Miner Weekly: Asia Dominates Antalpha’s $1.6B Bitcoin Loan Book

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Bitmain’s financing arm, Antalpha, filed for an initial public offering in the U.S. this week. While the target raise of $50 million and its modest $47 million in 2024 revenue may not make major waves, the prospectus reveals compelling details about the company’s lending business, particularly its role in servicing bitcoin miners and the growing investor demand in Asia.

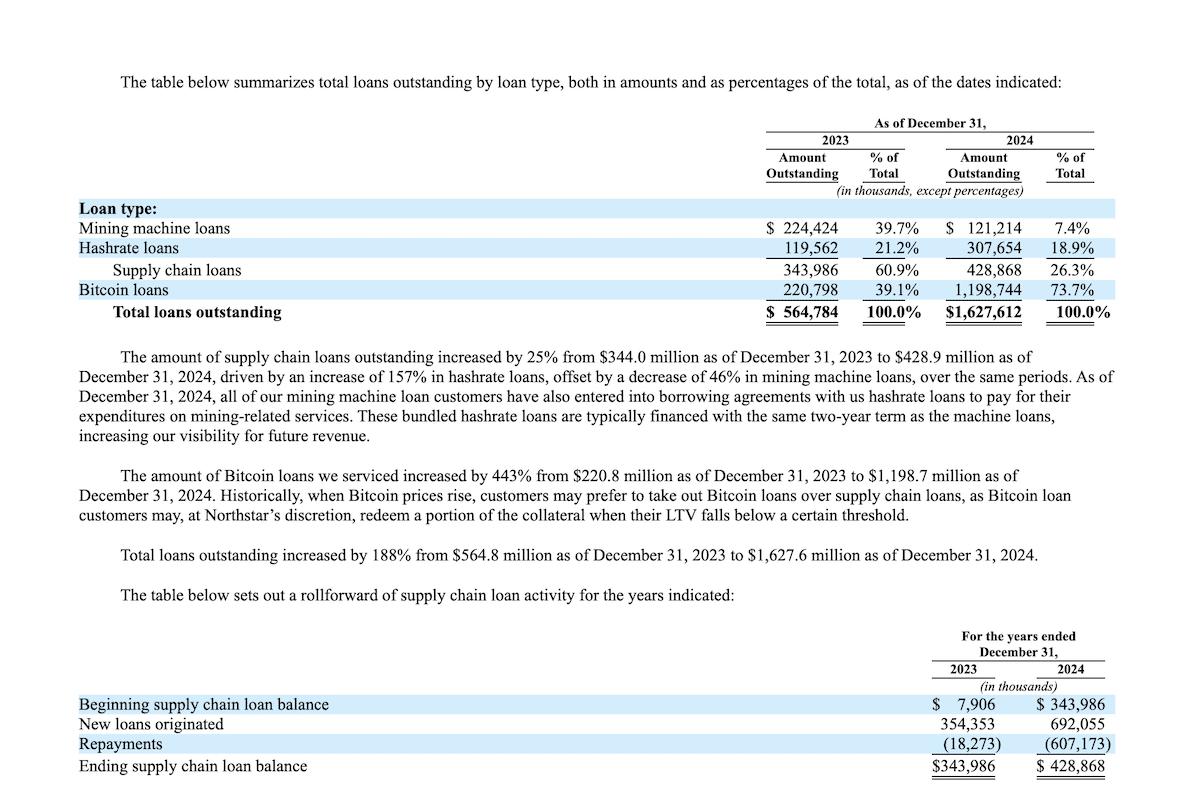

Antalpha operates a dual-pronged lending model tailored to the digital asset mining industry. It offers both bitcoin-backed loans and supply chain financing, including loans secured by mining hardware or hashrate. These two product lines serve distinct but complementary purposes, enabling mining companies to access liquidity while optimizing capital efficiency.

Bitcoin Loans

Bitcoin loans are facilitated through Antalpha’s platform, Antalpha Prime, in partnership with external financing providers, most notably Northstar. In this arrangement, Antalpha acts as a service provider, helping customers obtain capital using bitcoin as collateral without assuming credit risk on its own balance sheet. Borrowers typically pledge bitcoin, which is held as security for the duration of the loan.

These loans surged in 2024. Antalpha ended the year with $1.2 billion in bitcoin loans outstanding—more than five times the previous year’s total—and originated $1.23 billion in new loans during the year. The growth reflects strong institutional demand for crypto-backed credit, particularly across Asia.

But who is Northstar, the key financing partner behind these loans? Antalpha and Northstar were initially sister companies under a shared parent entity ultimately controlled by Bitmain co-founder Ketuan Zhan. This corporate connection made Bitmain a foundational partner in developing Antalpha’s bitcoin loan servicing business.

During the 2024 Reorganization, Antalpha underwent a major corporate restructuring. The business—including its assets, employees, and subsidiaries—was carved out of Northstar and transferred to a newly formed Cayman Islands holding company, Antalpha Platform Holding Company. The parent company subsequently disposed of all its interest in Northstar, ending formal ownership ties. Northstar is now owned by an irrevocable trust for which Zhan is the settlor and beneficiary, with a professional trustee managing the trust.

Supply Chain Loans

Antalpha’s supply chain financing supports miners in purchasing equipment or paying for related services. These loans—typically issued in USDT—are often collateralized with either bitcoin or mining hardware, most notably Bitmain’s S19XP models, which the manufacturer holds in surplus inventory.

