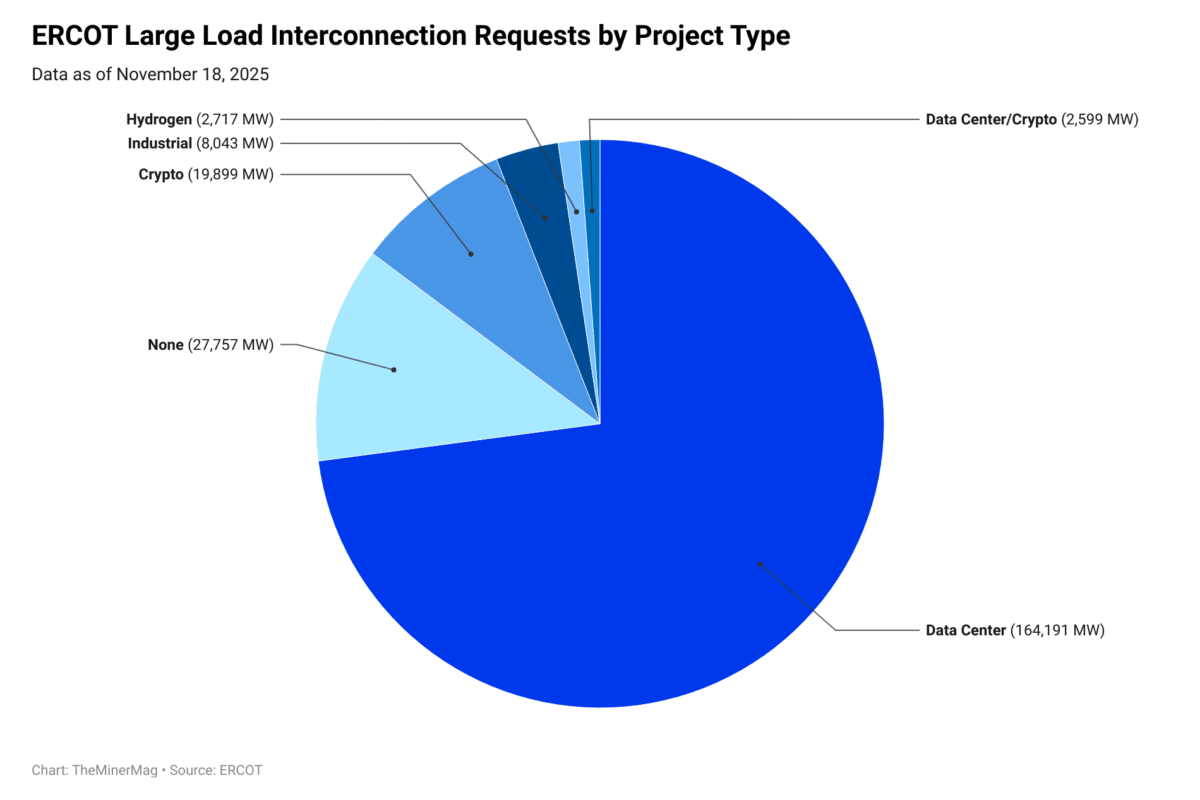

Fast-forward to now, the tone could not be more different. Hashprice has cooled, drifting back toward cycle lows. The exuberance has faded. And the arms race is—in the words of several CEOs—effectively on pause. Miners are reserving power capacity not for new S23s, but for liquid-cooled GPU pods. Deals from Terawulf, Cipher and IREN with hyperscalers have set the direction of travel. Bitfarms, a fixture of the public-miner cohort, went as far as telling investors this week that it expects to wind down bitcoin mining entirely by 2027.

Against that backdrop, the monthly updates have thinned out quickly. MARA and Cipher did not publish October figures. Core Scientific appears to have stopped as well. They follow peers like IREN, Terawulf and Bitfarms, which dropped their monthly cadence earlier this year.

Who’s left? A short list: Riot, CleanSpark, Cango, Bitdeer, BitFuFu, Canaan and HIVE. Ionic, which is preparing for an IPO, is also still reporting.

That said, it’s not that public miners have stopped reporting entirely. Most still disclose production, treasury balances and hashrate in quarterly filings. Because so many miners released Q3 numbers in recent weeks, TheMinerMag estimated their production levels on a month-by-month basis for July through September. And when you count the full cohort of 19 major public miners—including Ionic, which is still in IPO mode—they collectively accounted for roughly 34% of the network’s identifiable production as of September.

The October picture looks much thinner only because the monthly cadence has broken down and Q4 filings won’t arrive until early next year. With fewer companies issuing standalone October updates, the identifiable share of bitcoin production drops to just 18% for now.

In a way, the shrinking disclosure footprint reflects the broader mood of the sector. When bitcoin mining was a race to scale at any cost, monthly updates were a way of keeping score. Now, as the industry pivots toward HPC and AI—and as hashprice grinds along the floor—the scoreboard matters a lot less. The story has moved on.

Regulation News

- Malaysia’s Tenaga Nasional incurs losses of more than $1 billion from crypto power theft – Reuters

- Cease-and-desist issued to Bitcoin mining site in Eaton County over noise complaints – WKAR

Hardware and Infrastructure News

- Hut 8 Sells 310 MW Ontario Power Plants to Prioritize Bitcoin, HPC Infrastructure – TheMinerMag

- Bitmain Opens Bidding on S19k Pros at $5.5/TH as Market Slump Pressures Bitcoin Miner Sales – TheMinerMag

Corporate News

- American Bitcoin Shares Slide in Pre-Market Sell-off Despite Q3 BTC Output Surge – TheMinerMag

- Canaan shares rise 18% on gross-profit turnaround, doubled revenue and record bitcoin holdings – The Block

- Ionic Digital Appoints Andy Stewart as Chief Executive Officer – Link

Financial News

- Applied Digital prices $2.35B senior secured notes at 9.25% – Link

- Pentwater Discloses $400M Core Scientific Position Following Failed CoreWeave Deal – TheMinerMag

- Cipher to Raise $333 Million More for Barber Lake Build-Out Amid Fluidstack HPC Expansion – TheMinerMag

- Bitfury, known for its Bitcoin mining, launches $1 billion initiative to invest in ethical tech and AI – Fortune