Miner Weekly: The Return of Private Miners as Halving Looms

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

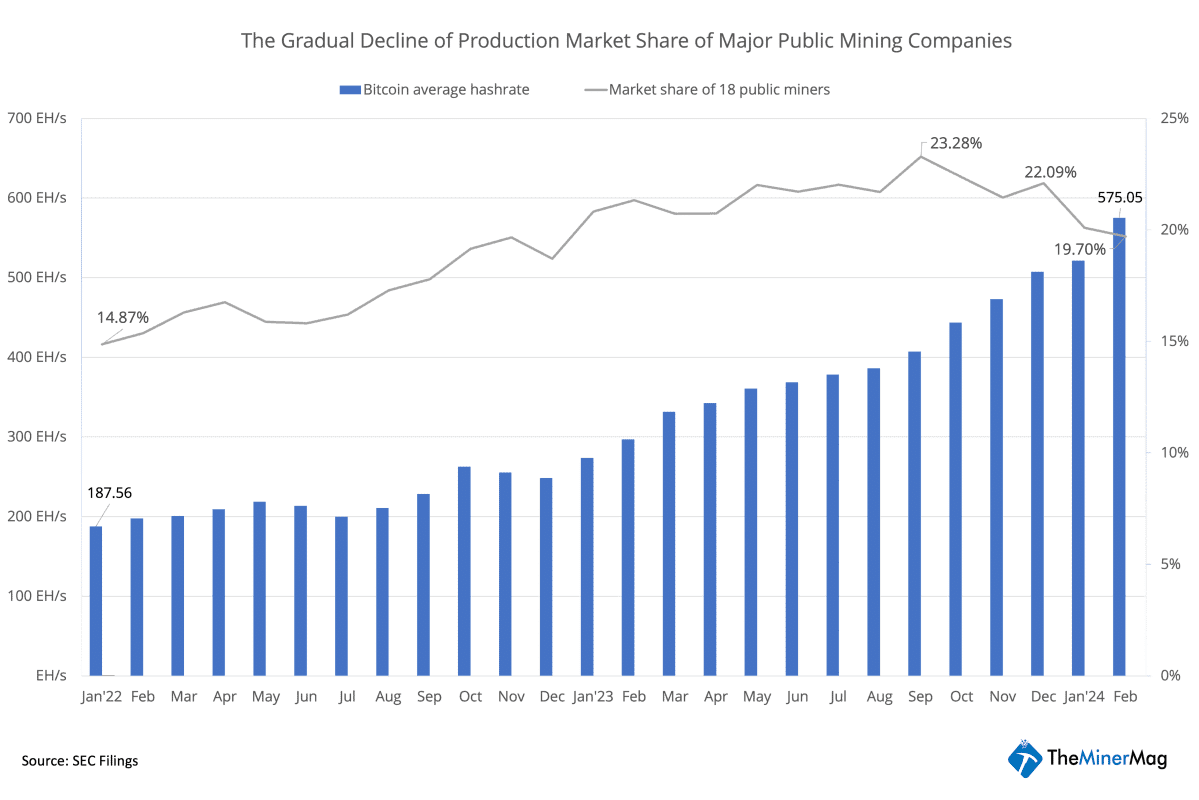

As bitcoin’s monthly average hashrate sets new records by ripping through 600 EH/s, the production share of publicly traded mining companies appears to be gradually declining — a sign of the return (and maybe an expansion) of private miners.

Based on data compiled and analyzed by TheMinerMag, 18 major publicly traded mining companies mined less than 15% of bitcoin’s block rewards in January 2022. That number gradually grew to 23.28% in September 2023, alongside bitcoin’s average hashrate increase during those 21 months. But after bitcoin regained the $30k level in October, it began to decline and reached 19.7% in February while bitcoin’s average hashrate continued to rise to 575 EH/s.

Notably, Marathon Digital, the largest publicly traded mining company by proprietary hashrate, had significant downtime since mid-January. Even if there were no major downtime for Marathon, that number would still be less than 21% in February. For context, those 18 companies mined 6,674 BTC in September and 5,578 BTC last month.

Following the market rally in October, bitcoin’s hashprice soared from $60/PH/s to around $130/PH/s in December amid a transaction fee spike. It later subsided to $80/PH/s, but has been fluctuating around $100/PH/s since January.

With the recent hashprice rebound, even an old mining machine like M21S could be making some marginal gross profits again at an energy rate of $0.07/kWh. Hence more private mining companies may have plugged in their machines again over the past few months ahead of the halving to squeeze more juice out of their idle older machines while they still can.

But with the halving happening in a month, all the older generations of equipment are set to be phased out unless bitcoin’s hashprice soars to over $200/PH/s before halving. Bitcoin’s average hashrate in October was around 450 EH/s and is 600 EH/s in March so far. If we assume the majority of the hashrate increase since October came from older equipment, then we could see a hashrate correction to the low 500 EH/s levels after halving.

Hardware and Infrastructure News

- Marathon Acquires Bitcoin Mining Site from Applied Digital for $87.3M – TheMinerMag

Corporate News

- Luxor Looks to Help Bitcoin Miners Hedge Halving Risk With New Hashrate Futures – CoinDesk

- Bitdeer Announces Completion and Successful Validation of NVIDIA DGX SuperPOD H100 System – Link

- Greenpeace Catches Hell for Its ‘Explosive’ Bitcoin Mining Report – Decrypt

Financial News

- Bitdeer Is ‘Differentiated’ From Peers, Shares Are Cheap: Benchmark – CoinDesk

- Bitdeer Plans $750 Million Raise with Shelf Registration – TheMinerMag

Feature

- The 4MB Ordinal, Biden’s Mining Tax and Craig Wright’s Demise – The Mining Pod

- Bitcoin Mining Stocks Are…Down? – The Mining Pod

- Bitcoin Halving Is a ‘Show Me the Money’ Moment for Miners – CoinDesk