Miner Weekly: Bitcoin Mining Stocks Shed $23B as Four-Week Slide Tests the Sector’s Bull Run

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Bitcoin mining stocks have erased more than $20 billion in market value over the past month, raising the question of whether the sector’s sharp year-end rally is losing steam.

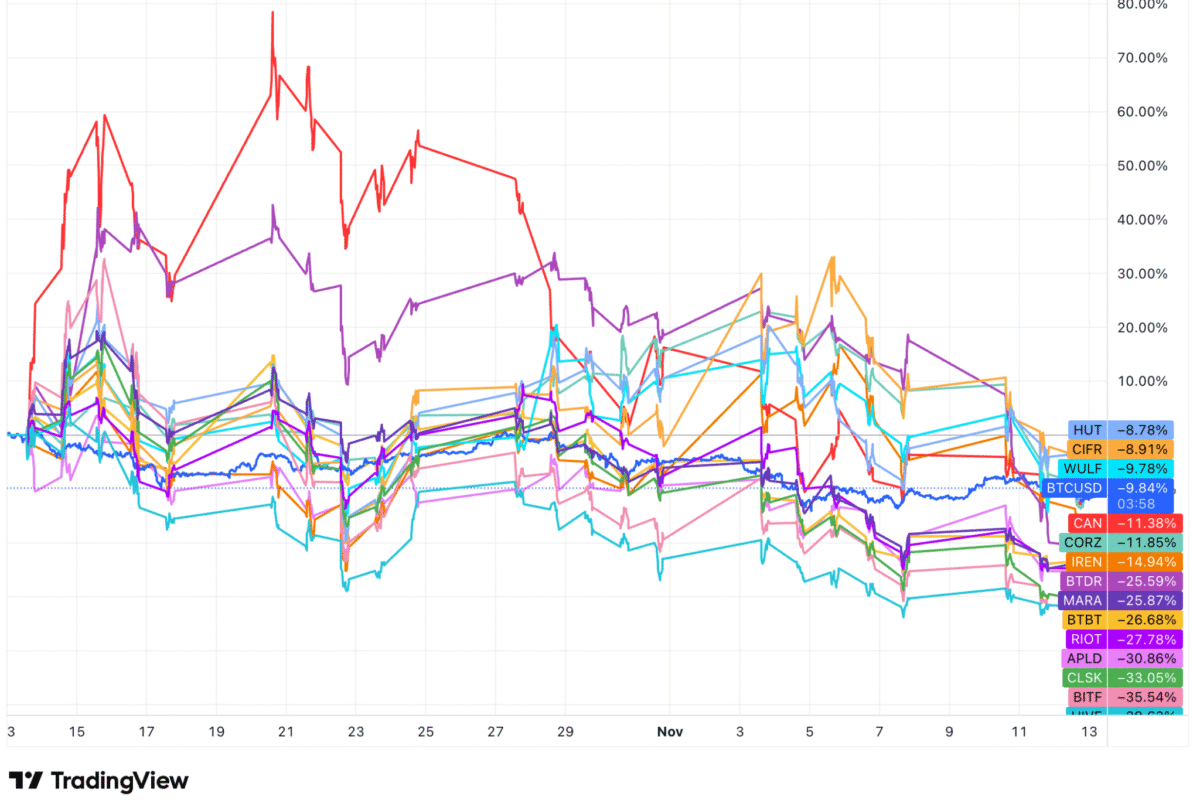

Around October 15, a group of 15 major publicly traded miners extended a multi-week rally that pushed their combined market capitalization to nearly $90 billion, as TheMinerMag reported at the time. But sentiment has deteriorated since. As of November 12, the cohort’s total market cap has fallen to $67 billion, a decline of 25% from the October peak.

A TradingView snapshot of the period shows the sector underperforming bitcoin, with most miners falling more steeply than BTC’s roughly 10% slide over the same timeframe.

The pullback comes even as institutional investors have been accumulating mining equities. Recent Schedule 13G filings show:

- Fidelity’s FMR LLC disclosed an 8% stake in Riot.

- Jane Street crossed 5% ownership thresholds in Terawulf, Cipher and Bitfarms.

- Barclays PLC reported a 5.27% position in Core Scientific.

- Situational Awareness, a hedge fund, increased its Core Scientific stake to 9.4% in mid-October.

