Miner Weekly: Halving Hits Bitcoin Fees Too?

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

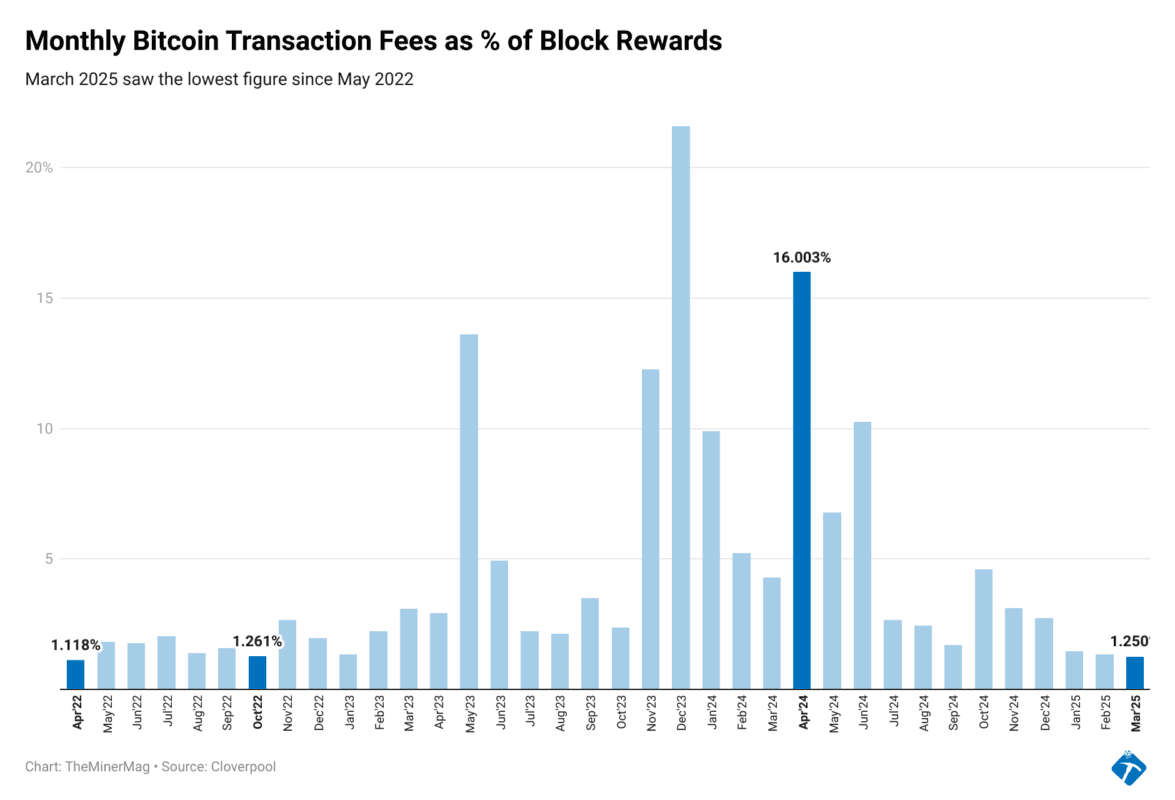

As March 2025 draws to a close, Bitcoin’s transaction fees have experienced another notable decline, now making up only 1.25% of the total block rewards, according to TheMinerMag’s analysis of Bitcoin blocks this month so far.

This marks the lowest percentage of transaction fees in three years, since April 2022, signaling a significant shift in the network’s dynamics. In 2025, Bitcoin fees have consistently accounted for less than 2% of the monthly block rewards.

For context, transaction fees in March 2025 have totaled 155 BTC so far, which is not yet half of the 361 BTC from three years ago. Has the halving come for transaction fees, too?

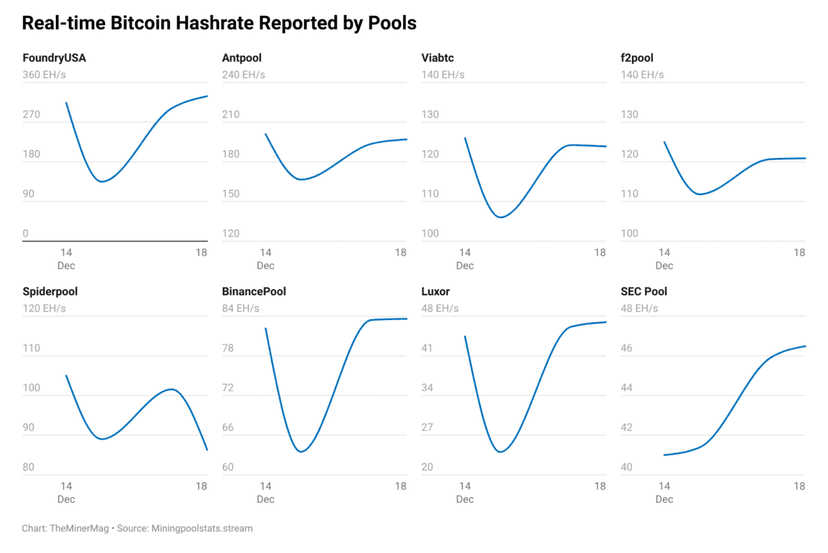

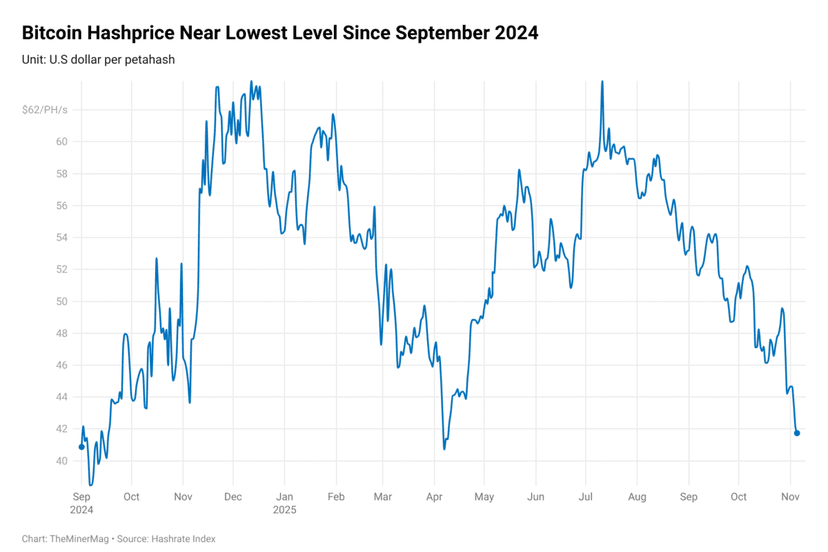

Meanwhile, Bitcoin’s seven-day moving average hashpower has quietly recovered, climbing back to 840 EH/s from just below 800 EH/s a week ago. The quiet and steady rise in hashrate indicates that confidence remains strong among large, efficient players, despite Bitcoin’s hashprice—the revenue miners earn per terahash per second—remaining stagnant below $50/PH/s.

With the hashrate recovery, the network is expected to undergo a difficulty adjustment in approximately 10 days, which is projected to rise by 5%. With more miners competing for the same block subsidies and fewer fees to go around, this increase in difficulty could further strain profitability for miners with higher operational costs.

Without a significant uptick in Bitcoin’s market price or a revival in transaction fees, these miners may soon face an unmanageable situation: they may no longer be able to compete.

