Bitfury CEO Sheds 5% of Cipher’s Stock Since July Rally

Bitcoin miner Cipher Mining’s stock surge to fresh yearly highs has coincided with a series of share sales by its largest outside shareholders tied to Bitfury and its chief executive officer, Valerijs Vavilovs.

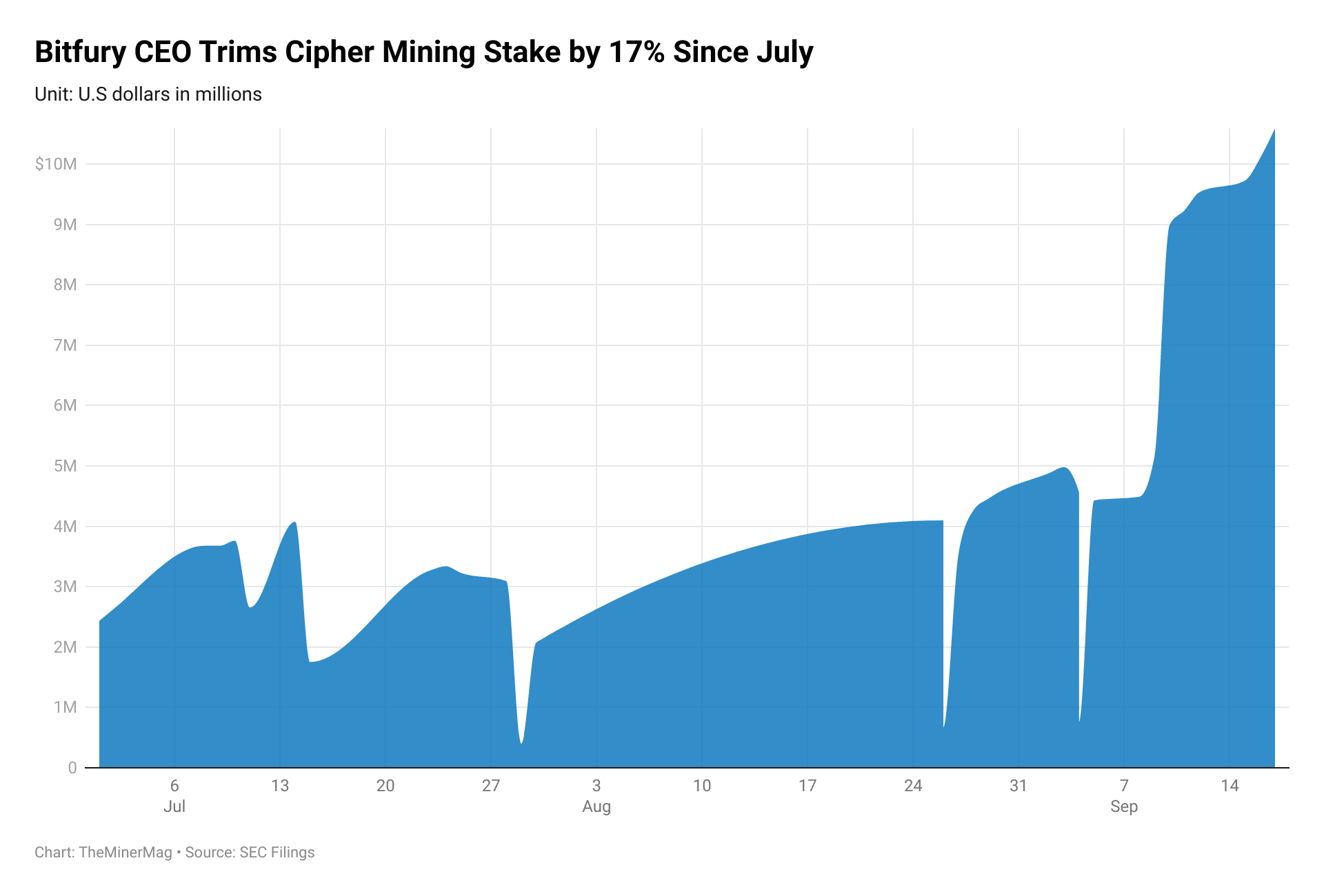

According to recent Schedule 13D filings, V3 Holding — a vehicle wholly owned by Vavilovs — has been steadily trimming its position in Cipher since early July. On July 8 and 9, V3 sold an aggregate of 1.2 million shares at an average of $6.13 per share, representing 2.6% of its direct holdings at the time.

The filing described the disposals as part of a “disciplined, long-term strategy” by V3 and Vavilovs to diversify personal investments and fund philanthropic initiatives, while committing to a cap of no more than 5% of Cipher’s average daily trading volume on any single day.

