Miner Weekly: Make Mining Stocks Great Again

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

It’s been an interesting week in the bitcoin mining world: we saw a public miner coming out with a bold ASIC roadmap, a hashprice rollercoaster over the weekend, a public miner taking a “poison pill,” and an industry cuddle with Donald Trump, who wants “all the remaining bitcoin to be MADE IN THE USA!!!”

(Not sure if that’s great for bitcoin, but okay! You can read all the mentioned news from the links at the bottom of this letter)

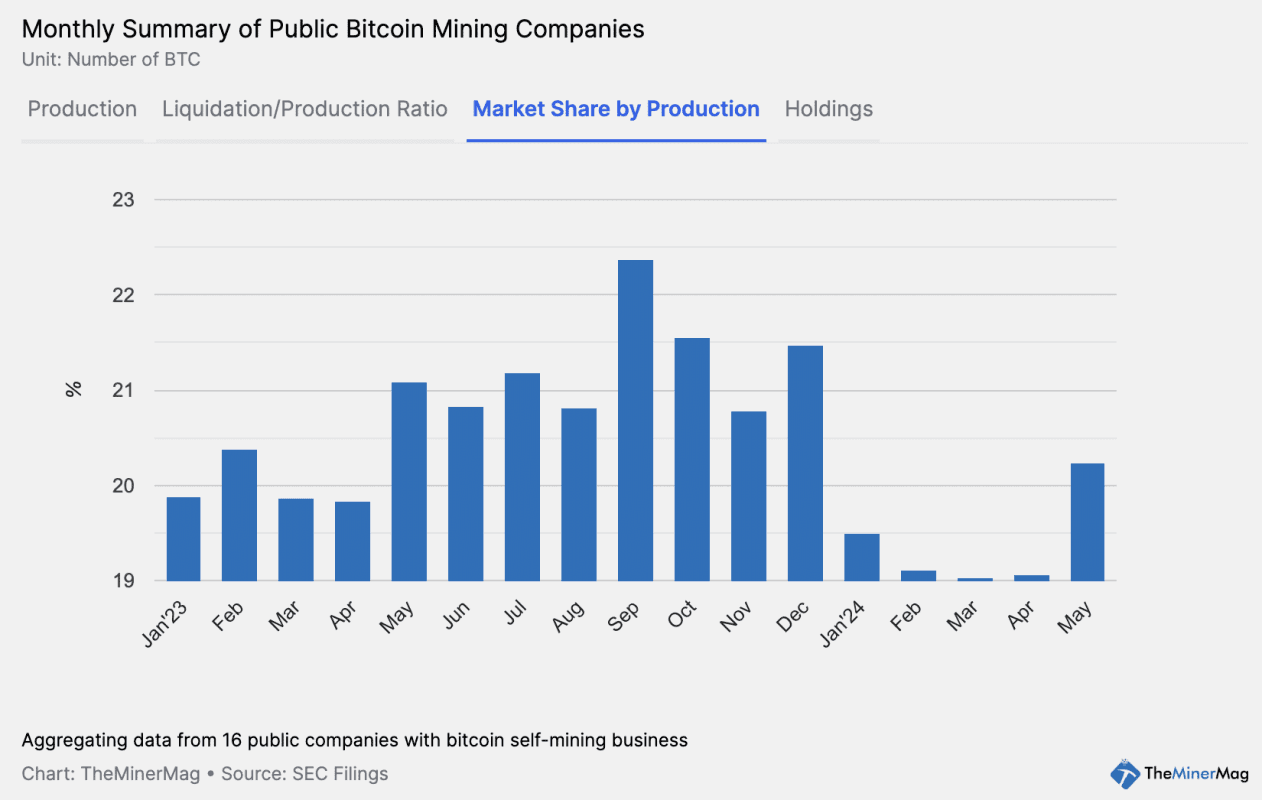

It was also interesting to see that one full month after bitcoin’s fourth halving event, the production share of publicly traded mining companies was back above 20% again.

Out of the 16 public mining firms regularly tracked by TheMinerMag, 15 have released production updates for May. But even with one company missing (looking at Hut8), the remaining 15 mined 20.24% of the total block rewards available last month.

That number was the highest since December, a sign that privately owned operators might have played a larger role in the overall decrease of bitcoin’s network hashrate, which was down 4% from 625 EH/s in April to 599 EH/s in May.

Meanwhile, the 15 companies combined sold 64% of their mined bitcoin in May. That means their combined bitcoin reserves increased to 40,000 BTC as of the end of May, although CoinDesk reported on Wednesday, citing data from CryptoQuant, that Marathon sold 1,400 BTC in June month-to-date.

And the production share was not the only number that went up after the halving.

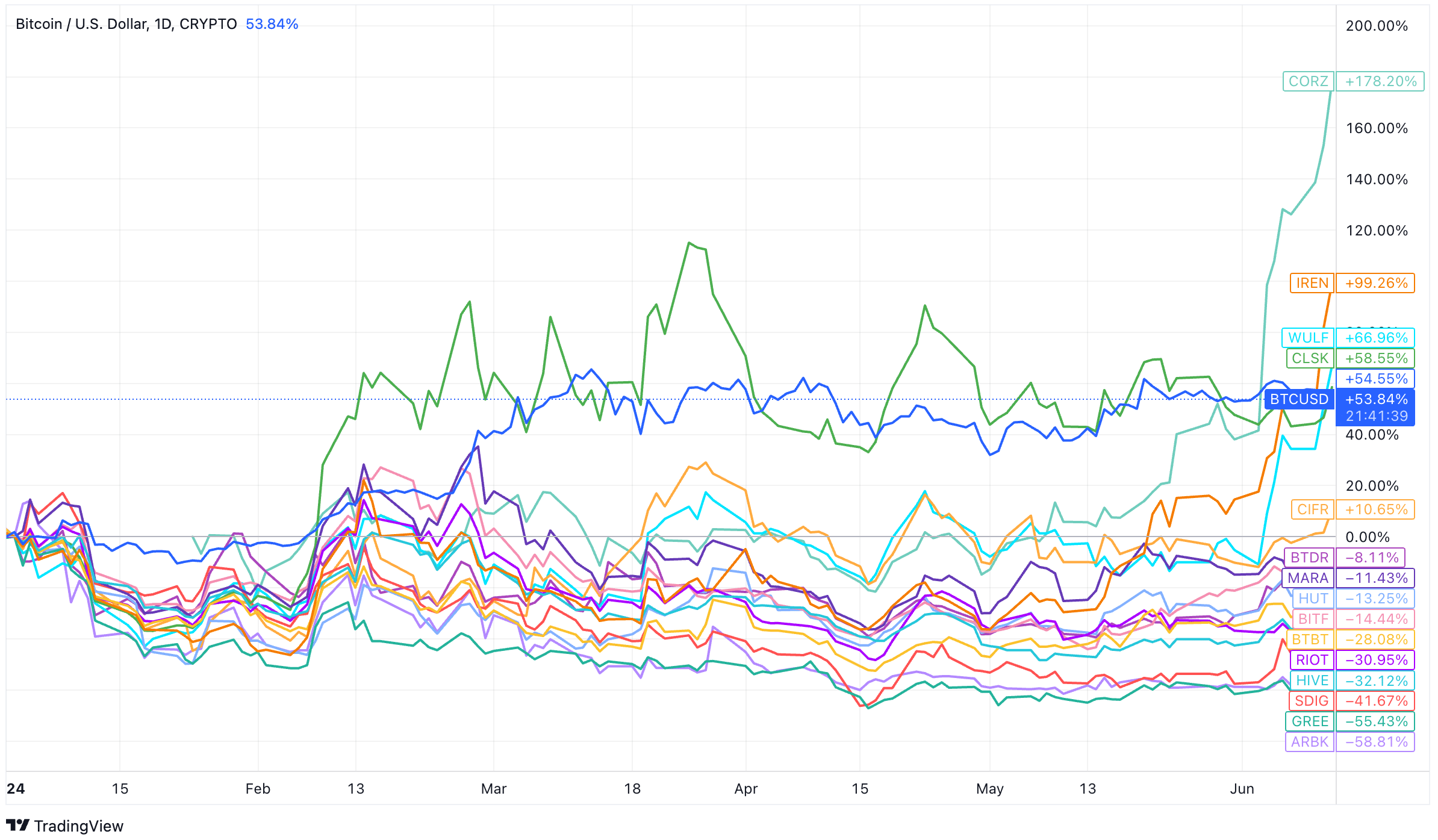

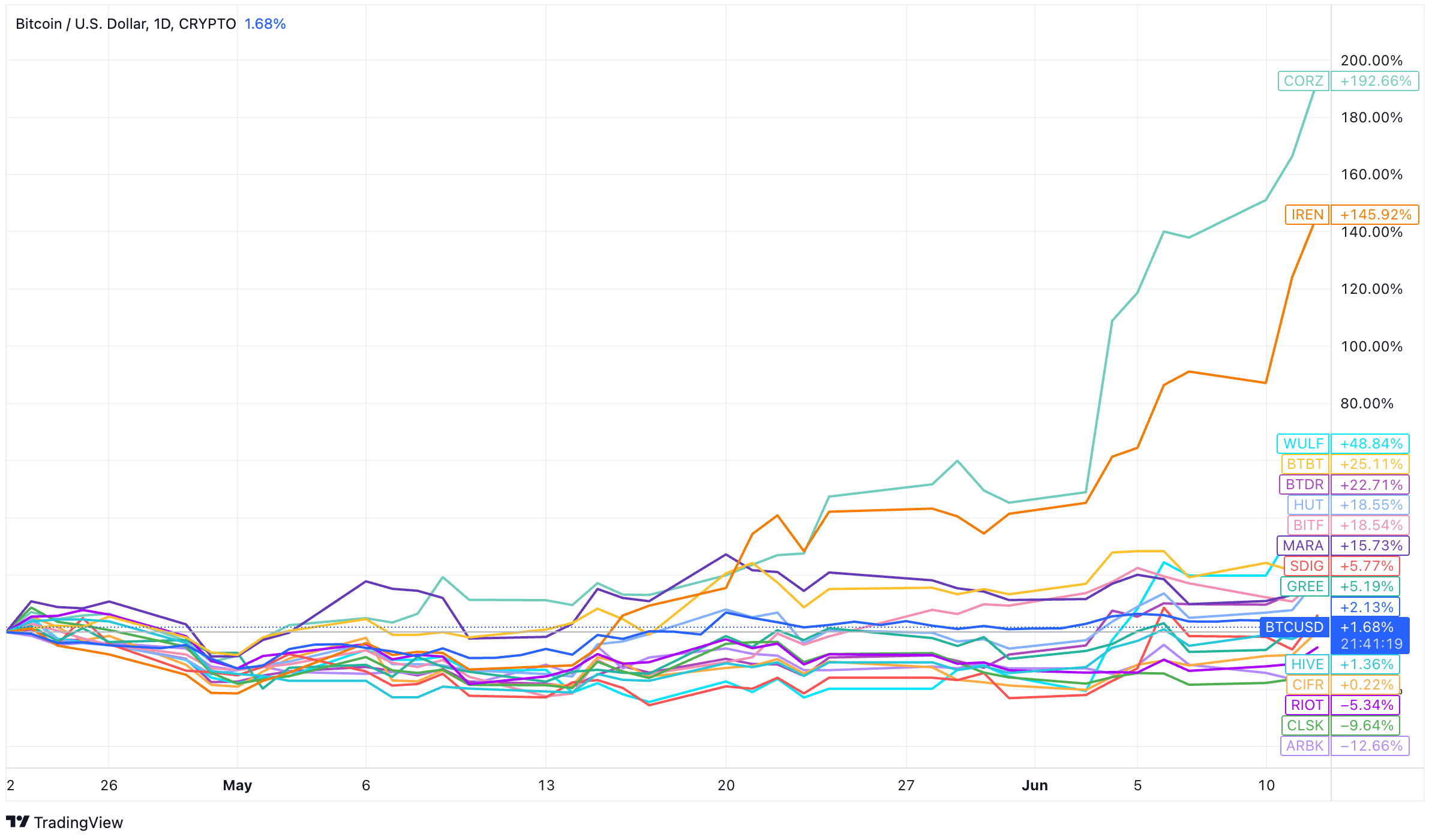

Although year-to-date, only a handful of mining stocks managed to outperform bitcoin, many of them have been seriously playing catch up since late April.