Institutional inflows, however, have not offset selling elsewhere. Tether trimmed 8 million Bitdeer shares, a move that likely contributed to Bitdeer’s decline during the period. More broadly, miners with weaker balance sheets or higher leverage saw outsized drawdowns as bitcoin retreated from the $120,000 range to the low $100,000s.

Despite the four-week slump, most miners remain ahead of bitcoin on a year-to-date basis. Still, the drawdown has pushed several names into oversold territory relative to BTC, a reversal from mid-October when miners were outperforming and attracting renewed speculative interest.

The divergence leaves the sector at an inflection point: is this a temporary retracement driven by macro jitters and profit-taking, or the early sign that the post-halving bull run is already fading?

With bitcoin’s hashprice hovering near cycle lows and mining economics tightening again, the next few weeks may help determine whether miners reclaim their October momentum—or whether this is another cycle where optimism peaks early, only to ask the familiar question: see you in four years?

But for some, like Bitfarms, the answer is already taking shape. The company announced on Thursday a major strategic shift to orderly wind down its bitcoin mining hashrate beginning in 2026 and repurpose its facilities in Canada and the U.S. for HPC workloads, starting with its 18-megawatt site in Washington.

Hardware and Infrastructure News

- Phoenix Energizes 30MW Bitcoin Mine in Ethiopia, Expanding African Footprint – TheMinerMag

- Proof-of-work Privacy Coin Zcash Continues Historic Surge, Nearing 8-Year High Price – Decrypt

- Auradine Unveils New Teraflux Bitcoin Miners to Expand US Hardware Push – TheMinerMag

Corporate News

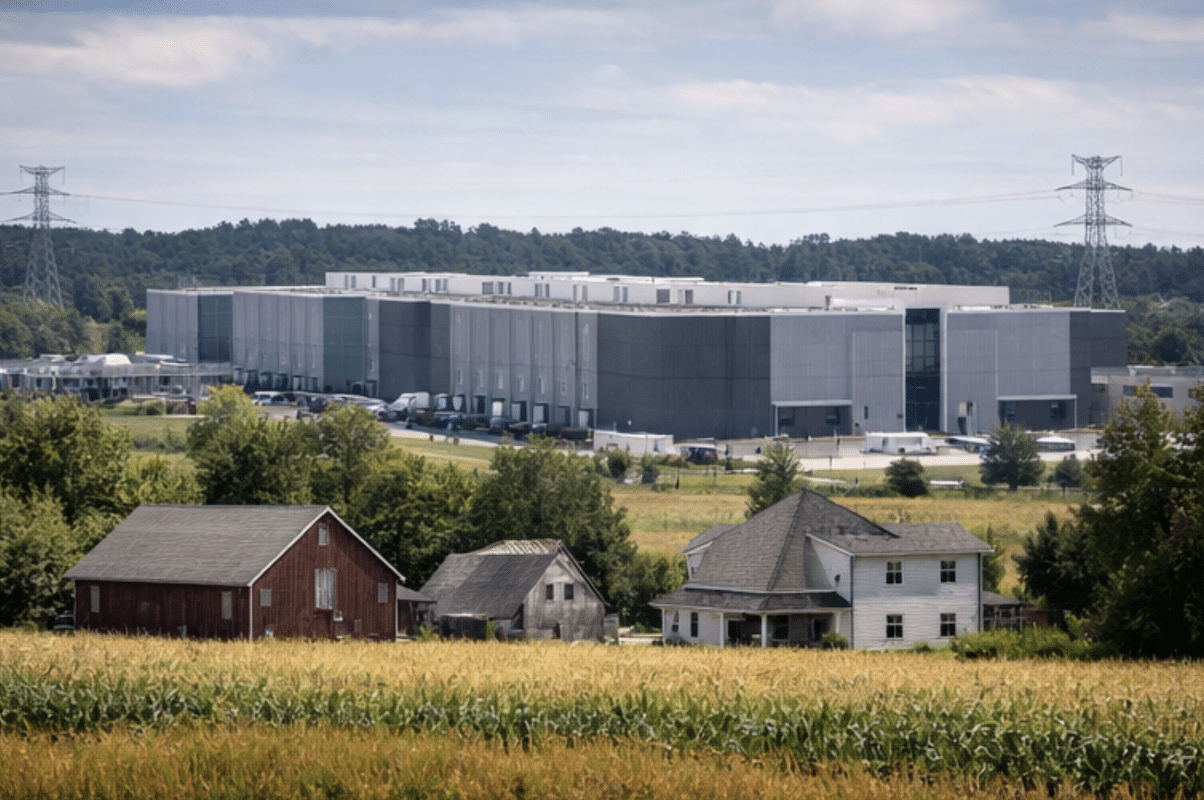

- Greenidge Renews Air Permit for New York Bitcoin Mine, Ending Years-Long Legal Fight – TheMinerMag

