Miner Weekly: Bitcoin’s Rising Cost Is Fueling the AI Exodus

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

The bitcoin mining arms race may be losing steam — not solely because rewards are shrinking (though March’s low fees didn’t help), but because a more lucrative opportunity is emerging on the horizon.

This week, Iris Energy announced it would pause hashrate expansion once it hits 52 EH/s in the coming months. Despite only recently ramping up its fleet, the company now says it will prioritize capital discipline as it reassesses how to allocate debt and equity financing amid shifting market conditions.

Meanwhile, Bitfarms revealed it has hired senior executives to lead its high-performance computing (HPC) initiative. One of them was named James Bond! The company plans to convert its newly acquired Pennsylvania bitcoin mining sites from its merger with Stronghold into HPC infrastructure. To support this transformation, Bitfarms has secured up to $300 million in loans from the Macquarie Group.

They’re not alone. Galaxy Digital, which has been operating the Helios bitcoin mining site acquired from Argo, is poised to scale back its proprietary hashrate, converting the site for HPC purposes after securing a 15-year lease with CoreWeave.

Earlier this year, Riot also announced it would pause its 600-megawatt hashrate expansion to reserve that capacity for potential HPC conversion.

These companies are just the latest in a growing cohort of miners shifting from bitcoin mining to AI, citing steadier returns and less cutthroat competition. For some, AI isn’t just a side hustle — it’s quickly becoming the main event. While CoreWeave’s lackluster IPO debut last week raised some eyebrows, a well-argued piece from Fortune suggests the issue lay more with CoreWeave itself than with demand for AI infrastructure.

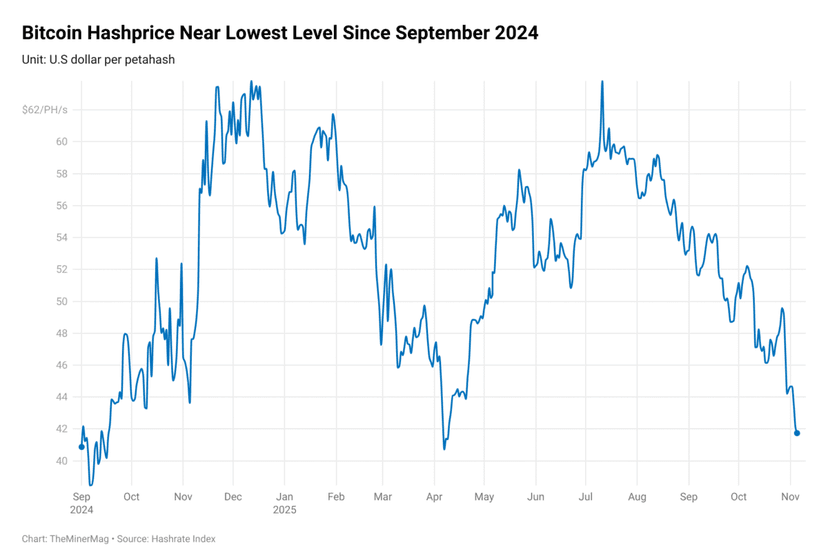

This wave of introspection is arriving just as bitcoin’s mining costs are surging. In Q4, BTC’s average price jumped over 36% quarter-over-quarter, breaking past $100,000 for the first time in history. But beneath that bullish surface, mining economics are becoming increasingly fragile.

