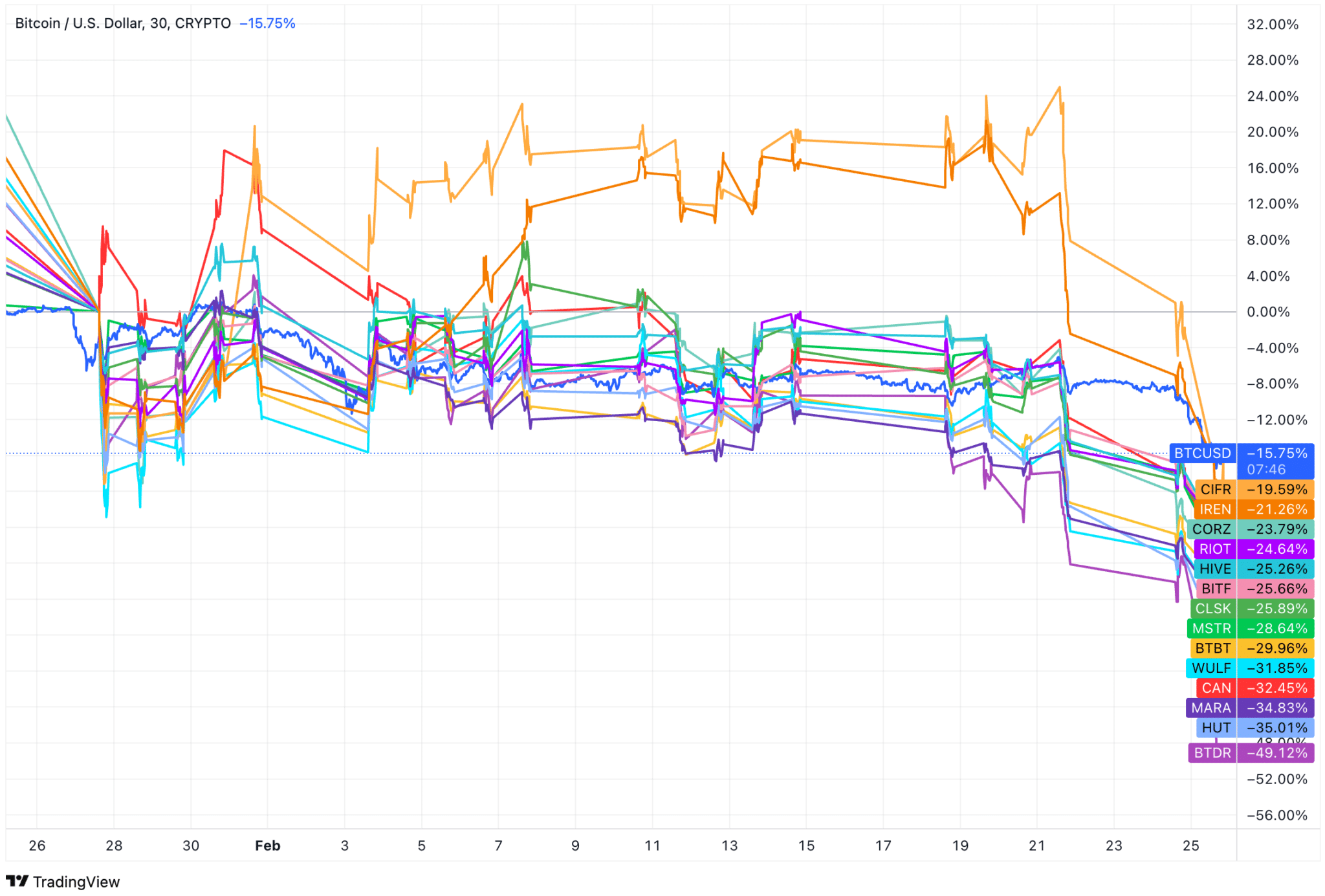

Bitcoin Mining Stocks Lose $13B Amid February Market Selloff

The total market capitalization of 15 major Bitcoin mining stocks has dropped by $13 billion over the past month, following a broader market decline. Bitdeer led the downturn with a 55% loss, followed by Hut 8.

Bitcoin’s price fell below $90,000 on Tuesday for the first time since November, driven by ongoing market turbulence exacerbated by a $1.5 billion hack of the derivatives exchange Bybit over the weekend.

