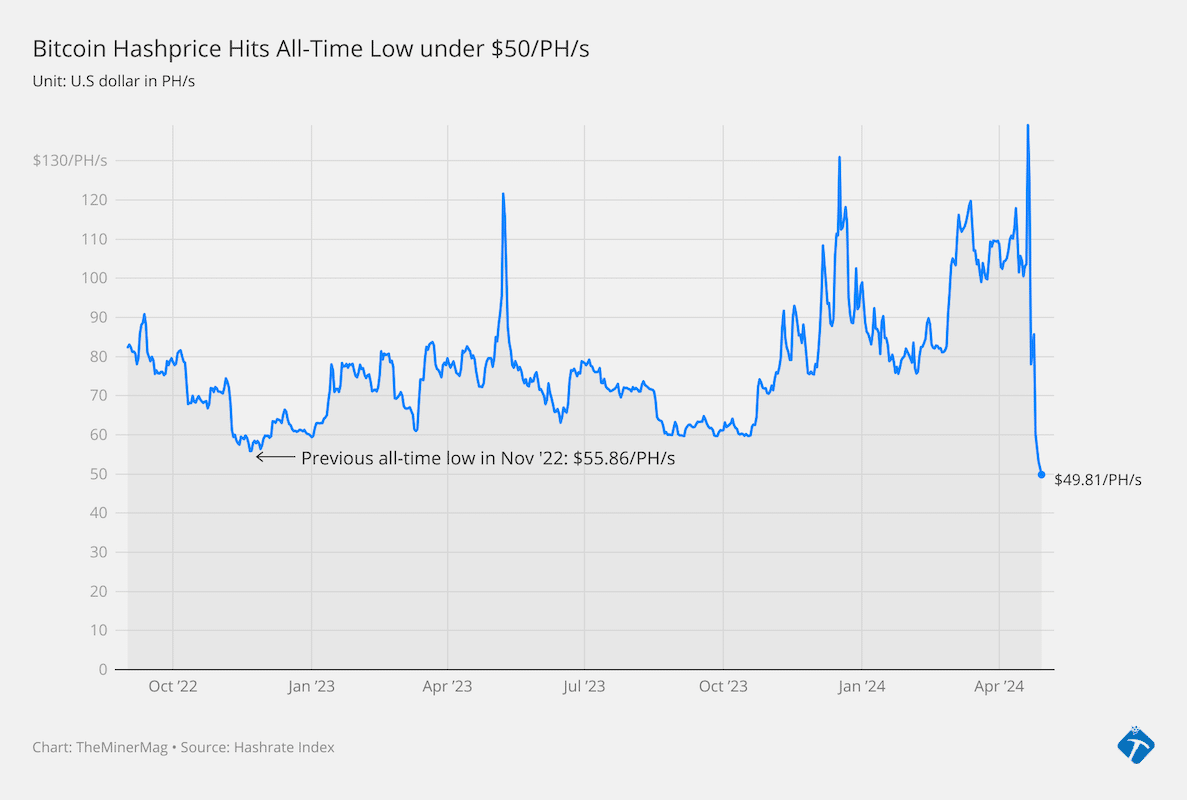

Bitcoin’s hashprice, which represents the daily dollar revenue per unit of hashing power, has once again dipped below $45/PH/s after the network’s difficulty adjusted to over 100 trillion for the first time.

Network data indicates that Bitcoin’s mining difficulty increased by 6.24% to reach 101 trillion, following two weeks where the hashrate averaged 728 EH/s. As a result, Bitcoin’s hashprice dropped to $43/PH/s, putting pressure on inefficient mining operators despite Bitcoin’s market price being just 5.5% below its all-time high.

