Miner Weekly: Bitmain’s Secret Bitcoin Mining Proxy? The Cango Connection

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

It’s no secret that Bitmain is the largest producer of bitcoin mining machines. It’s also no secret that Bitmain mines itself—competing with its customers—while keeping those operations as discreet as possible.

But a recent transaction proposal sheds light on how Bitmain may have been working behind the scenes to get its proprietary mining assets indirectly listed in the U.S. through a shell company that initially appeared to be pivoting into Bitcoin mining.

Cango, a Chinese automobile financing platform, unexpectedly announced in November last year that it had purchased 32 EH/s of on-rack hashrate (bitcoin compute power) directly from Bitmain. The deal was valued at $256 million in cash, despite Cango holding less than $100 million in cash and just $560 million in current assets as of September. Additionally, Cango agreed to acquire another 18 EH/s of energized hashrate from Bitmain-linked entities in exchange for $144 million in new stock.

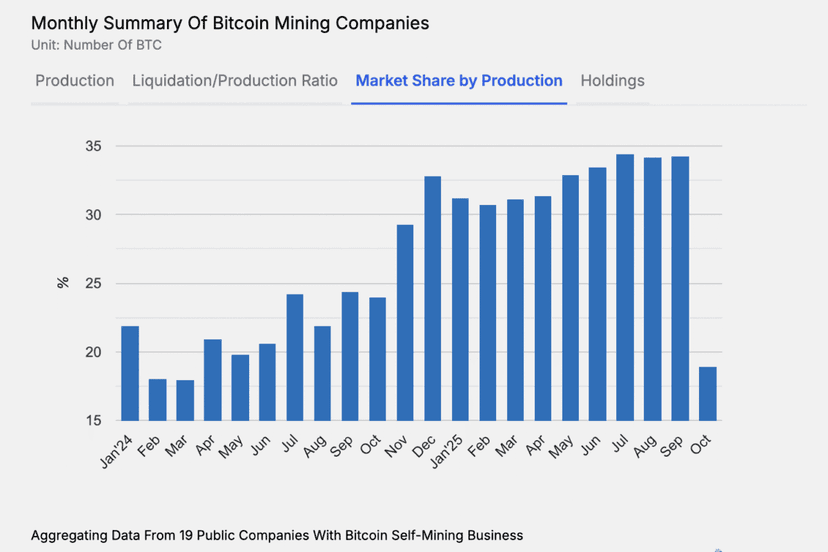

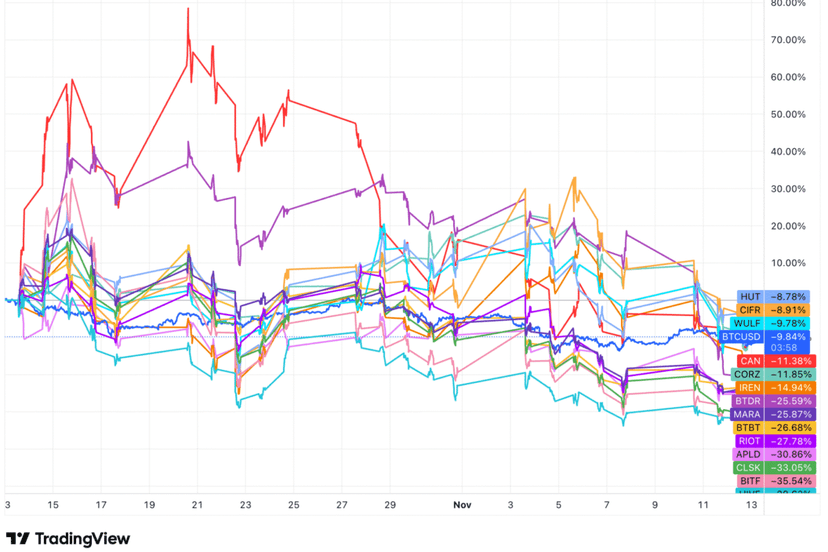

The move sent Cango’s stock on Nasdaq soaring, prompting its co-founders to offload portions of their holdings in November. Since then, Cango has been issuing monthly production updates, ranking it among the top five publicly-traded bitcoin mining firms by realized hashrate.

This may be the fastest bitcoin mining pivot at this scale. But in hindsight, Cango likely set out to serve as a mining proxy for Bitmain from the start.

Four months after announcing its mining pivot, Cango revealed that it had received a letter of intent from a British Virgin Islands-registered company called Enduring Wealth Capital Limited (EWCL). The proposal outlined a plan to take control of Cango, dispose of its car loan business in China, and shift its focus to bitcoin mining overseas.

So, who is EWCL?

Given its registration in the British Virgin Islands—known for protecting ownership privacy—its true controllers remain undisclosed. However, Cango’s SEC filing names two key decision-makers at EWCL, both of whom are employed by Antalpha, which is known to be a financing, custody, and investment spin-off of Bitmain.

Antalpha has publicly positioned itself as a “strategic partner” of Bitmain since its debut in 2022, though little is known about their structural relationship, as Antalpha is also registered in the British Virgin Islands. However, a 2022 filing on its major beneficial ownership in the U.S.-listed firm Metalpha propelled Antalpha to disclose its own ownership structure.

That filing revealed that Antalpha is 100% owned by Antpool, which itself is 80% controlled by Bitmain chairman Ketuan Zhan through a shell company he fully owns. Antalpha also follows the same branding style as Bitmain’s other products and offerings like the Antminer, Antbox, and Antpool, etc.

In essence, Bitmain likely orchestrated the sale of 32 EH/s of on-rack S19XPs to Cango—a U.S.-listed shell company—only to have its financing subsidiary move in to take control of Cango. The real question is: How much hashrate does Bitmain still own and operate that remains undisclosed? In other words, to what extent is Bitmain competing with its customers?

Regulation News

- Alberta judge orders shutdown of Bitcoin mine on Rocky View County land - DiscoverAirdrie.com

Hardware and Infrastructure News

- Bitdeer Launches New Bitcoin Miner as Buyers Seek Payment Delays - TheMinerMag

- Nova Energy's natural gas-powered cryptomine in Pennsylvania approved - DCD

- Stronghold Digital agrees to speed cleanup of its PA. coal ash pile - WESA

- Bit Digital Relocates Bitcoin Miners to Soluna, KaboomRacks as Coinmint Phases Out 46 MW - TheMinerMag

Corporate News

- Cango Poised to Become Bitcoin Mining Proxy for Bitmain - TheMinerMag

- Bitfarms completes Stronghold acquisition, sells Paraguay facility to HIVE in US push - The Block

- Foreman, Cholla Energy score patent win in dispute with Lancium - Blockspace

Financial News

- Tether Raises Bitdeer Stake to 21%: SEC Filing - CoinDesk

Feature

- How Bitdeer Is Transforming Bitcoin Mining Machines - Coindesk

- How BitFuFu Is Leveraging Cloud Contracts For International Growth - The Mining Pod

- The Company Testing Wall Street’s Appetite for A.I. Computing Power - NYT