Tether Acquires $32M in Bitdeer Shares Amid April Downturn

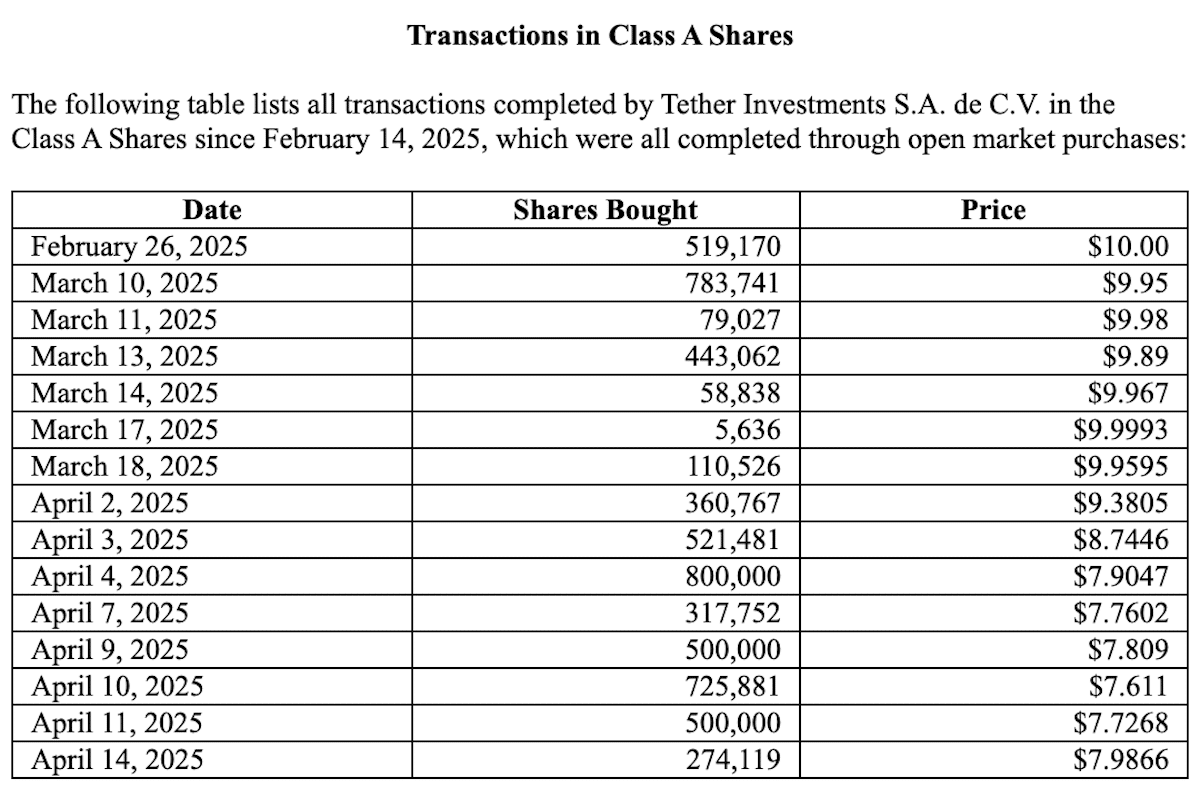

Stablecoin giant Tether has increased its stake in Bitdeer amid a broader market sell-off, with transactions in early to mid-April totaling approximately $32 million.

Regulatory filings show that the series of purchases, completed on various dates this month, reflects the steady accumulation strategy adopted by Tether during a period of notable market volatility.

Over the past month, Bitdeer’s stock price has dropped 28%. On a year-to-date basis, it has shed 65% of its value, making it the most heavily sold Bitcoin mining stock compared to major competitors.

Tether’s recent buying spree took place between April 2 and April 14, involving a total investment of $32 million for 4 million shares at an average price of $8.05.

This followed a series of transactions in March, when Tether acquired 1.48 million Bitdeer shares at an average price of $9.94. With the latest purchases, Tether held a 24.2% stake in Bitdeer as of April 14. Bitdeer’s stock closed at $7.38 on Wednesday.

The steady series of transactions, executed at gradually decreasing average purchase prices, suggests that Tether is reinforcing its confidence in Bitdeer despite prevailing market uncertainties. Tether first made a major investment in Bitdeer in March 2024 through a $100 million private placement.

Meanwhile, the stablecoin behemoth is doubling down on its commitment to the Bitcoin mining ecosystem. Earlier this week, Tether announced that it would route its current and future Bitcoin hashrate to the OCEAN mining pool, as part of its effort to help decentralize the network’s hashing power.