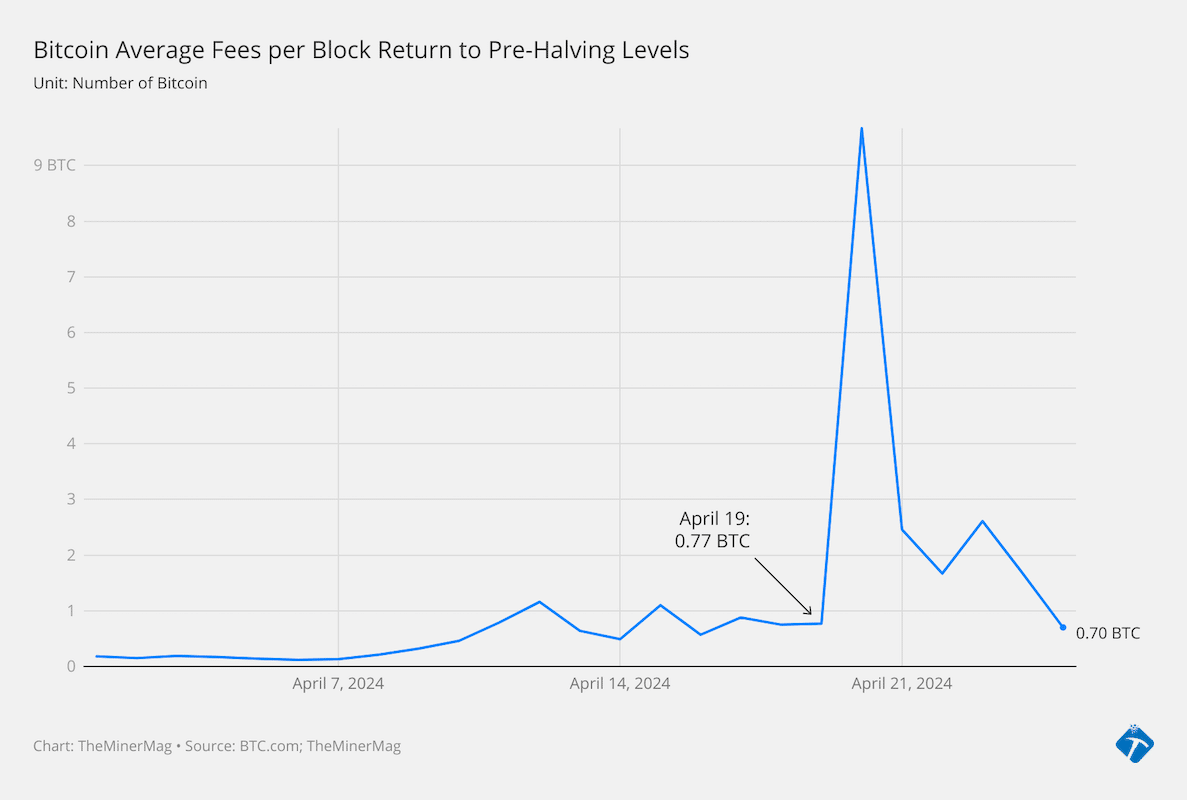

This increase in difficulty occurred less than three weeks after Bitcoin’s hashprice had rebounded to the $50/PH/s level in mid-October, providing short-term relief to miners. Since then, the hashprice has mostly stayed above $45/PH/s, with occasional spikes over $50/PH/s due to increases in transaction fees.

Public mining companies in North America continue to drive the recent increase in Bitcoin’s network hashrate. The three largest mining operators—MARA, CleanSpark, and Riot—together accounted for 12.07% of all Bitcoin block rewards mined in October.

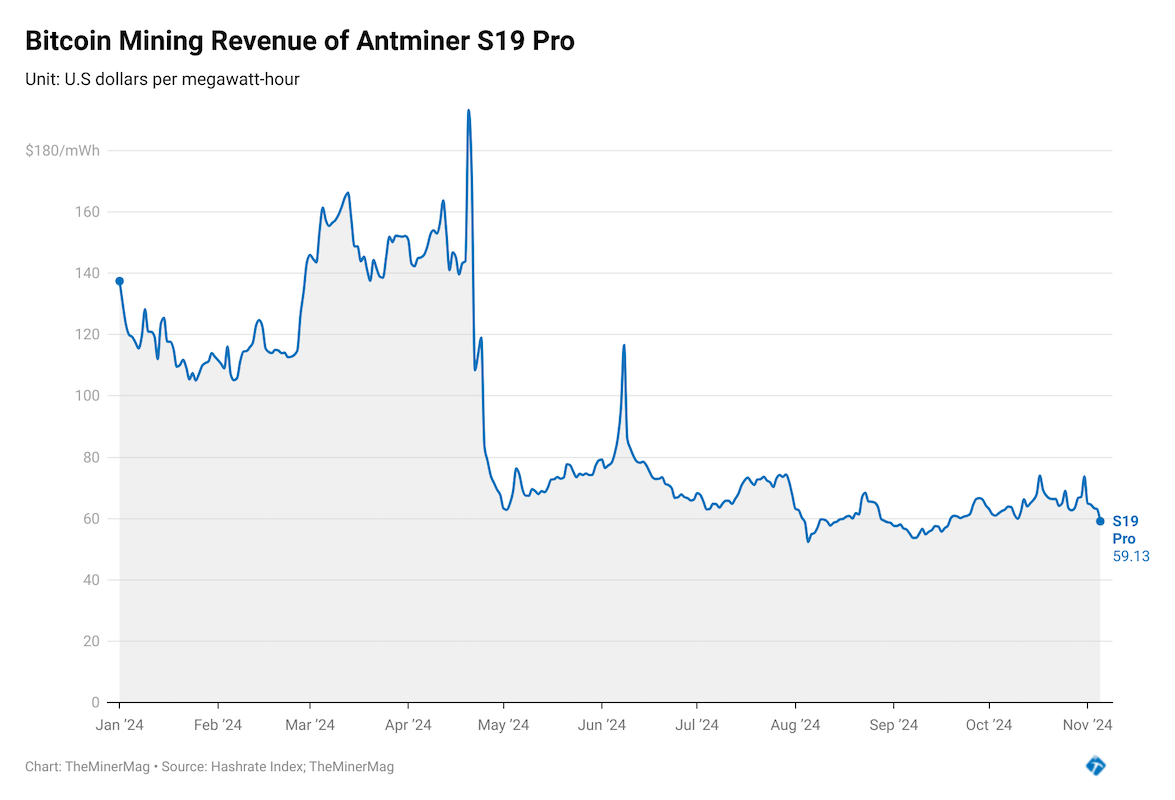

With the latest decrease in hashprice, revenue for older mining equipment, such as the Antminer S19 Pro or similar models, has also fallen to just below $60 per megawatt-hour (mWh). This means that any Antminer S19 Pro operator with electricity costs higher than $60/mWh is not mining at a profit.

Share This Post: