MARA Purchased 192 Bitcoin in September While Retaining Mined BTC

Bitcoin mining giant MARA has continued to purchase Bitcoin from the market while retaining all the Bitcoin it mined in September.

According to a production update released on Wednesday, MARA mined 705 BTC in September and increased its Bitcoin holdings by 897 BTC, ending the month with a total of 26,842 BTC on its balance sheet.

This indicates that the company purchased 192 BTC, valued at approximately $11.59 million based on Bitcoin’s average price last month. This marks the fourth consecutive month that MARA has recorded a negative Bitcoin sale due to its market purchases, complementing its 100% HODL mining strategy.

By August 30, a dozen publicly traded mining companies with Bitcoin holdings totaled 59.7k BTC on their balance sheets, with MARA alone accounting for about 42% of that figure.

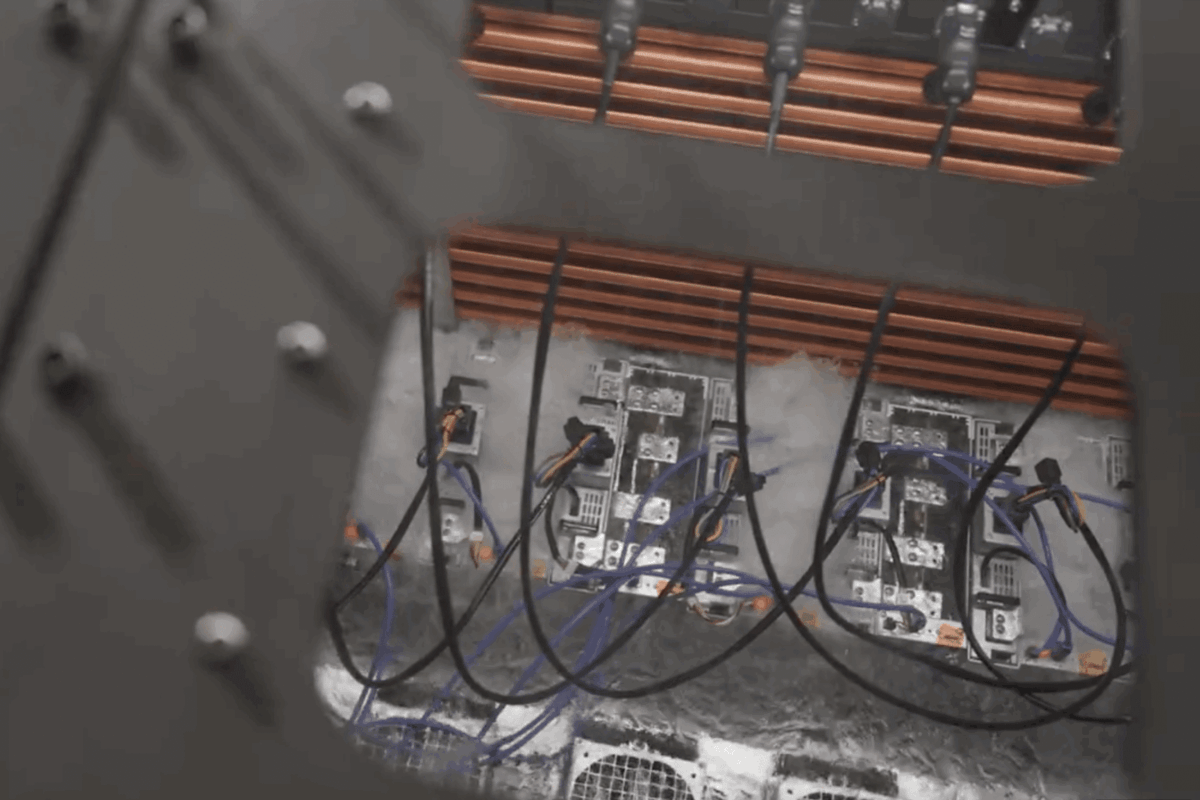

In addition, MARA reported that it energized more hashrate in September, reaching 36.9 EH/s in installed capacity, although it hasn’t disclosed any miner preorders since 2022. It is reasonable to expect that MARA has been installing TeraFlux miners from Auradine. MARA Chairman Fred Thiel claimed in a recent Forbes interview that the company not only invested in Auradine but also co-founded it.

Previously, MARA advanced $44 million in prepayments to Auradine since Q3 2023 for future purchases of the TeraFlux miners. Auradine announced in July that production volumes of its air-cooled AT2880 and immersion-cooled AI3680 models were ramping up in Q3 this year.

It is not clear what other types of miners MARA has purchased. MARA’s advance to mining hardware vendors increased from $96 million as of Dec. 31, 2023, to $261 million and $385 million as of Mar. 31 and Jun. 30, 2024, respectively.