This financing is divided into two categories:

- Mining machine loans – to fund hardware purchases

- Hashrate loans – to cover hosting fees and other operational costs

By the end of 2024, Antalpha had $429 million in outstanding supply chain loans and had originated $245 million in new loans that year. These were secured by both liquid and illiquid collateral, with an average loan-to-value (LTV) ratio of 44.3%.

Together, bitcoin and supply chain loans form the backbone of Antalpha’s business. The company now services 75 institutional clients globally under a capital-light model built on technology and external partnerships.

Asia Footprint

All told, Antalpha had $1.6 billion in loans outstanding across the supply chain and Bitcoin loan products. Notably, as of December 31, 2024, 77.4% of Antalpha’s total loan book—equivalent to $1.26 billion—was extended to clients in Asia, up from 66.2% in 2023. This marks the largest regional concentration by far and highlights Antalpha’s strategic focus on Asian digital asset markets.

This regional bias underscores the strong interest among Asian institutional and corporate clients in crypto financing, especially to fund mining hardware and operations. By contrast, exposure to borrowers in the Americas dropped to 6.9% in 2024 (from 24.6% in 2023), while EMEA clients accounted for 15.7%, a slight increase.

Hardware and Infrastructure News

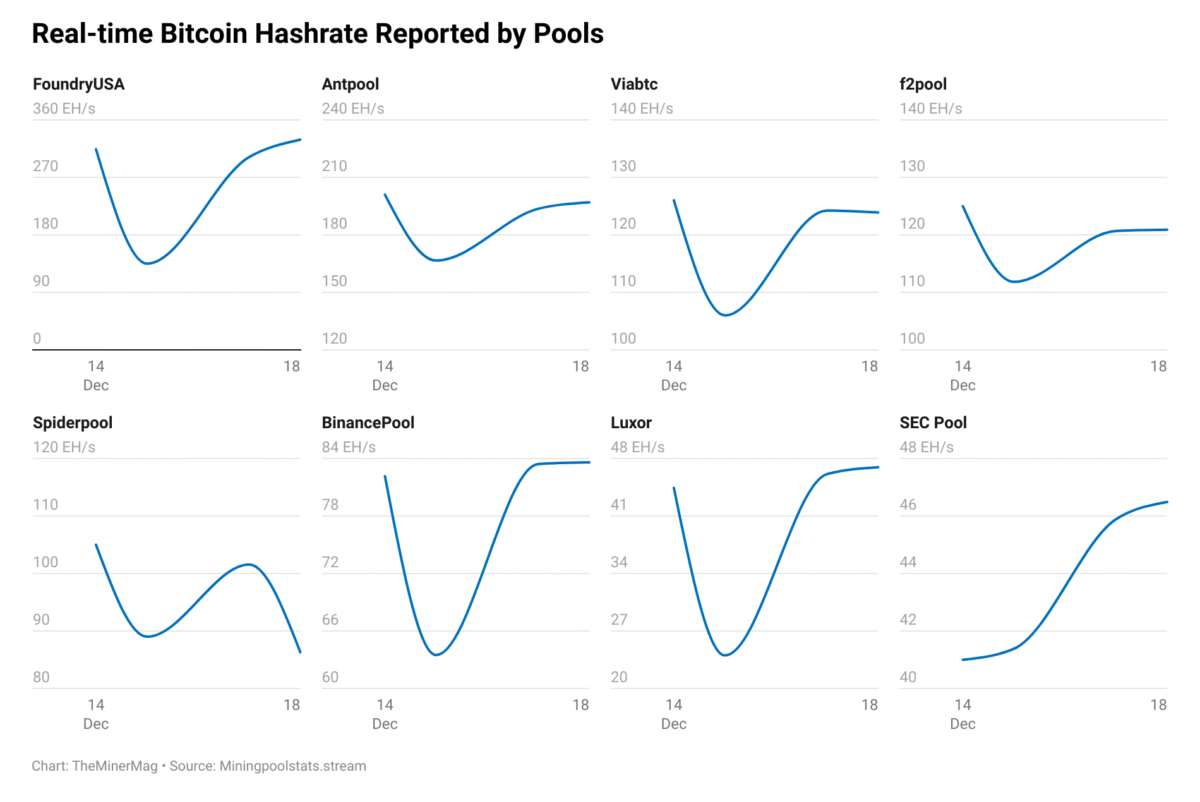

- Bitcoin Mining Difficulty Hits Record High as Hashrate Tops 900 EH/s – TheMinerMag

- HIVE Targets 5 EH/s Bitcoin Hashrate Boost with Paraguay Site by Q2 – TheMinerMag

- LAPD Recovers $2.7M in Stolen Bitcoin Miners – TheMinerMag

Corporate News

- Tether to Back OCEAN Pool with Current, Future Bitcoin Hashrate – TheMinerMag

- Riot Taps Coinbase for $100M Bitcoin-Backed Loan Amid Prolonged Hashprice Slump – TheMinerMag

Financial News

- Bitdeer Raises $179M in Loans and Equity Amid Bitcoin Chip Push – TheMinerMag

Feature

- How Some Bitcoin Mining Firms Try to Game U.S. Customs Controls – Coindesk

- Hashprice Below $40? Mining Report Paints a Stark Picture for Bitcoin Miners – Bitcoin.com

- Bitcoin Miners Get Little Relief From Top Cryptocurrency’s Rally – Bloomberg