Miner Weekly: Bitcoin Miners Go All In with 100k BTC and $4.6B in Debt

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

A previous Miner Weekly issue estimated that major North American Bitcoin mining institutions were on track to reach a combined holding of 100,000 BTC by March.

Despite last month’s market sell-off, the total Bitcoin held by 14 private and public mining companies with a Bitcoin reserve strategy surpassed the 101,000 BTC mark for the first time at the end of February.

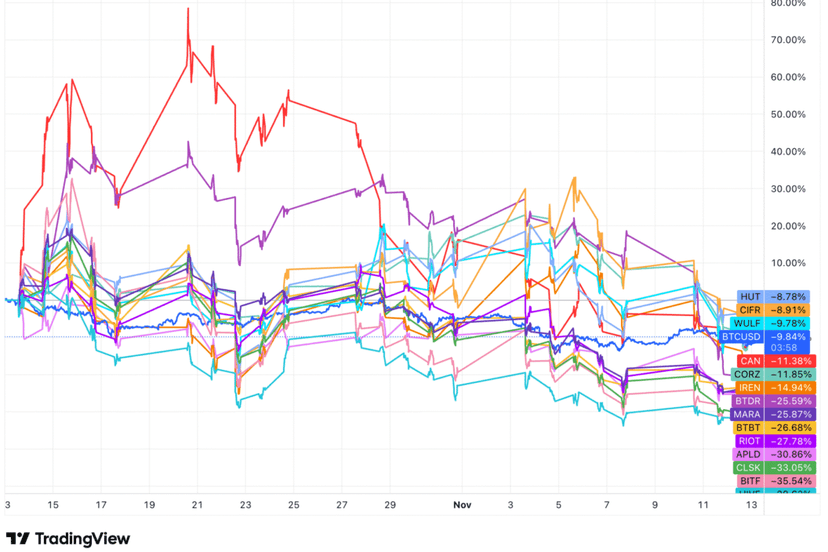

This growth is primarily driven by large mining and data center operators such as MARA, Riot, Hut 8, CleanSpark, Core Scientific, and Cango, either purchasing Bitcoin from the market using funds raised through debt and equity or continuing to hodl a significant portion—if not all—of their monthly Bitcoin production.

According to data compiled by TheMinerMag, major public mining companies raised $6.37 billion in the last quarter. Of this, $1.6 billion came from stock offerings, while the remaining $4.6 billion was raised through debt financing—primarily the issuance of convertible bonds with zero coupon rates.

For context, mining companies raised just $1.7 billion in Q3, with $1.2 billion from stock offerings and only $500 million from debt financing. While they raised a similar amount from shareholder dilution in Q4, they took on significantly more debt. In total, they secured $5.27 billion in debt financing in 2024, with 87% of that occurring in the last quarter.

