Miner Weekly: Bitcoin Halving Pain May Be Inevitable After All

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

The biggest news following the biggest bitcoin event this year was probably the soaring transaction fees offsetting the impact of bitcoin’s halving on hashprice, at least for the first few days.

Right after bitcoin’s fourth halving, the network’s hashprice jumped to two-year highs around $180/PH/s despite the quadrennial event slashing block subsidies from 6.25 BTC to 3.125 BTC.

The bitcoin hashprice measures the dollar value of revenue each TH/s or PH/s of computing power can generate daily. It surged after halving because of the soaring transaction fees relating to the Rune protocol.

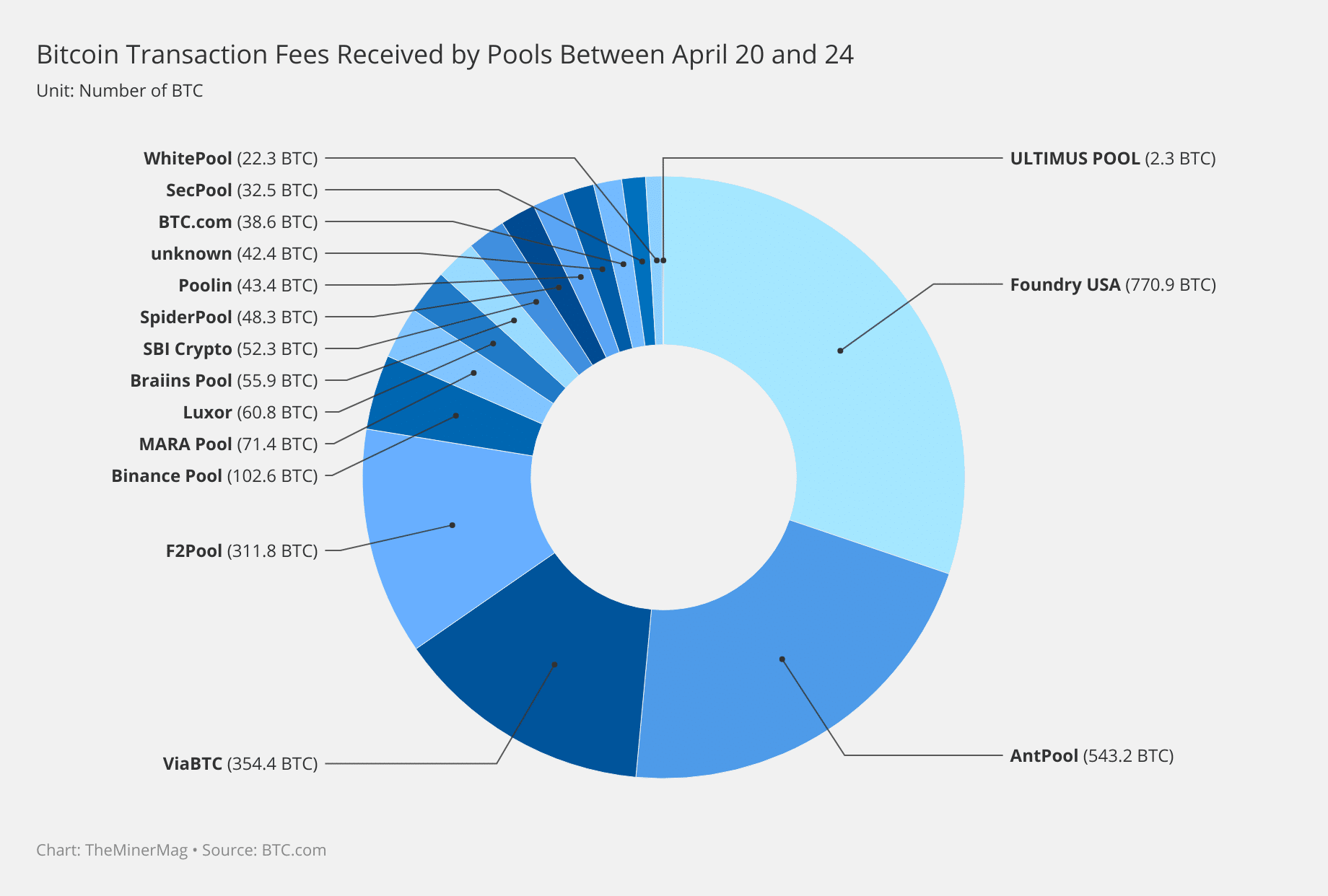

As of April 24, transaction fees month-to-date amounted to 3,902 BTC. 65% of those fees were generated after the halving block on April 20.

