Marathon Acquires Bitcoin Mining Site from Applied Digital for $87.3M

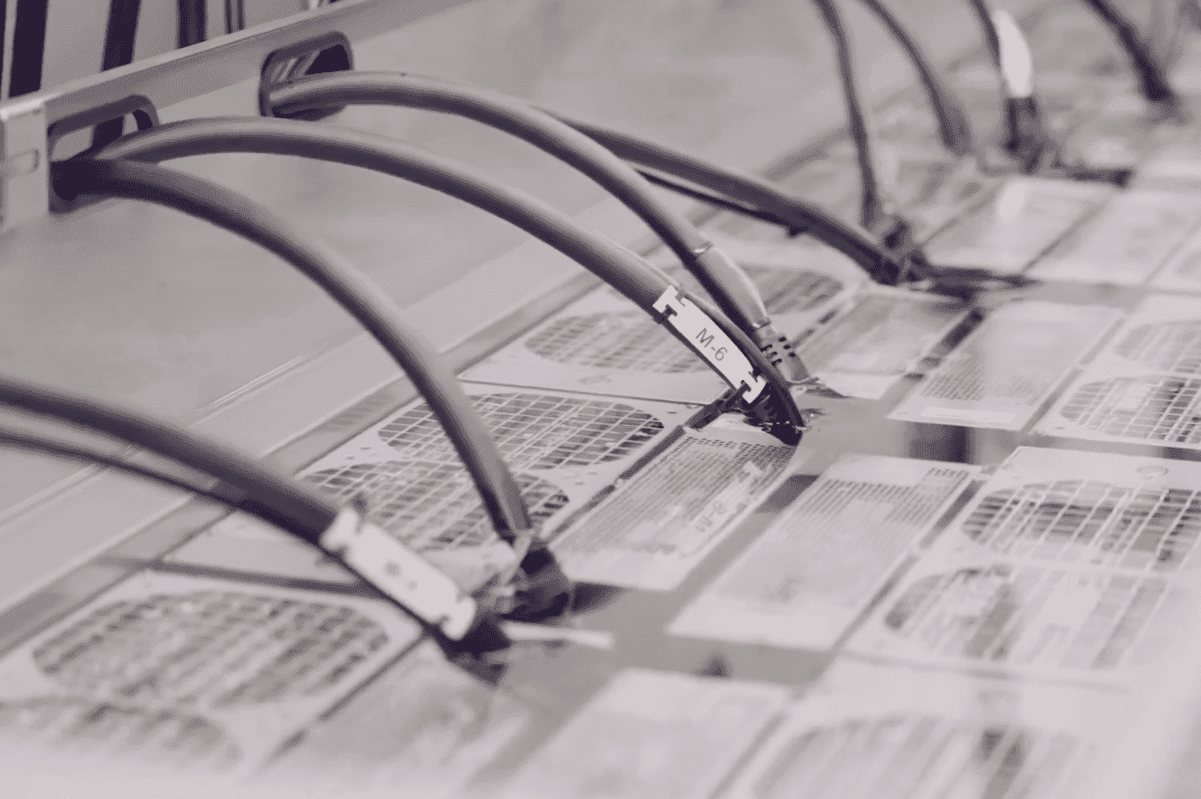

Marathon Digital, the largest publicly traded bitcoin mining by proprietary hashrate, is set to acquire a 200-megawatt (MW) mining site from its current host Applied Digital for $87.3 million.

Applied Digital announced on Friday that it entered into a definitive agreement with Marathon to sell its Garden City, Texas site for $436,500 per MW. The gross sales price was $97.3 million before “price adjustments contemplated” in the deal.

Applied Digital did not elaborate on the price adjustment terms. However, since mid-January, it experienced a power outage in its Ellendale and Garden City sites in Texas. That caused significant hashrate downtime and production decline for Marathon in January and February.

Applied Digital said the transaction will release $12 million of restricted cash that it previously pledged as collateral for the site’s letter of credit. The deal is expected to close in Q2 this year.

As of the end of February, Marathon had 4.5 EH/s of hashrate hosted in Applied Digital’s Garden City site. In theory, a 200 MW site can power 6.5 EH/s of S19 Pro miners or about 11 EH/s of S21 miners. Marathon said in a separate announcement that it plans to make full use of the 200 MW in 2024 exclusively for its own bitcoin mining operations.

The transaction is Marathon’s latest infrastructure acquisition as part of a strategy pivot away from the asset-light mining model, where it relied entirely on third-party sites to host its miners.

As previously reported, Marathon purchased two sites totaling 390 MW – one in Granbury, Texas, and one in Kearney, Nebraska – from Generate Capital for $179 million. The company claimed that the latest acquisition is expected to lower its fleet hashcost by 20%.

Marathon raised $750 million via equity financing since Q4 and has entered into a new at-the-market program aiming to raise another $1.5 billion to fund its capital expenditures including infrastructure buildout and miner purchases.

Marathon’s share price is down 20% year-to-date despite bitcoin’s 50% price gain since the New Year.