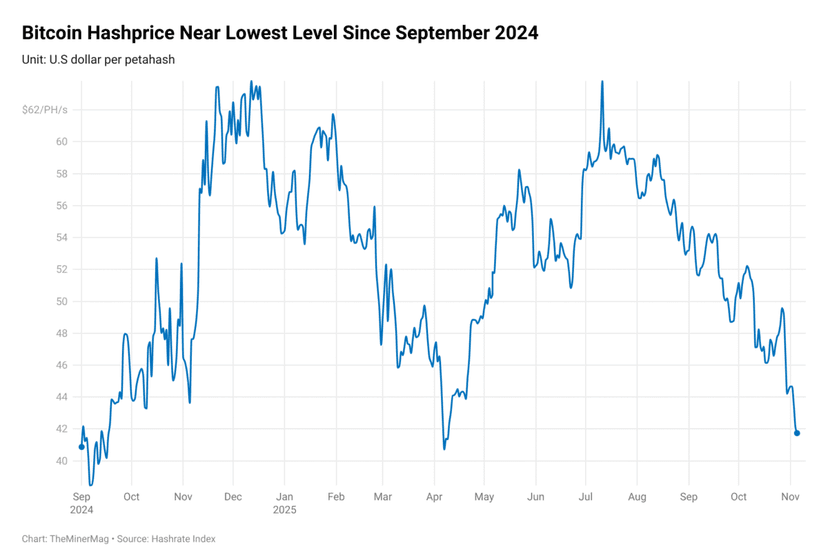

With Bitcoin’s hashprice—daily revenue per unit of computing power—falling below $50/PH/s again, hitting $45/PH/s during the recent market downturn, it will be interesting to see how these dynamics shift, particularly for companies colocating their equipment.

For example, Cango, the Chinese automobile financing firm that pivoted to Bitcoin mining, reported a Q4 production cost of approximately $67,769 per BTC, translating to a fleet hashcost of $42/PH/s, according to TheMinerMag’s analysis.

Given Bitcoin’s hashprice of $46/PH/s, this isn’t generating meaningful gross profit. The company is likely betting on Bitcoin’s upside to accelerate its return on investment. However, this strategy means covering significant operating expenses upfront without selling any mined BTC. In Q4, Cango spent $63.2 million to mine 933.8 BTC—excluding depreciation and amortization—nearly double its combined revenue over the four quarters before its pivot to Bitcoin mining.

Hardware and Infrastructure News

- Bitdeer Touts 9.7J/TH Efficiency in A3 Bitcoin Chip Tests - TheMinerMag

Corporate News

- NYDIG's Parent Firm Stone Ridge Accuses Mawson of $30M Bitcoin Miner Theft - TheMinerMag

- CleanSpark to join S&P SmallCap 600 index as shares decline alongside BTC - The Block

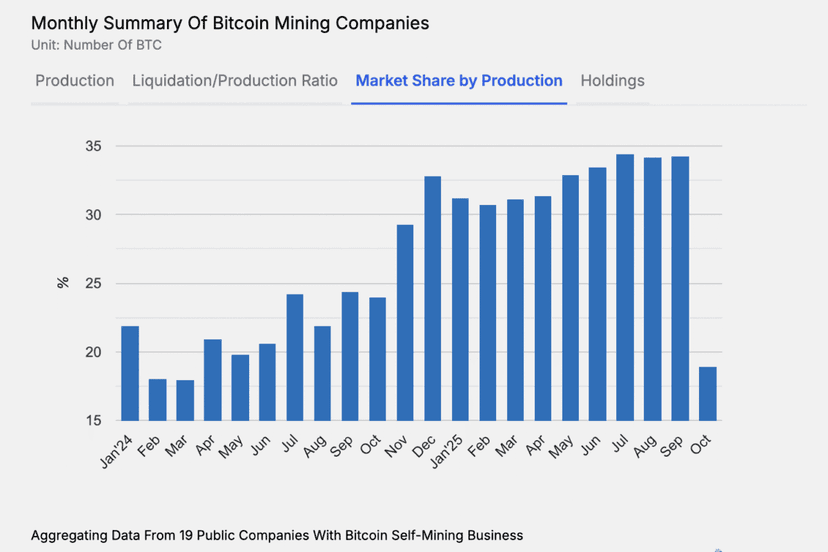

- JPMorgan says public bitcoin miners to keep gaining share in BTC network hashrate - The Block

- Bitdeer's Own BTC Holdings Surge Since Start of Year - Decrypt

Financial News

- CoreWeave inks $11.9 billion contract with OpenAI ahead of IPO - Reuters

- Canaan Secures $200 Million for US Bitcoin Mining Expansion - TheMinerMag

Feature

- How Analysts Are Rating Bitcoin Miners’ Pivot to AI and Chip Manufacturing - Decrypt

- As Utility Bills Soar, New Yorkers Face the Cost of a Greener Future - NYT

- Bitcoin Mining In Australia - The Mining Pod