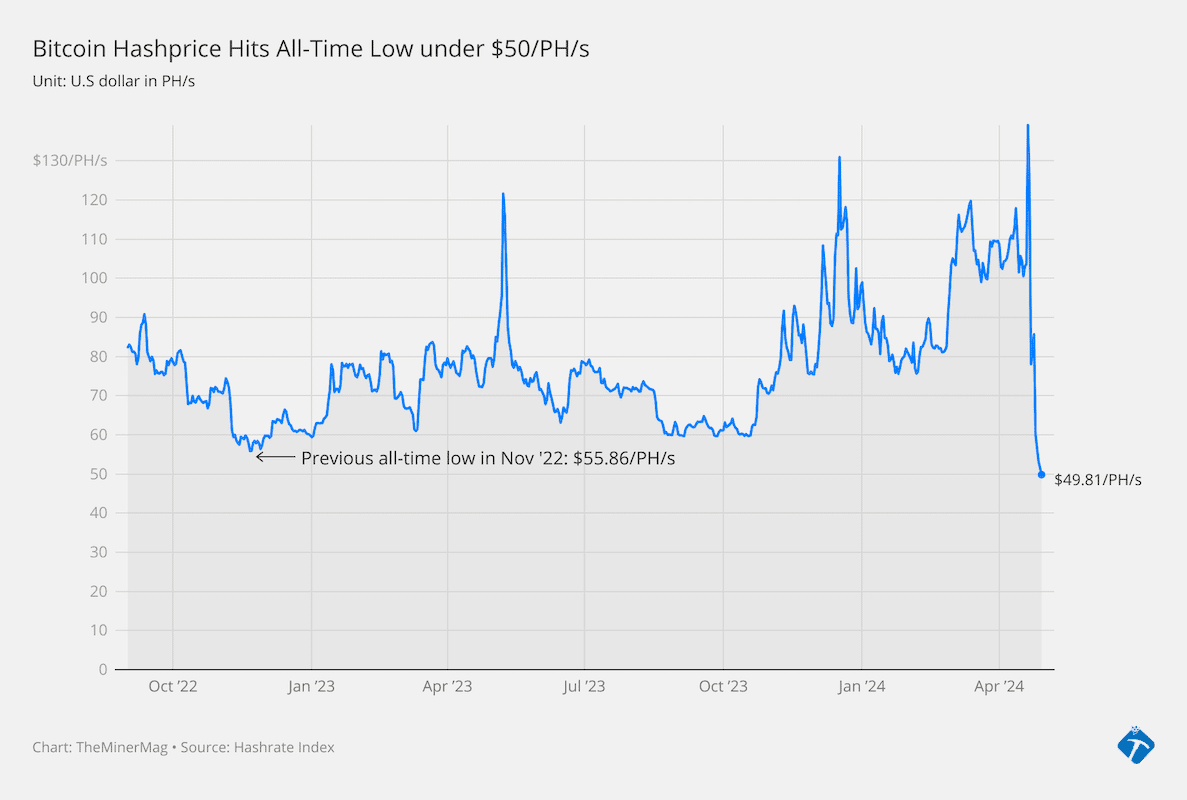

Bitcoin Hashprice Hits All-Time Low Under $50/PH/s

Bitcoin hashprice, the dollar value of daily mining revenue per each PH/s of computing power, has hit all-time lows under $50 a week after bitcoin’s fourth halving event.

Data shows that bitcoin’s hashprice dropped to $49.81/PH/s on Monday for the first time ever amid bitcoin’s market price slump nearing $62,000 and the halving event that slashed bitcoin subsidies to 3.125 BTC per block.

This is also 10% lower than the previous all-time high of $55.86 set on Nov. 21, 2022, at the bottom of the last bearish market, according to data from Luxor’s Hashrate Index.

Bitcoin’s transaction fees initially soared for about five days after the halving on April 20, which pushed bitcoin’s hashprice to two-year highs and bitcoin’s hashrate and difficulty to a new record.

However, as the fees subsided to pre-halving levels since Thursday, bitcoin’s hashprice began freefalling from $180/PH/s to $100/PH/s before tanking further to $49/PH/s as of writing.

Such mining revenue volatility appears to have affected miner operators already as bitcoin’s average hashrate begins to decline gradually.

Indeed, the average block production interval between the current block as of writing (841,333) and the previous difficulty adjustment block (840,672) is 608 seconds. That is about 1.33% slower than the intended interval of 600 seconds per block.

The slower-than-usual block production is caused by the decline of the hashrate plugged into the network following an unprecedented difficulty increase right after a halving event.

While hashprice measures the daily revenue per unit of hashing power, hashcost evaluates the daily cost of running each unit of corresponding hashing power, including fleet hashcost, corporate hashcost, and financial hashcost. Introduced by TheMinerMag, the hashcost metric normalizes the fluctuation of bitcoin’s network hashrate and block rewards.

The Q4 earnings reports of various public mining companies show that their fleet hashcosts were mostly under $50/PH/s. But the situation looked different if their corporate and financial hashcosts were included.

As bitcoin’s hashprice drops to new lows under $50/PH/s, it appears more paramount than ever for public mining companies to keep upgrading fleet efficiencies and streamline corporate overhead in an effort to mine with both gross and net profits.