Bitcoin Mining Stocks Double in Value to $90 Billion as Sector Extends Rally

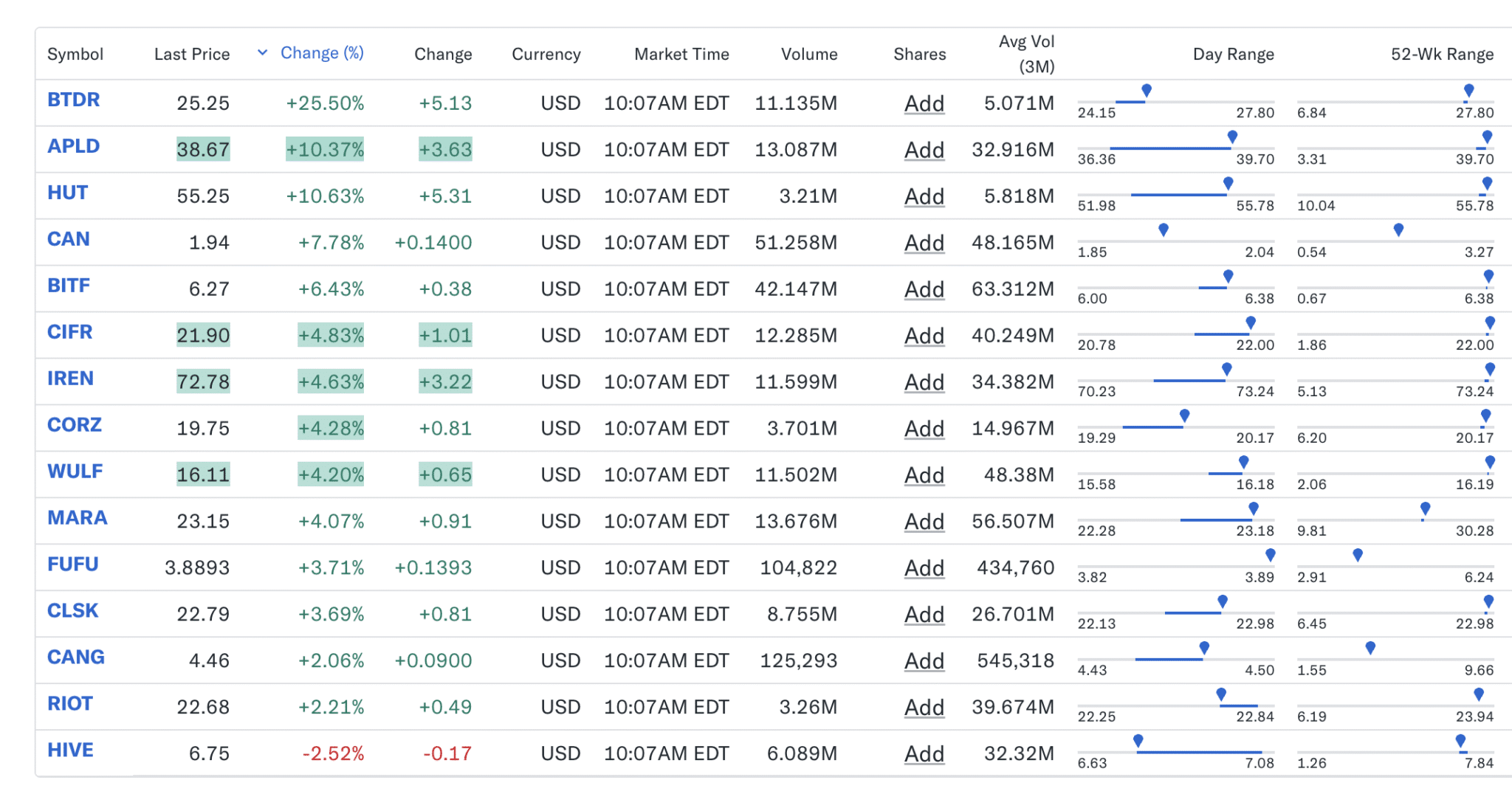

Bitcoin mining stocks continued their strong rebound on Wednesday, pushing the combined market capitalization of 15 major publicly listed miners to over $90 billion—more than double the level recorded less than two months ago.

The rally was led by Bitdeer, whose shares jumped as much as 32% to $26.61, marking their highest level in over a year. The Singapore-headquartered company on Tuesday disclosed a 32.9% increase in realized hashrate in September via the energization of its proprietary mining rigs, overtaking Riot as the world’s fifth-largest public Bitcoin miner.

Canaan, another mining hardware maker and operator of its own mining fleet, gained as much as 11.1% to $2.00. The company recently secured a 50,000-unit order for its A15 Pro Avalon miners and expanded its pilot gas-to-power mining project in Canada.

The momentum extended across nearly the entire sector. Applied Digital and Hut 8 also posted double-digit gains on Wednesday, while almost every other company is approaching or has set new 52-week highs.

The sharp rise in valuations reflects renewed investor confidence in vertically integrated miners that combine ASIC design, self-mining, and AI infrastructure capacity.

It also highlights the broader shift in market sentiment toward digital infrastructure operators, even as hashprice remains under pressure near $47/PH/s due to record network difficulty and a softening bitcoin price.