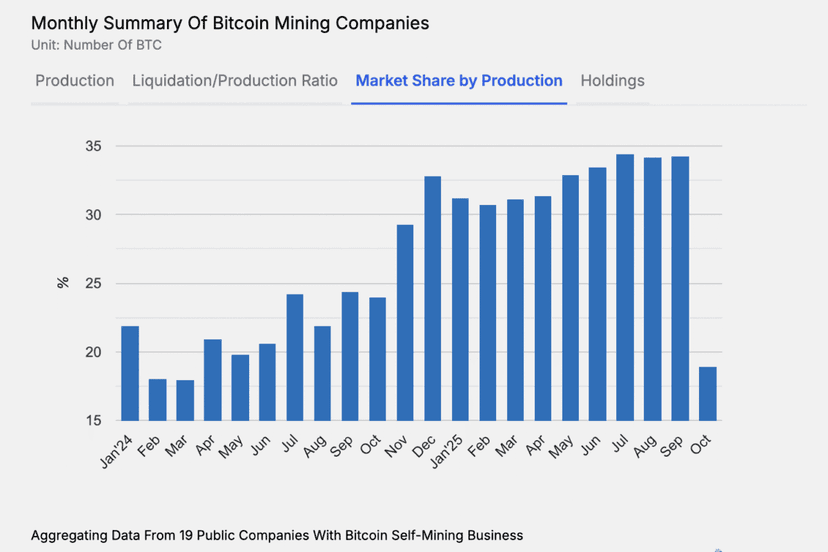

According to TheMinerMag, the average direct cost of bitcoin production among 15 public miners rose 22% quarter-over-quarter, reaching $51,800 per BTC in Q4 — driven by an overheated hashrate and soaring electricity prices in key U.S. states.

This reality is forcing companies to rethink the incentive structure that has long defined the mining industry. For years, miners have been stuck in a relentless feedback loop: the price rises, more machines come online, hashrate climbs, difficulty increases, margins shrink, capitulation ensues, the market bottoms, and the cycle repeats. The pivot to AI and HPC could break this loop — though success will depend heavily on execution.

Still, if major players are pausing hashrate expansion and stepping away from the bitcoin mining game theory, the diehard miners could emerge with a larger share of the “orange pill” — and perhaps, stronger staying power in the long term.

Regulation News

- Tariffs Disrupt Bitcoin Mining Supply Chain Rooted in Asia - Bloomberg

Hardware and Infrastructure News

- Galaxy Digital to Scale Back Bitcoin Mining Amid Shifts to AI Hosting for CoreWeave - TheMinerMag

- IREN to Pause Bitcoin Hashrate Expansion at 52 EH/s to Focus on AI Cloud Growth - TheMinerMag

Corporate News

- Soluna and Luxor Announce Turnkey Mining Success With BitMine - Link

- Adam Back, Blockstream Push to Enforce $28M Bitcoin Award Against InnoSilicon - TheMinerMag

- Trump Sons Back Hut 8’s New Bitcoin Mining Spin-off - TheMinerMag

- Bitfarms Boosts Realized Bitcoin Hashrate by 15% Following Stronghold Merger - TheMinerMag

- Cango Exits Auto Business in $352M Deal to Mine Bitcoin for Bitmain’s Antalpha - TheMinerMag

Financial News

- MARA Enters $2 Billion ATM Plan as Full Bitcoin Hodl Continues - TheMinerMag

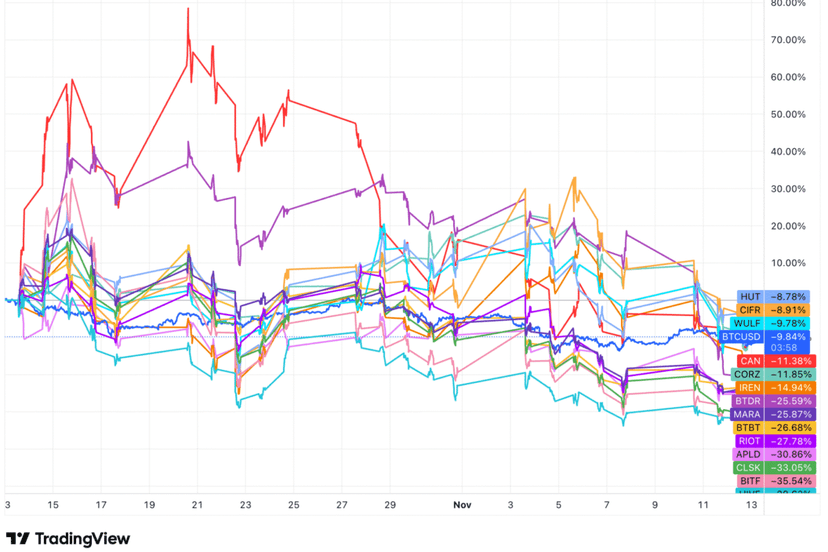

- U.S.-Listed BTC Miners Tracked by JPMorgan Shed 25% - CoinDesk

- Bitfarms Secures up to $300 Million Loan from Macquarie Group to Fund Initial HPC Project Development at Panther Creek - Link

Feature

- Bitcoin Miners See Growing Opportunity Under Trump, Though Challenges Persist - Decrypt

- To the Moon? OG Miner Wang Chun Becomes First Bitcoin Hodler in Space - TheMinerMag

- Bitcoin Miner Hut 8 Could Look to Acquire a Hyperscaler, Clear Street Says - CoinDesk