Bitdeer Joins Bitcoin Miners to Issue $150M Convertible Notes

Singapore-headquartered bitcoin mining and colocation provider Bitdeer has announced a proposed public offering of $150 million in convertible senior notes due 2029.

The move makes Bitdeer the third public bitcoin mining firm this week to announce a convertible bond offering, as the industry grapples with squeezed profitability following the recent bitcoin halving.

The notes, which will be senior, unsecured obligations of Bitdeer, are set to mature on August 15, 2029. Additionally, the company plans to grant underwriters a 30-day option to purchase an additional $22.5 million in notes to cover potential over-allotments. The interest rate, initial conversion rate, and other terms of the notes will be determined at the time of pricing.

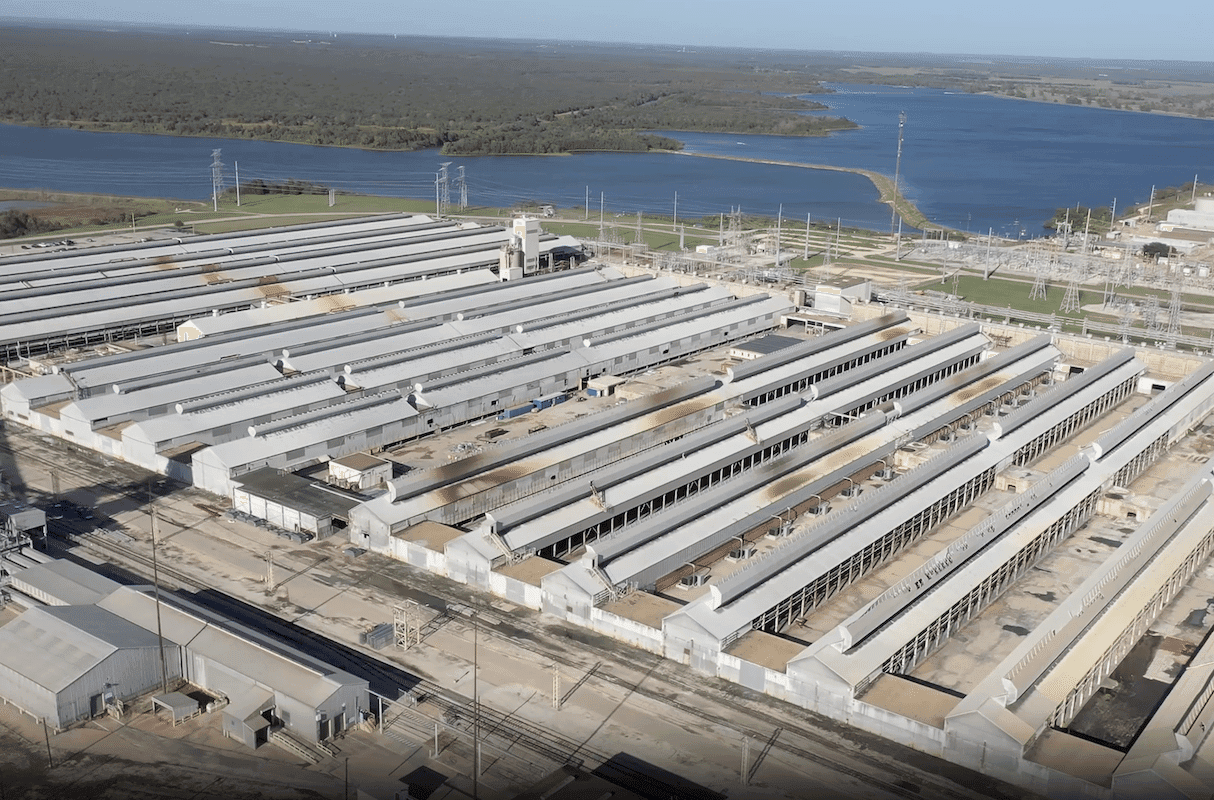

Bitdeer intends to use the proceeds from this offering for a range of purposes, including expanding its data centers, developing ASIC-based mining rigs, and general corporate needs.

Earlier this week, Marathon announced a $250 million convertible notes offering, which closed on Wednesday with an upsized raise totaling $300 million. Marathon subsequently used $250 million of the proceeds to purchase 4,144 BTC from the market.

Meanwhile, Core Scientific closed a $400 million convertible notes offering as part of an effort to restructure its existing loans, taking advantage of the new debt’s significantly lower interest rate.

As noted in the latest Miner Weekly newsletter, public bitcoin mining companies raised $1.6 billion via equity financing in Q2. Although this figure fell short of the record $1.9 billion raised in Q1, debt financing activity is on the rise.

Bitdeer’s stock price was down 13% during the pre-market hours on Thursday. The company raised about $150 million during the first half of 2024 via stock issuance, according to its Q2 filing.