- Northern Data Moves Forward With Rumble Merger After Exchange Ratio Cut – TheMinerMag

- Fire Put Out at Bitdeer’s Under-Construction Bitcoin Mine in Ohio, No Injuries Reported – TheMinerMag

- MARA Pool Mines Bitcoin Block With 1 BTC Fee Paid on $10 Transaction – TheMinerMag

- Bitfarms Plans to Wind Down Bitcoin Mining by 2027, Begins HPC Conversion at Washington Site – TheMinerMag

Financial News

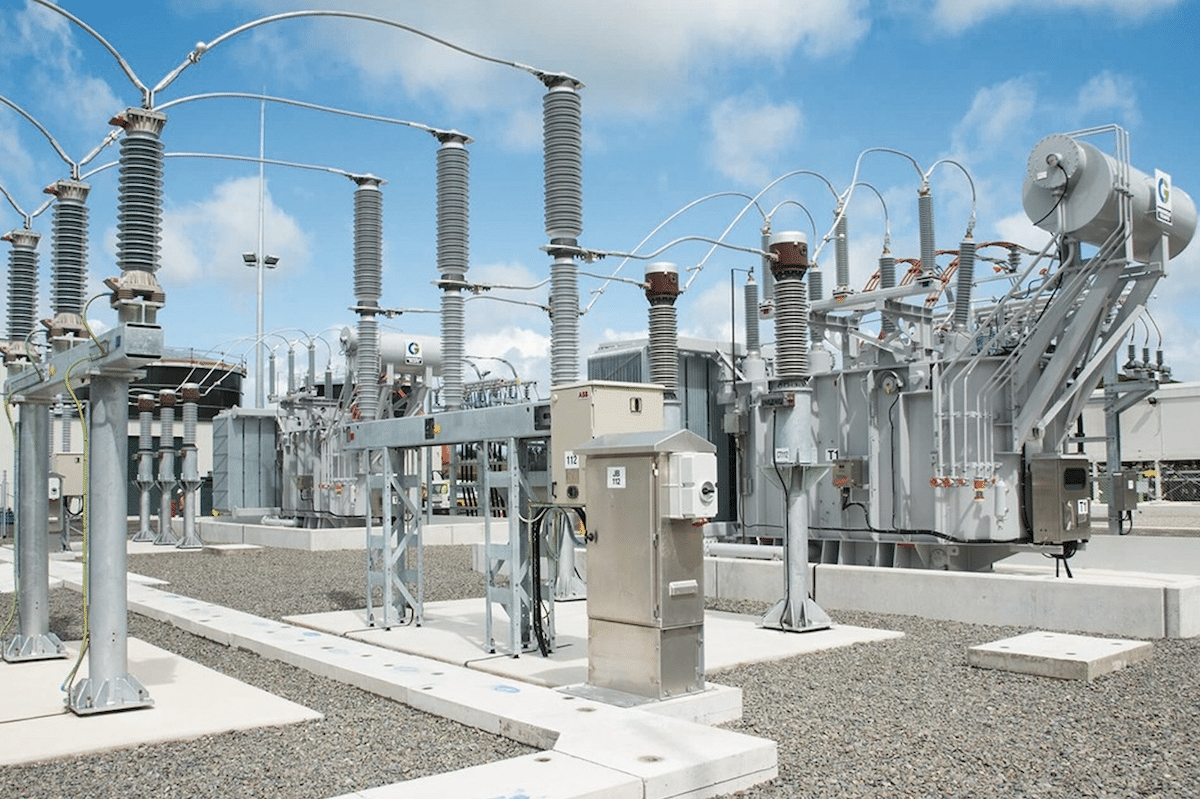

- Applied Digital Plans $2.35B Senior Notes to Fund North Dakota HPC Data Centers – TheMinerMag

- CleanSpark Upsizes Convertible Bonds to $1.15B as Bitcoin Miner Debt Wave Accelerates – TheMinerMag

- Tether unloads 20%of its stake in bitcoin miner Bitdeer – Blockspace.media

- Bitdeer Shares Drop 22% After Pricing $400M Convertible Notes and $149M Equity Offering – TheMinerMag