In a step closer to a bankruptcy exit, Core Scientific has reached settlement agreements with several infrastructure suppliers, which are now subject to the bankruptcy court’s approval.

The bitcoin mining giant filed four motions on July 14 seeking court orders to approve the global settlement agreements with Huband-Mantor Construction (HMC), J.W. Didado Electric, Trilogy LLC, and Condair Inc, respectively.

Each of the four companies was an infrastructure supplier to Core’s mining facilities, focusing on elements such as electrical systems, construction, power distribution units, and humidification systems.

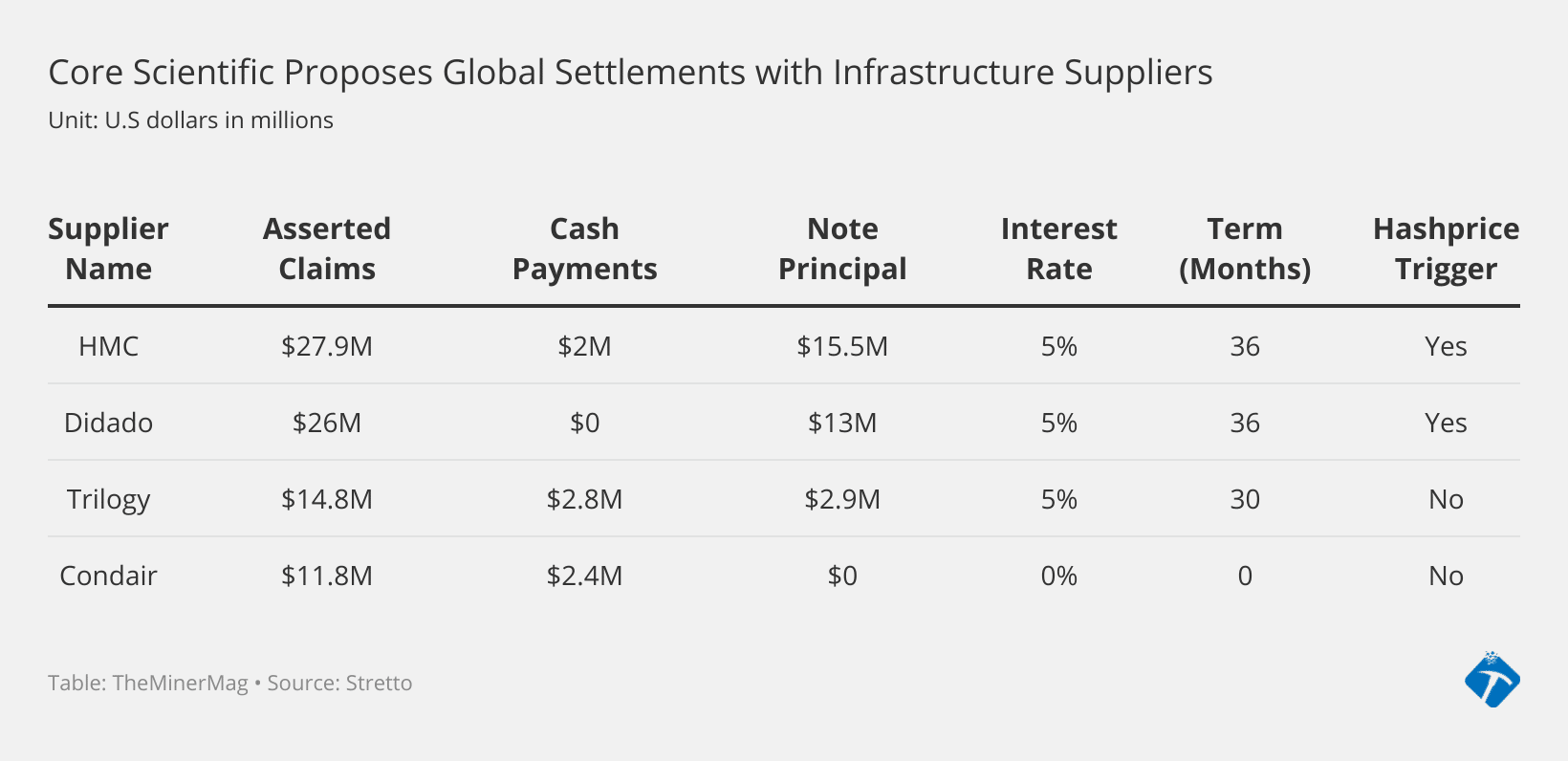

Following Core’s Chapter 11 filings in December, the four creditors submitted proof of claims with a total amount of $80 million, which, as Core put it, constitutes “large secured and unsecured” claims against itself. Core said in the motions that they reached agreements after “good faith negotiations.”

If the proposed settlements are approved, Core will pay $7.2 million in cash and issue promissory notes with a total principal amount of $31.4 million as part of the terms to extinguish all those claims. The key financial components of the terms are outlined below:

The notes carry a 5% annualized interest, which will become 12% in the event of default. One interesting element of the terms is a hashprice trigger. In the settlement agreement with HMC and Didado, Core is required to make a one-time mandatory prepayment of 25% of the remaining note principals if bitcoin’s hashprice trades above $130/PH/s for consecutively 90 days.

The settlement deals could be significantly helpful for Core’s bankruptcy exit and post-emergency expansion. The total cash and notes payable of the agreements including interests over the 30 to 36 months following the court’s approval add up to $43.2 million, which is only 54% of the asserted claims.

Core acknowledged that the likelihood of winning litigations against each of the four suppliers is uncertain. If it doesn’t succeed, Core will be held a much larger liability, not to mention the time and expenses associated with the litigations.

In addition, Core previously engaged three of the four suppliers in its Cottonwood facilities in Texas and Cottonwood is vital to Core’s expansion.

According to its bankruptcy exit plan laid out in June, Core’s proprietary hashrate and revenue growth in a post-emergency situation relies heavily on the utilization of potential capacities (200 megawatts) in Cottonwood towards the end of 2025. That is critical for Core to regain the market share in proprietary mining and to sustain financial payments when its major competitors are aggressively plugging in miners ahead of the halving next year. The reorganization plan is set for a court hearing on Aug. 24.

Initially after the bankruptcy protection proceedings, Core’s market share by production and realized hashrate was still 5.1% but over the past six months it has been eroded by Marathon, Riot, CleanSpark, Cipher and Terawulf. As of June, Core’s market share declined to 3.63%, followed closely by Marathon’s 3.45%.

This is yet another fresh reminder of the competitive nature of bitcoin mining.

Share This Post: