Miner Weekly: MARA’s Bitcoin Deployment Implies Up to 6.5% Annualized Yield – For Now

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

While non-mining companies often hold bitcoin as a long-term treasury asset, miners accumulate it through their core operations—and have stronger incentives to put it to use. The practice of deploying BTC reserves to generate returns or enhance liquidity began gaining traction during the 2020 halving cycle, particularly as institutional lending platforms became more accessible to miners.

By 2021, companies like Hut 8 had started allocating portions of their treasury to yield-generating strategies, including a 1,000 BTC loan to Genesis Capital that earned a 4% annual return. Hut 8 ultimately recalled those funds shortly before Genesis collapsed during the 2022 bear market. Several other counterparties—including BlockFi, Celsius, and Babel Finance—also collapsed amid broader market contagion.

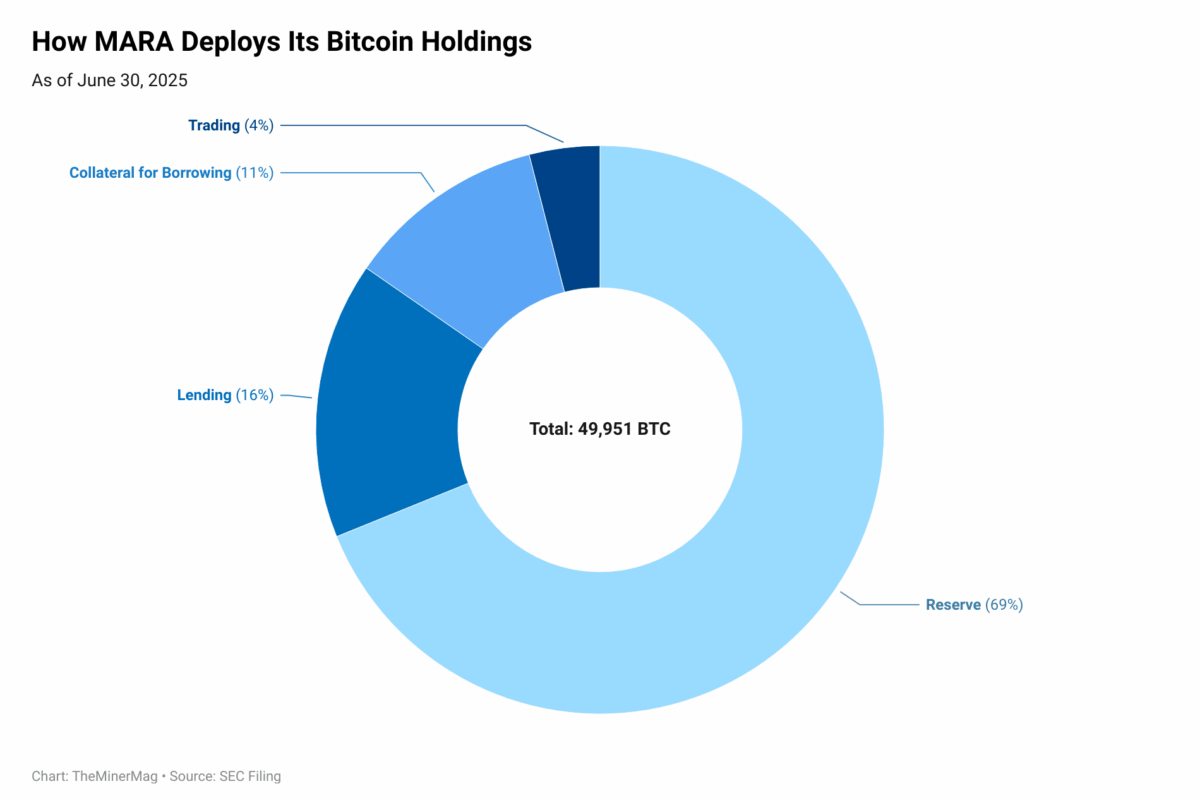

Despite the risks, miners have continued to explore structured ways to deploy their BTC. MARA, one of the largest public bitcoin holders, held 49,951 BTC as of June 30, with approximately 15,550 BTC—or around 31%—actively allocated across lending agreements, asset management programs, and collateralized credit lines. Other major mining holders like CleanSpark have also established in-house treasury management functions to actively deploy their BTC reserves.

MARA’s latest quarterly filing offers fresh insights into how the company is managing its BTC treasury in the current cycle.

Lending: 7,877 BTC

MARA began exploring bitcoin lending in 2024 through master securities loan agreements with multiple counterparties. These arrangements allow the company to loan out BTC in exchange for interest income, adding a yield component to its treasury strategy.

By the end of 2024, MARA had loaned out 7,377 BTC, as previously reported by TheMinerMag. In Q2 2025, the company expanded the program slightly, lending an additional 500 BTC. This brought the total under loan to 7,877 BTC as of June 30.

During the quarter, the lending program generated $6.8 million in interest income, bringing the year-to-date total to $13.1 million. Based on average BTC prices in Q1 and Q2, this equates to an annualized yield of approximately 3.5%.

Two Prime Account

To diversify its yield strategies, MARA partnered with asset manager Two Prime in Q2 to manage a portion of its BTC via a Separately Managed Account (SMA). The company transferred 500 BTC in mid-May to test the waters, followed by another 1,500 BTC in late June. As of June 30, a total of 2,004 BTC was under active management.

The initial tranche of 500 BTC generated 4 BTC over roughly 45 days—a return of 0.8%, or an annualized yield of 6.5%. This outpaces returns from lending, though it may also introduce higher active risk. The SMA prioritizes capital preservation and liquidity, with trades limited to bitcoin-denominated options, futures, swaps, and spot strategies.

Bitcoin-Backed Credit Lines

MARA is also leveraging its BTC as collateral to secure fiat liquidity through two credit lines:

Original Line of Credit: Established in October 2024 and amended in February 2025, this facility provides $200 million in credit backed by 4,499 BTC. It carries a 10.5% interest rate and begins maturing in 2026.

New Line of Credit: Opened in March 2025, this facility offers $150 million backed by 3,250 BTC at a lower 8.85% interest rate, maturing in March 2026.

At the time of transfer, the 7,749 BTC used as collateral was valued at over $554 million, providing substantial overcollateralization and financial headroom. As of June 30, 5,669 BTC remained locked as collateral, securing the $350 million outstanding across both facilities.

Both credit lines feature dynamic collateralization mechanisms. If BTC’s value fluctuates significantly, MARA must either top up or may reclaim collateral to maintain the required thresholds. These facilities offer flexible liquidity while preserving exposure to bitcoin’s long-term upside. Notably, similar structures were used in 2022 when Bitfarms was forced to liquidate its BTC holdings during a summer market crash.

Hardware and Infrastructure News

- HIVE Surpasses 14 EH/s, Remains On Track to Reach 18 EH/s by End of Summer and 25 EH/s by U.S. Thanksgiving – Link

- Auradine Shipped $73M Worth of Bitcoin Miners to MARA in H1 2025 – TheMinerMag

- Canaan Inc. to Supply Additional Avalon A1566I Immersion-Cooling Miners to CleanSpark – Link

Corporate News

- Bit Digital Seeks Shareholder Approval to Expand Share Capital for Ethereum Accumulation – TheMinerMag

- Bitmain Plans First US Factory by Q3 in Trump Gambit – Bloomberg

- Bitfarms Announces Second Principal Executive Office in NYC and Initiates Conversion to U.S. GAAP – Link

- Canaan Inc. Announces Adoption of Cryptocurrency Holding Policy and Strategic Long Position in Bitcoin – Link

Financial News

- Cryptofirm Bitzero secures $25m in funding to power mining operations – DataCenterDynamics

- MARA Completes Upsized $950 Million Offering of 0.00% Convertible Senior Notes due 2032 – Link

- Bitcoin Miner MARA Is Missing Out on AI Boom: Compass Point – Decrypt