Since then, V3 and affiliated entities have accelerated sales into Cipher’s rally. Between late July and mid-September, V3 and Bitfury Top HoldCo collectively sold more than 10 million shares, often in daily blocks of 500,000 to 900,000 shares. Reported prices ranged from under $5 per share in early July to nearly $12.65 per share by mid-September, as Cipher’s stock more than doubled over the period.

The disposals reduced V3’s combined beneficial ownership in Cipher from 25.7% on July 8 — when it held 95.4 million shares, including both direct and indirect stakes via Bitfury entities — to 20.2% as of September 15, or 79.4 million shares. Bitfury Top HoldCo and its subsidiary Bitfury Holding together still hold more than 48 million Cipher shares.

Vavilovs, who serves as CEO and chairman of Bitfury, remains Cipher’s largest outside shareholder through V3 and Bitfury-related holdings. Bitfury, once one of the earliest global players in Bitcoin mining hardware, has in recent years focused on data center development, blockchain services, and maintaining strategic equity in Cipher following Cipher’s 2021 public listing via a SPAC merger.

Despite the ongoing sales, filings noted that Vavilovs and V3 view Cipher’s long-term growth prospects positively and that the disposals are not a reflection of diminished confidence in the company.

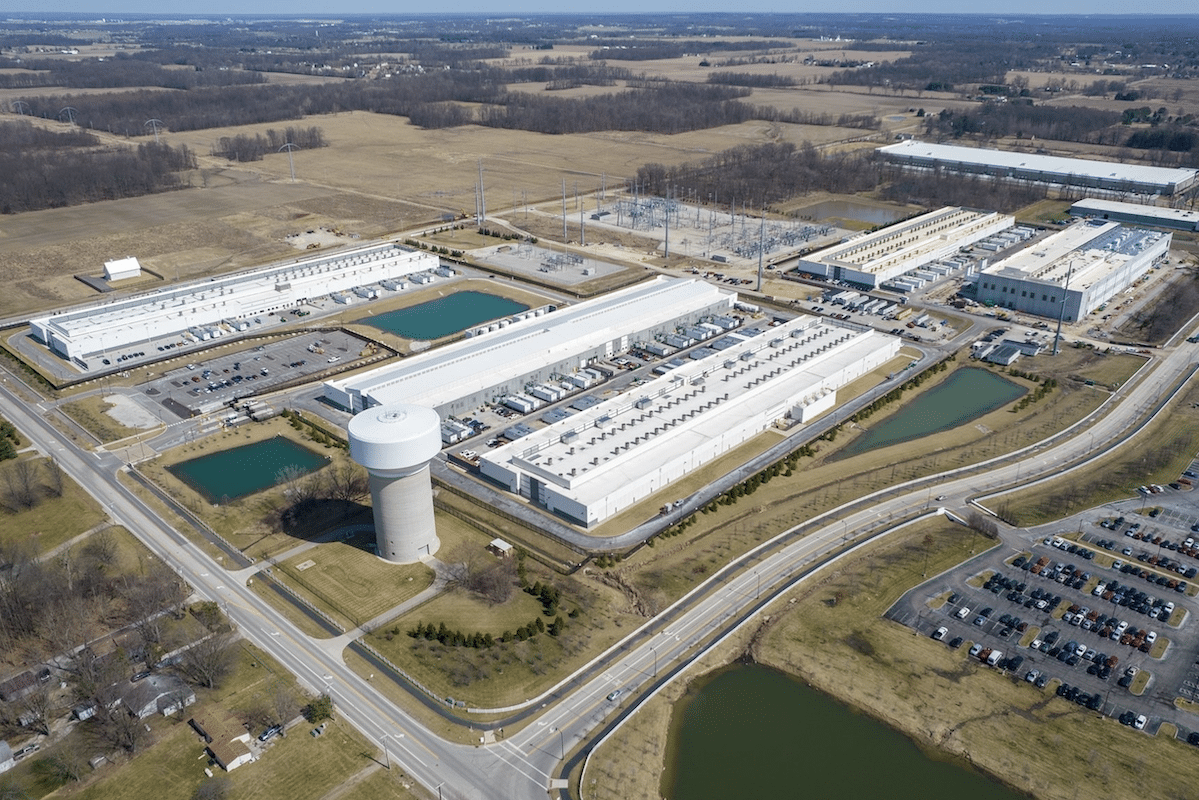

Cipher’s equity performance has been supported by rapid growth in its mining capacity. The company has consistently ramped up realized hashrate over recent months, energizing newly arrived miners at its new Black Pearl facility.