Riot Seeks to Acquire Rhodium’s Rockdale Bitcoin Mining Assets in $185M Deal to Settle Disputes

Riot Platforms is aiming to acquire assets from Rhodium Encore at its Rockdale, Texas Bitcoin mining facility in a $185 million deal that would settle ongoing litigation between the two companies.

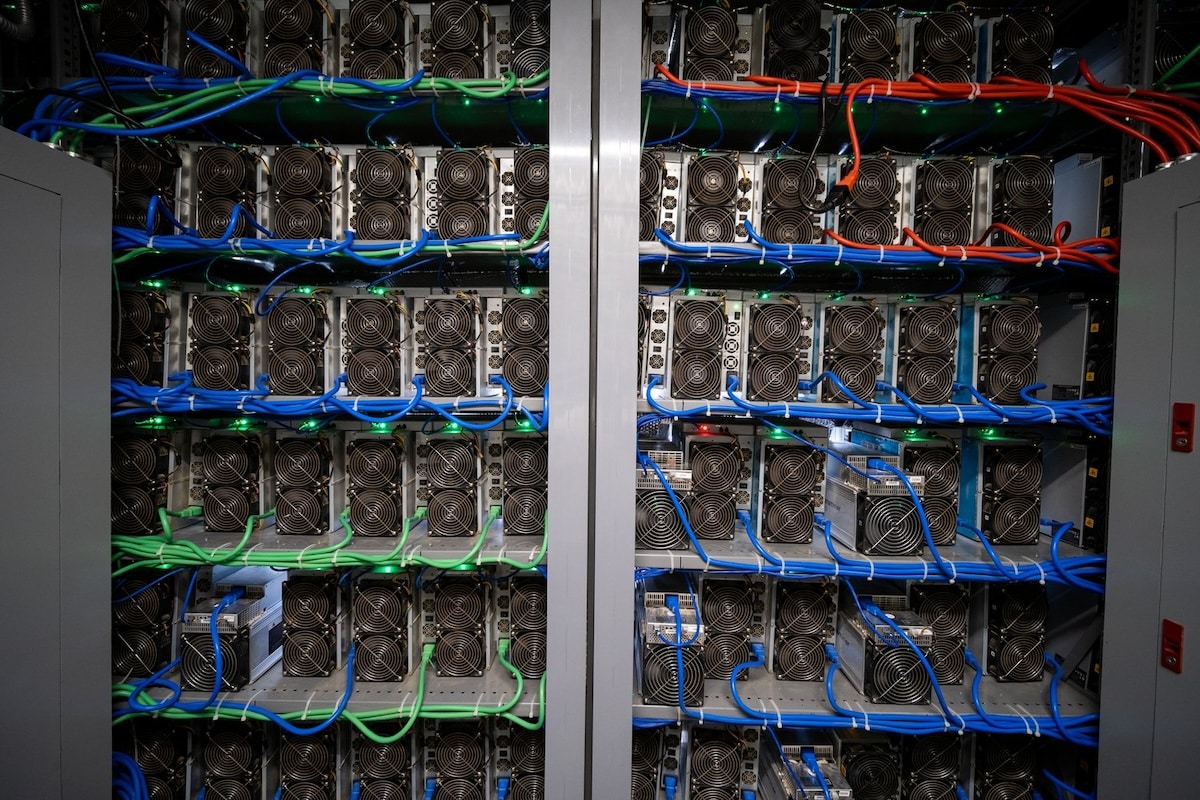

In a statement released Friday, Riot said its subsidiary, Whinstone US, has entered into a non-binding term sheet to purchase Rhodium’s tangible assets at Rockdale, including ASIC miners and 125 megawatts of power capacity.

The proposed transaction remains subject to approval by the bankruptcy court overseeing Rhodium’s Chapter 11 proceedings, as well as the finalization of definitive terms.

Under the proposed term sheet, Riot would pay $129.9 million in cash, return $6.1 million from Rhodium’s power security deposit, and issue $49 million worth of Riot shares, priced based on the 10-day volume-weighted average leading up to closing.

In exchange, Rhodium would vacate the Rockdale site within three business days of closing and transfer all on-site equipment to Riot.

If completed, the deal would give Riot full control over the Rockdale facility’s total power capacity and enable it to reallocate the 125 MW currently used by Rhodium for its own mining operations. The agreement also includes mutual releases of all existing litigation and waivers of any future claims unrelated to the transaction.

Rhodium filed for bankruptcy in mid-2024 amid widespread industry consolidation following the Bitcoin halving. Its hosting and profit-sharing arrangement with Riot had deteriorated over the past few years due to escalating disputes.

Rhodium also previously sold its proprietary Temple site for $40 million, including infrastructure and power agreements.