Riot Offloads 11M Bitfarms Shares in One Day, Slips Below 5% Ownership

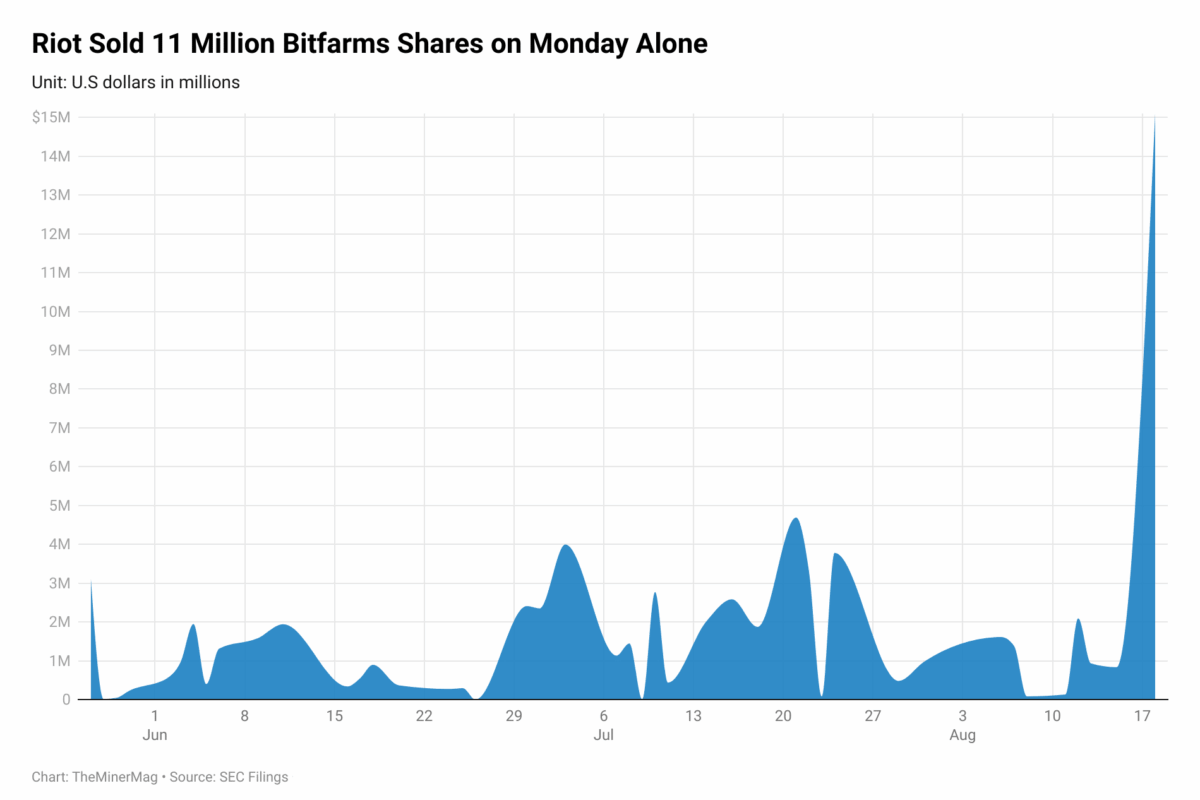

Riot Platforms has sharply reduced its stake in rival bitcoin miner Bitfarms after accelerating share sales in recent weeks, capped by a divestment of 11 million shares on Monday.

According to securities filings, Riot sold more than 11.1 million Bitfarms shares on August 18, worth about $15.1 million at an average price of $1.36. The move slashed its ownership below the 5% threshold that requires public disclosure.

So far in 2025, Riot has sold about 71.5% of the 90 million Bitfarms shares it accumulated last year, unloading roughly 64.4 million shares at an average price of $1.11 and generating proceeds of $71.3 million. Riot built its position in 2024 at an average cost of $2.24 per share, meaning the divestment has come at a steep loss relative to its initial investment.

The August 18 sale marked Riot’s largest single-day transaction in months, significantly above its prior daily disposals, which generally ranged between a few hundred thousand and 4 million shares.

Riot began offloading its Bitfarms holdings in late May, when sales were made in smaller blocks at prices under $1. By July, volumes and values had increased, with multiple million-share transactions executed around the $1.20–$1.30 range.

Altogether, the data shows Riot has steadily unwound its position across dozens of trades through the summer, cashing out more aggressively as Bitfarms’ share buyback program pushed its stock price from below $1 in June to the mid-$1.30s in mid-August.