Marathon Prepays $72M for Bitcoin Miner Purchases

Marathon appears to have made notable bitcoin miner preorders in Q4, although it has not made public announcements like most of its competitors.

The company said in its annual report on Wednesday that it had $96 million marked as “advances to vendors” on its balance sheet as of Dec. 31. That number increased from $24 million as of Sep. 30.

For Marathon, such an entry specifically refers to the prepayment made to bitcoin miner manufacturers relating to equipment purchases. It had a cash outflow of $72 million that was spent on miner prepayments during Q4, which was 45% of the total $159 million it spent in 2023.

Marathon did not elaborate on the type of miners it was buying with the vendor prepayments. However, in September, Marathon paid $15 million to its portfolio company Auradine to secure certain rights to buy future stocks of the bitcoin ASIC chipmaker’s Teraflux miners.

Auradine is backed by Marathon with a $35 million equity investment. Marathon’s chairman and CEO Fred Thiel also sits on Auradine’s board of directors.

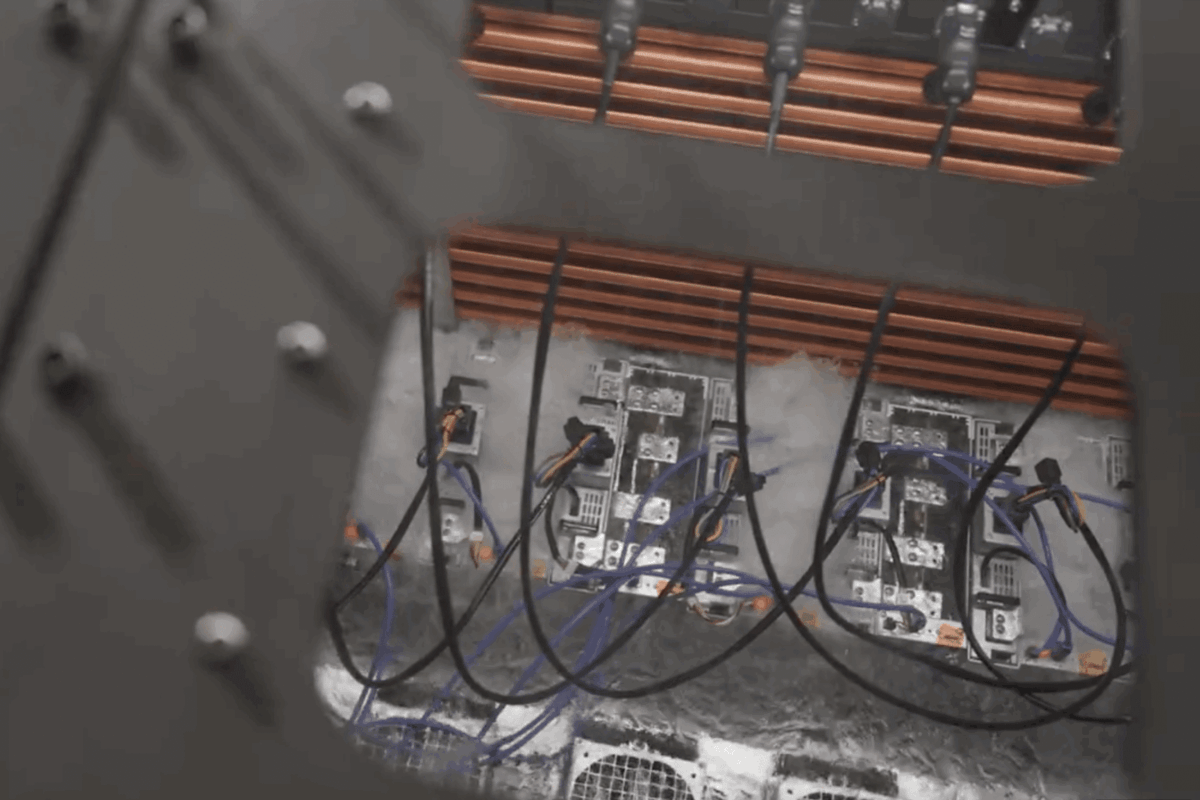

In November, Auradine launched its Teraflux bitcoin miners with ASICs that are designed in the U.S. It touts an efficiency of as much as 15 J/TH for the latest generation and targets to ship in large volume in Q2.

Marathon had 24.7 EH/s of energized hashrate as of Dec. 31, the majority of which were Bitmain’s Antminer S19 Pros and S19XPs that Marathon purchased from the 2021 cycle. Some of those inventories were mostly sitting idle in 2022 and did not become fully energized until the second half of 2023.

As previously reported, Marathon’s miners that are hosted in Applied Digital’s Ellendale and Garden City sites had notable downtime over the past month. It appears to be close to a full recovery based on the number of blocks mined by its Mara Pool over the past few days.