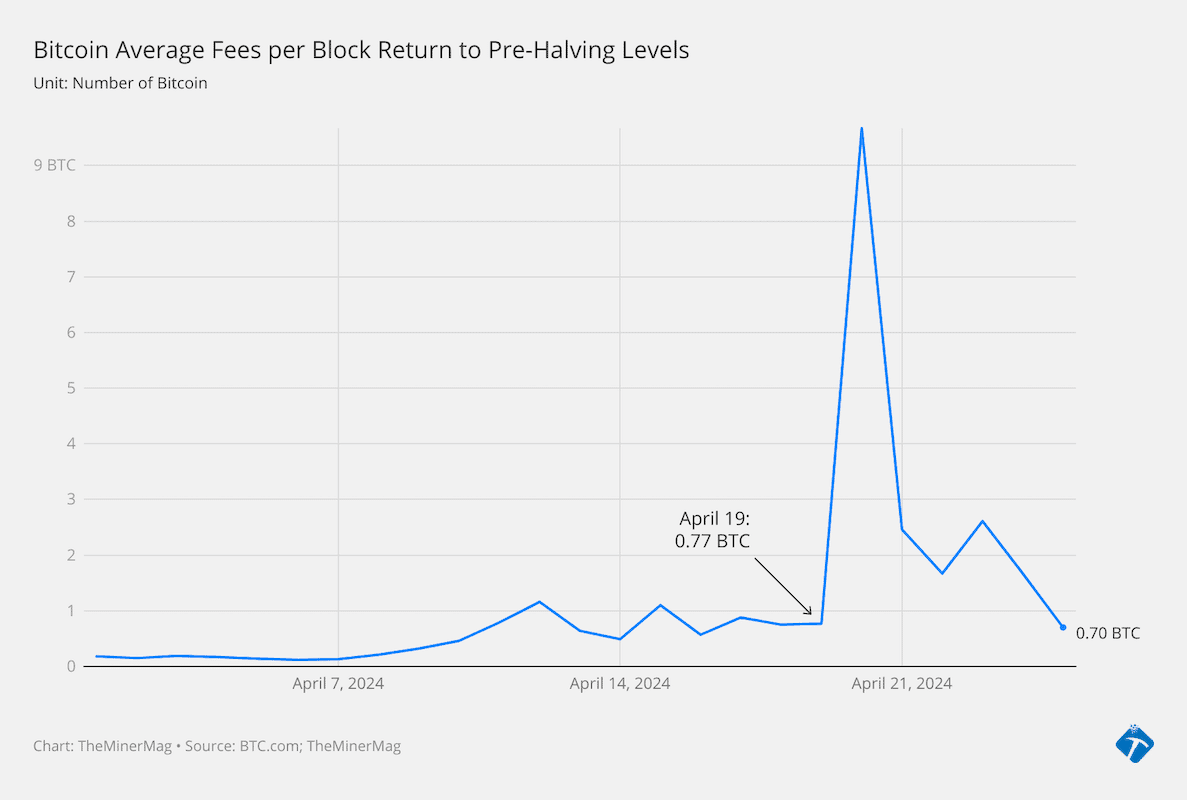

However, the average block fees appear to have subsided to 0.7 BTC since Wednesday, after soaring to 9.67 BTC on the halving day alone, as the chart above shows.

In addition, bitcoin’s market price dropped slightly from $66,000 over the weekend to below $64,000 as of writing. Meanwhile, the average hashrate over the past three days jumped even higher to 688 EH/s.

The rising hashrate post-halving, the subsiding fees, and the not-so-bullish price movement have caused the hashprice to slump below $60/PH/s. That is 40% off from the pre-halving levels of $100/PH/s.

That being said, miner operators were at least able to profit substantially from the initial fee market volatility, as shown in the chart below. Over the five days following the halving block on April 20, mining pools collected 2,552 BTC as fees. That was much more than the 1,349 BTC of fees they received in the first 19 days of April combined.

Indeed, the halving block alone generated 37 BTC in transaction fees paid to miners on ViaBTC, which, by the way, is auctioning the “epic sat” from the halving block. The pool has already distributed 40.75 BTC to miners, so ViaBTC may keep all the profits from the auction. The latest bid for the epic sat is 10 BTC as of publishing.

Hardware and Infrastructure News

- Bitcoin Fees Spiked to $2.4 Million at Halving Block – TheMinerMag

- How a Jack Dorsey-Backed Bitcoin Miner Uses a Volcano in Kenya to Turn on the Lights in Rural Homes – CNBC

- Block Develops 3-Nanometer Bitcoin Mining Chip, Aims for Own Mining System – The Block

- Bitcoin Difficulty Never Went Up Right After Halving – Until Now: TheMinerMag

Corporate News

- ViaBTC to Auction ‘Epic Sat” after Isolating 40.75 BTC in Halving Block Rewards – TheMinerMag

Financial News

- Runes Protocol Launches on Bitcoin, Sending Fees Soaring as Users Rush to Mint Tokens – CoinDesk

- Bitcoin Miners Bag $109M in Halving Day Rewards as Hashprice Soars to Two-Year Highs – TheMinerMag

Feature

- How the Bitcoin Halving Will Affect Miners Big and Small – Decrypt

- Miners Double Down on Bitcoin Halving – FT

- As the Halving Fast Approaches, What’s Next for Bitcoin Miners? – The Block

- Bitcoin Miners Upgrade Power Centers and Get into AI to Brace for Slashed Revenue Post Halving – CNBC

- Why The Bitcoin Halving Matters With Alex Gladstein and Diverter – The Mining Pod

- Tsmc’s Debacle in the American Desert – Rest of World