MARA Pool’s Bitcoin Production Dropped by 45% in January

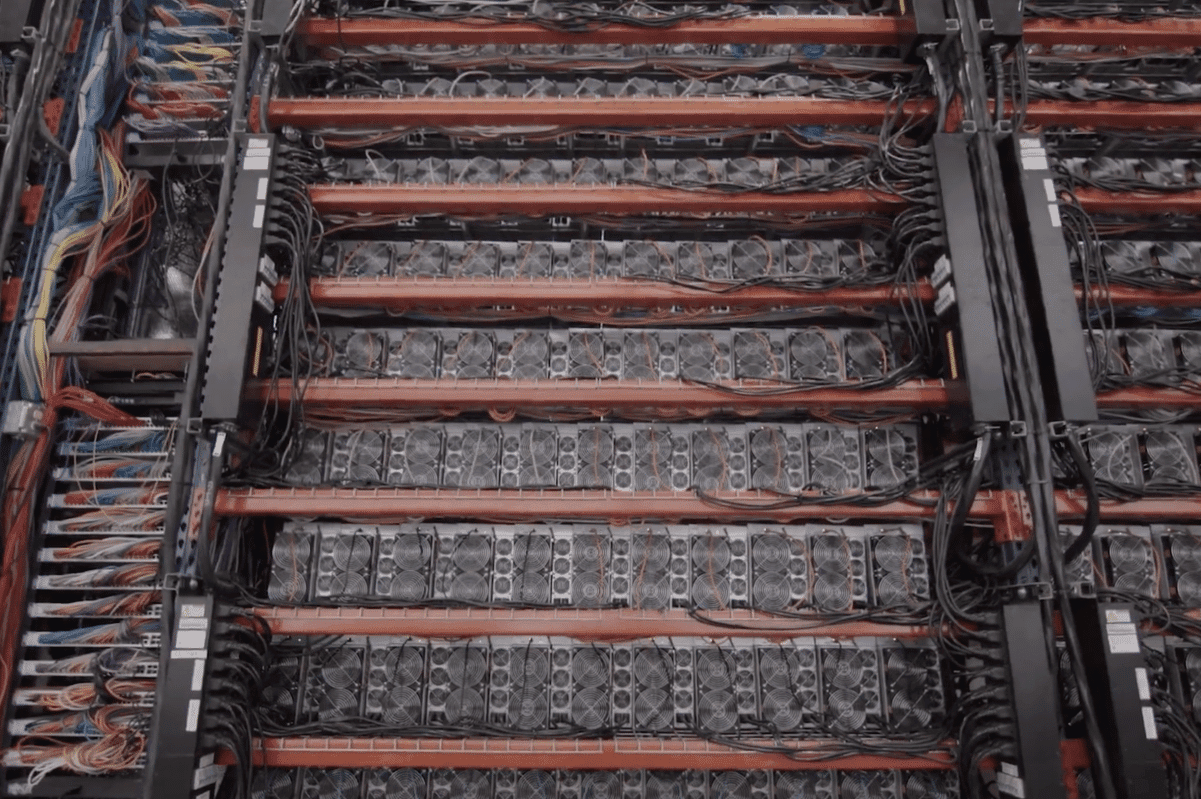

Marathon, the largest public bitcoin mining company by proprietary hashrate, may report a notable drop in January’s bitcoin production in the coming days.

Bitcoin network data shows that Marathon’s MARA Pool mined 980 BTC in January, which was down 44.5% compared to December’s record reward of 1,765 BTC. That represented a much larger setback than the decline of bitcoin’s mining production benchmark.

Bitcoin’s total mining rewards, including block subsidies and transaction fees, subsided to 31,366 BTC in January, representing a 14.4% decline on a month-over-month basis. Meanwhile, bitcoin’s monthly network hashrate set a new record of 521 EH/s after a brief interruption caused by the cold outbreak in Texas.

As such, on average, each EH/s of computing power could only produce 1.94 BTC in a day in January, down 16.7% from 2.33 BTC/EH/s in December. That means if a company did not increase or decrease its operating hashrate, its production in January would also drop by 16.7%.

The decline of bitcoin’s daily production benchmark appears inevitable, resulting from the game theory wherein mining participants worldwide rush to plug in hashrate before the looming halving that will cut the production benchmark even more.

For perspective, each EH/s of computing power could produce 2.45 BTC on average in a day last July, even though the bitcoin block rewards up for grabs that month were 8.2% less than that in January.

Marathon reported a record production of 1,853 BTC in December thanks to its ramped-up hashrate as well as the surge in bitcoin transaction fees during the month. Most of its production came from the block rewards received by its private MARA Pool.

The decline of MARA Pool’s rewards in January suggests the company may have curtailed a large portion of its hashrate, especially since the final week of the month. The production of 980 BTC implies a realized hashrate of 16.3 EH/s.

As the chart below shows, the five-day moving average of bitcoin blocks mined by MARA Pool began to drop in January and declined to fewer than 2 blocks on Jan. 31. With that being said, it is also possible that Marathon has just diverted a large portion of its hashrate to a different pool.