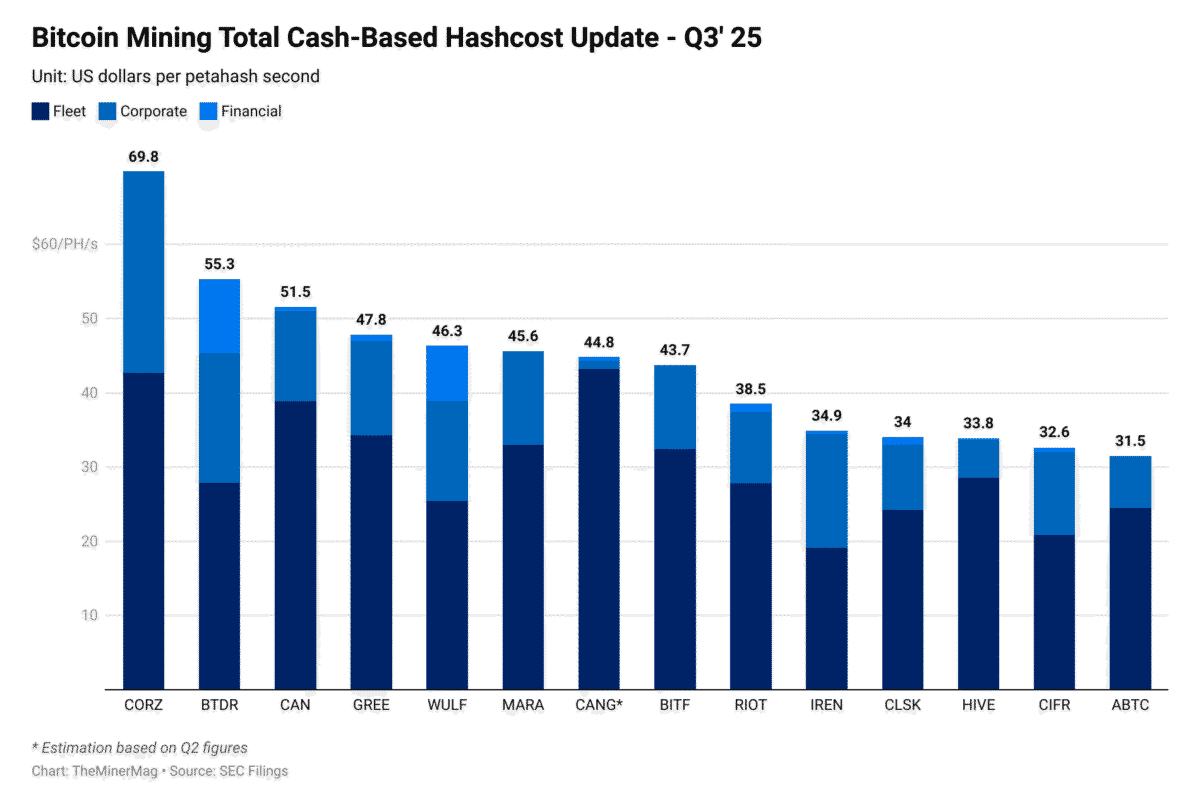

According to TheMinerMag’s analysis of earnings reports, the median hashcost—the direct cost miners incur per terahash per second—among publicly listed mining companies was around $34/PH/s in the latest quarter. This leaves only about $15/PH/s as gross margin, even for the largest institutional mining operations.

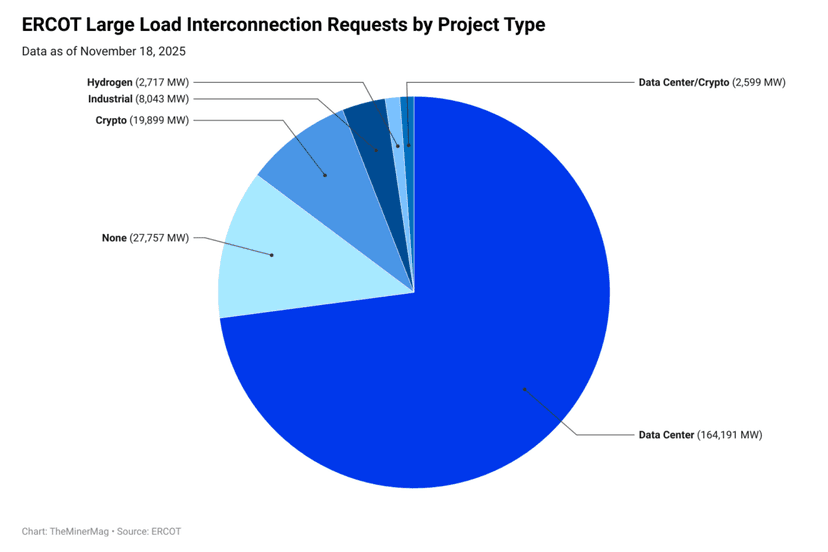

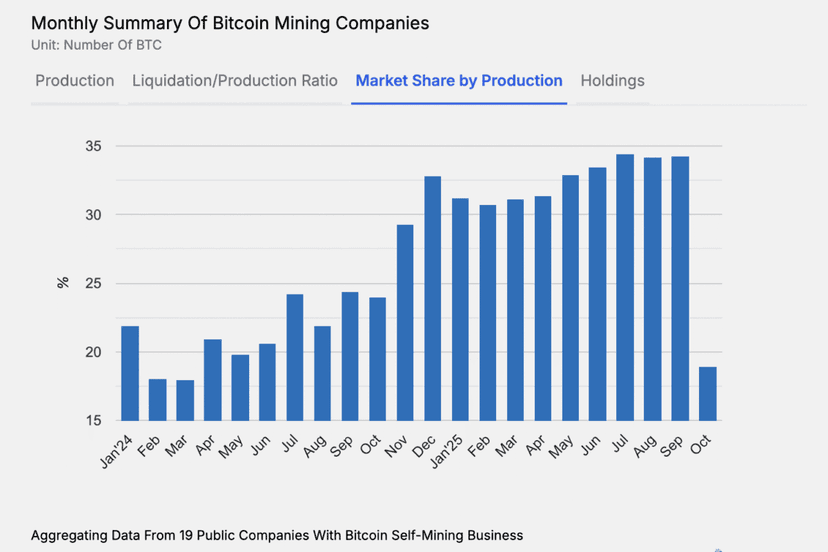

This environment is setting the stage for further consolidation within the Bitcoin mining industry. Larger players, with more efficient equipment and better access to cheaper energy, are positioned to absorb market share as smaller miners struggle to stay afloat.

Regulation News

- Proof-of-Work Crypto Mining Doesn’t Trigger Securities Laws, SEC Says - CoinDesk

- Pakistan Considers Bitcoin Mining to Help Offset Surplus Power Supply - TheMinerMag

- Arkansas auto salesman's plan for new Vilonia cryptomine must win over wary locals - KATV

Hardware and Infrastructure News

- TVP and Demand Pool announce upcoming launch of first Stratum V2 Bitcoin mining pool - Link

- Bitcoin Hashprice Remains Flat After Moderate Difficulty Uptick - TheMinerMag

- Auradine Launches Hydro Bitcoin Miner with 14.5 J/TH Efficiency - TheMinerMag

- Canaan Signs US Hosting Deals to Boost Bitcoin Hashrate by 4.7 EH/s - TheMinerMag

Corporate News

- Argo Names New CEO Amid Hosting Search for Bitcoin Miners - TheMinerMag

- NYDIG Set to Expand Hashrate after Acquiring Crusoe's Bitcoin Mining Assets - TheMinerMag

- Bitfarms Appoints HPC Executive as Bitcoin Miners Diversify Amid Industry Headwinds - TheMinerMag

- Argo Seeks $27M Stock Deal to Acquire GEM Mining - TheMinerMag

- Cango Extends Deadline on 18 EH/s Bitcoin Miner Deal Amid Takeover Talks - TheMinerMag

Financial News

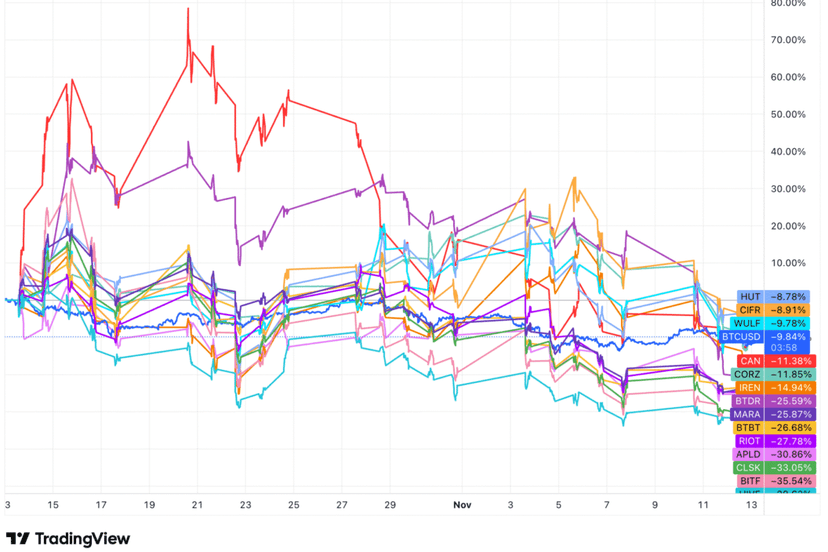

- Bernstein cuts price targets for Bitcoin miners amid underperformance relative to BTC in 2025 - The Block

- Riot Seeks to Acquire Rhodium's Rockdale Bitcoin Mining Assets in $185M Deal to Settle Disputes - TheMinerMag

- Argo Seeks $27M Stock Deal to Acquire GEM Mining - TheMinerMag

Feature

- Bitcoin Miners Feel Squeeze as Hashprice Erases Post-Election Gains - Coindesk

- Auradine’s AH3880 Server Rack ASIC Miner w/ Sanjay Gupta - The Mining Pod

- Bitcoin in the bush - the crypto mine in remote Zambia - BBC