According to TradingView’s data below, Core Scientific and Iris Energy had a solid rally over the past week riding on the AI and HPC trend and setting new 52-week highs. Others like Terawulf, Bit Digital, Bitdeer, Marathon, Bitfarms, and Hut8 have also posted double-digit growth since the halving.

Regulation News

- Paraguay Seizes 271 Bitcoin Miners in Power Theft Crackdown – TheMinerMag

- Donald Trump Commits to Championing Bitcoin Mining in DC – Bitcoin Magazine

- Trump Wants All ‘Remaining Bitcoin to be Made in the US’ – TheMinerMag

- Stanton residents, bitcoin mining site at odds on noise concern – KETV Omaha

Hardware and Infrastructure News

- Bitdeer Announces Chip Roadmap, 10 J/TH Bitcoin ASIC in Q4 – TheMinerMag

- Bitcoin Fees Are Skyrocketing Again—And It’s Not Because of Runes or Ordinals – Decrypt

- Cipher Expedites Bitmain Shipment by Upgrading to S21 Pro at $19/TH – TheMinerMag

- Bitfarms Eyes 120MW Bitcoin Mining Expansion in Pennsylvania – TheMinerMag

Corporate News

- Riot Appoints New Chief Operating Officer – Link

- Bitfarms to Take ‘Poison Pill’ to Block Riot’s Takeover Bid – TheMinerMag

Financial News

- Short sellers pile $3bn into Bitcoin miner bets in ‘very squeezable’ trade – DLNews

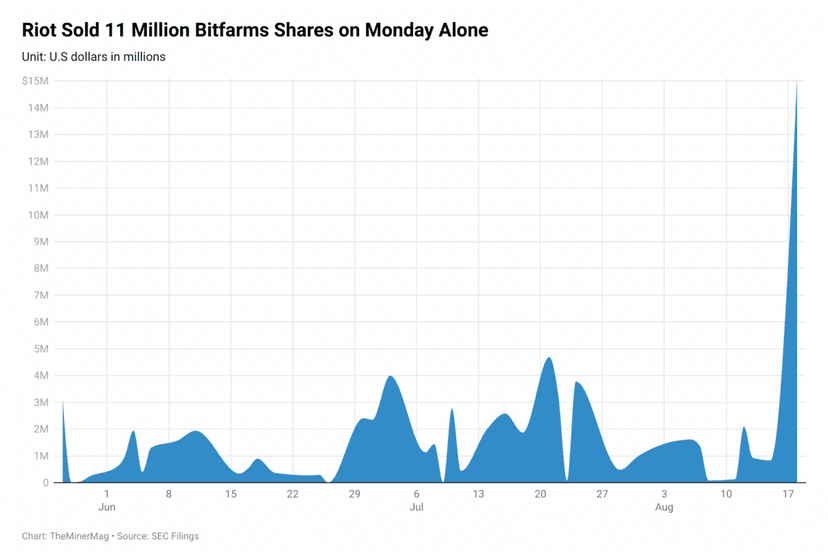

- Riot Has Invested $111M to Acquire 13.1% Stake in Rival Bitfarms – TheMinerMag

- Bitcoin Miners Cash in on BTC Rally as Exchange Transfers Hit Two-Month High – CoinDesk

Feature

- Riot’s Short Report, CoreWeave’s $1 Billion Offer and BitDeer’s ASIC Play – The Mining Pod

- These Miners Scaled Up (or Down) Hashrate Post Bitcoin Halving – TheMinerMag

- INTERVIEW: The Future Of Mining Hardware – The Mining Pod