Bitdeer Plans $750 Million Raise with Shelf Registration

Singapore-headquartered Bitdeer plans to raise up to $750 million via securities offerings, joining a list of bitcoin mining firms that are betting on continuous confidence in mining stocks.

The firm stated in a shelf registration prospectus on Monday that it plans to raise up to $750 million by selling ordinary shares, debt securities, and warrants from time to time, in one or more offerings.

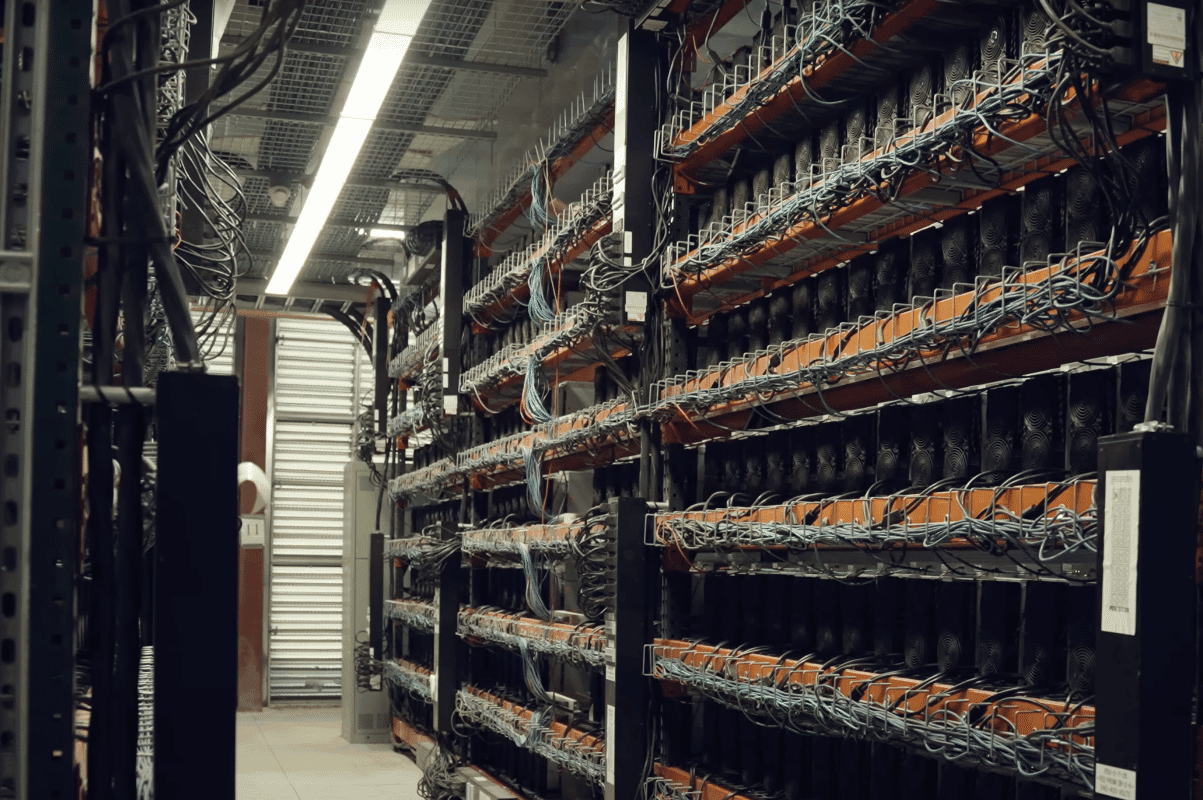

The filing comes weeks after Bitdeer announced the plan to roll out its proprietary bitcoin ASIC chip and a full miner system that is touted to match up with the efficiency of other market-leading manufacturers.

Additionally, Bitdeer filed a separate prospectus on Monday indicating that certain Selling Securityholders of the company plan to sell up to 63.7 million shares of their Class A ordinary shares intermittently. Based on Bitdeer’s closing price of $7.4, those shares are worth more than $470 million.

The filing further identified the beneficiaries of the Selling Securityholders as Bitdeer’s founder and sole director Wu Jihan and another shareholder named Zhao Zhaofeng. Wu and Zhao were both former board directors of Bitmain, which spun off Bitdeer as part of a settlement agreement in 2021.

As previously reported, major bitcoin mining companies like Marathon, Riot, and CleanSpark alone have raised more than $1.5 billion via equity financing since Q4 to fund their capital expenditures. Smaller operations like Bit Digital also managed to raise $22 million in Q4 and an additional $32 million in Q1 so far, according to its latest annual report for 2023.