Bitcoin mining stocks have been hit by both the crypto market downturn and a broader correction in the Nasdaq. The combined market capitalization of 15 publicly traded mining companies tracked by TheMinerMag declined to $23.2 billion as of Feb. 25, down from a local peak of $36.6 billion on Jan. 24.

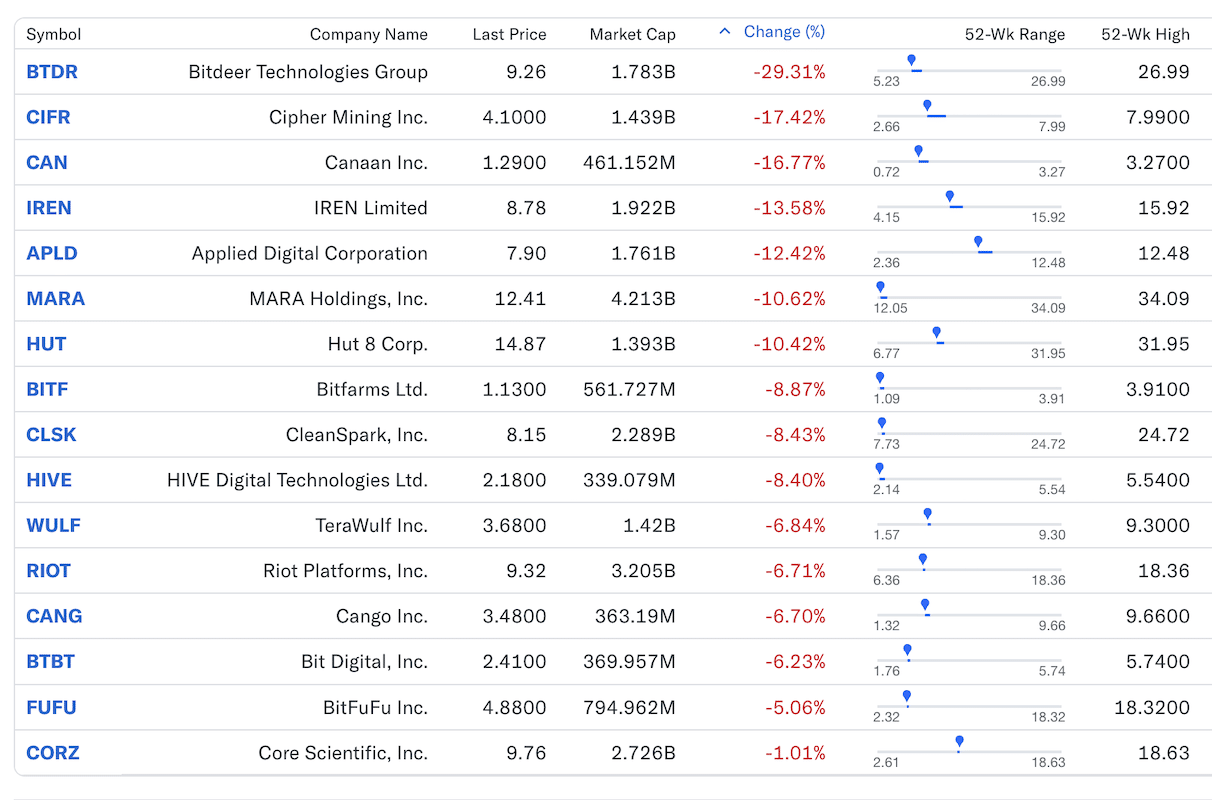

Bitdeer saw the steepest decline, with its market capitalization falling from nearly $4 billion to $1.78 billion in the past month. Its stock price plunged 29% on Tuesday alone after the company’s fourth-quarter earnings report revealed that CEO Jihan Wu could sell up to 4 million shares between March and June if a minimum price threshold is met.

Other mining companies, including Cipher, Canaan, Iris Energy, Applied Digital, MARA, and Hut 8, all posted double-digit losses on Tuesday. Core Scientific fared better than most, slipping just 1%.

Over the past month, Hut 8, MARA, Canaan, and Terawulf have all followed Bitdeer’s lead, each recording declines of more than 30% in their stock prices. The market capitalization of Hut 8 and Terawulf are both down over 40% since the local peak seen on Jan 24.