Miner Weekly: Bitcoin Mining Feels the Heat from Trump’s Tariffs

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

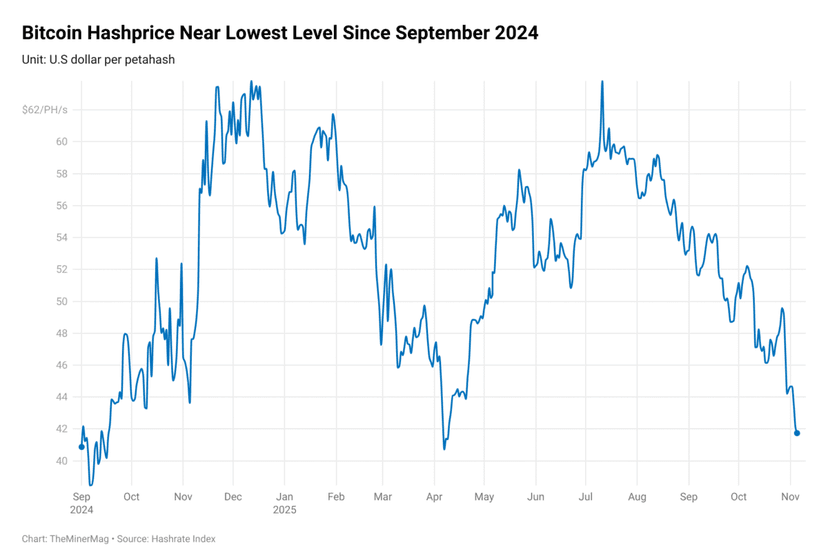

Bitcoin’s hashprice – a measure of mining profitability – has fallen back below $40/PH/s again this week, a level not seen since September 2024. This drop, triggered by a broader market sell-off sparked by U.S President Trump’s global tariffs, has serious implications for miners—even for those operating large-scale fleets. Although the market bounced back notably after the Trump administration announced a temporary 90-day pause on the said global tariffs, Bitcoin’s hashprice still just hovers above $42/PH/s.

According to TheMinerMag’s analysis of Q4 earnings, the $40/PH/s mark is a critical gross margin breakeven point for many public mining companies, based on their fleet hashcost—the direct cost of running mining operations, excluding corporate overhead and financial obligations.

With hashprice now back at breakeven levels, any additional costs beyond the fleet hashcost—including corporate overhead and interest payments —are pushing almost all these firms into net-negative territory in terms of their proprietary mining segment.

The broader total hashcost estimates from Q4 2024 illustrate just how thin margins have become. TheMinerMag’s corporate and financial hashcost estimates are based on a fair-share revenue approach.

The last time hashprice touched $40/PH/s was in mid-September 2024, when Bitcoin traded around $64,000. Fast forward to today, Bitcoin bounced back from a local low of $75,000 earlier this week to $82,000—yet miners are worse off. Why? Two key reasons:

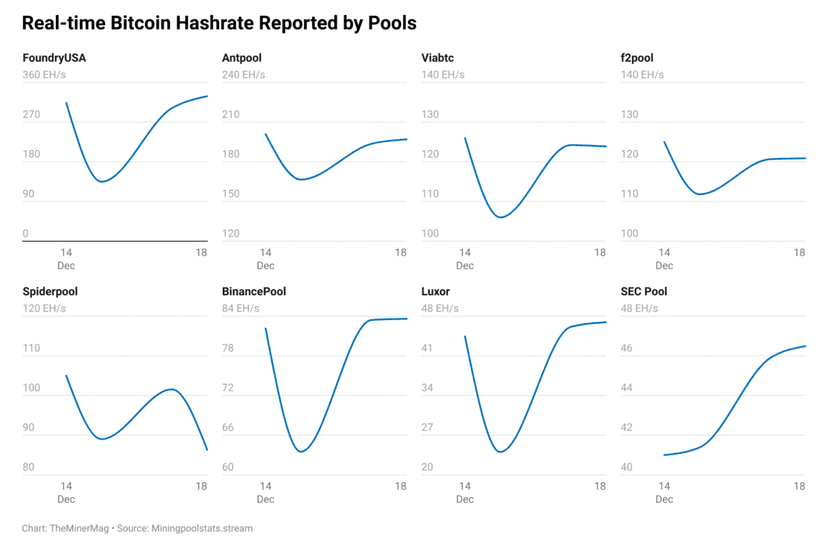

1. Network hashrate surge: Bitcoin’s 7-day average hashrate has surged past 900 EH/s, inching closer to the 1 zatahashes per second milestone. This relentless rise in computational power continues to dilute mining revenue per unit of hash.

2. Plunging transaction fees: After a short-lived fee spike last year, monthly block transaction fees have been setting record lows since this year.

The economics are especially bleak for operators still running S19 Pro-class machines, which, according to Coin Metrics, still account for half of the network’s hashrate. These miners, already marginal in profitability after the April halving, are likely to face accelerated shutdowns or redeployments in the weeks ahead unless hashprice sees a meaningful rebound.

Hardware and Infrastructure News

- Solo Bitcoin Miners Are Winning More Blocks Lately—What Gives? - Decrypt

- Bitcoin Hashprice Drops to Seven-Month Low, Pressuring Mining Margins - TheMinerMag

- Bitdeer Expands into Ethiopia, Pauses Disclosure of Bitcoin Chip Capacity - TheMinerMag

Corporate News

- Galaxy Digital gains SEC approval for Delaware move; Nasdaq listing expected in May - The Block

- Ionic Digital Explores AI, HPC Potential for Cedarvale Bitcoin Mine - TheMinerMag

Financial News

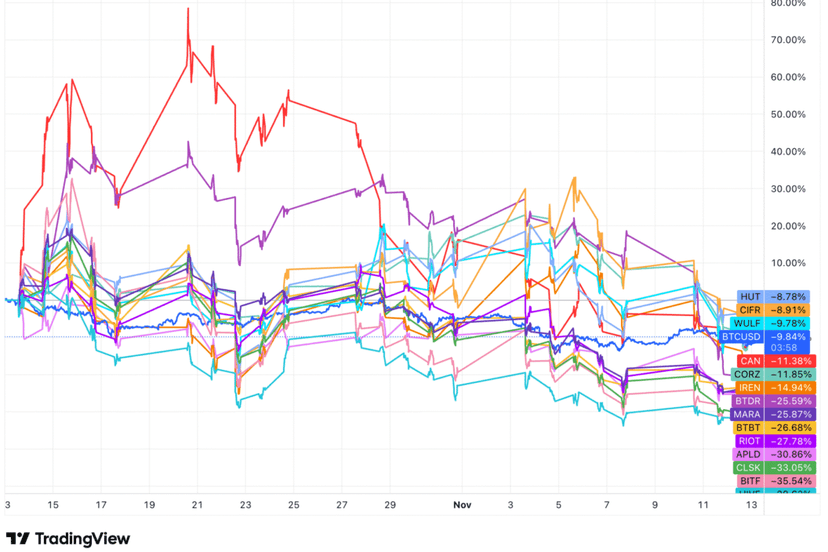

- Bitcoin Mining Stocks Tumble Amid Wider Market Turmoil - Decrypt

- Bitcoin Mining Stocks Rebound After Trump Pauses Tariff Plans - TheMinerMag

Feature

- The Trumps Mine BTC Now: Inside American Bitcoin w/ Matt Prusak - The Mining Pod