Bitdeer Announces Chip Roadmap, 10 J/TH Bitcoin ASIC in Q4

Bitdeer today announced a R&D roadmap for its SEALMINER bitcoin mining machine and committed to bringing greater transparency to the bitcoin mining industry.

The company said it expects to roll out two more generations of proprietary bitcoin ASIC chips within this year, which are said to be as efficient as 10 J/TH.

On Wednesday, the Nasdaq-listed bitcoin mining and cloud mining firm revealed a technological roadmap for its SEAL bitcoin mining ASIC chips and the SEALMINER systems in the coming year. The company also expressed its commitment towards driving greater transparency in the mining industry, addressing crucial aspects such as miners’ expectations of future technological advancements and delivery timelines, and providing access to data analytics on mining machine capabilities, equipment inventory, and collective purchasing behavior.

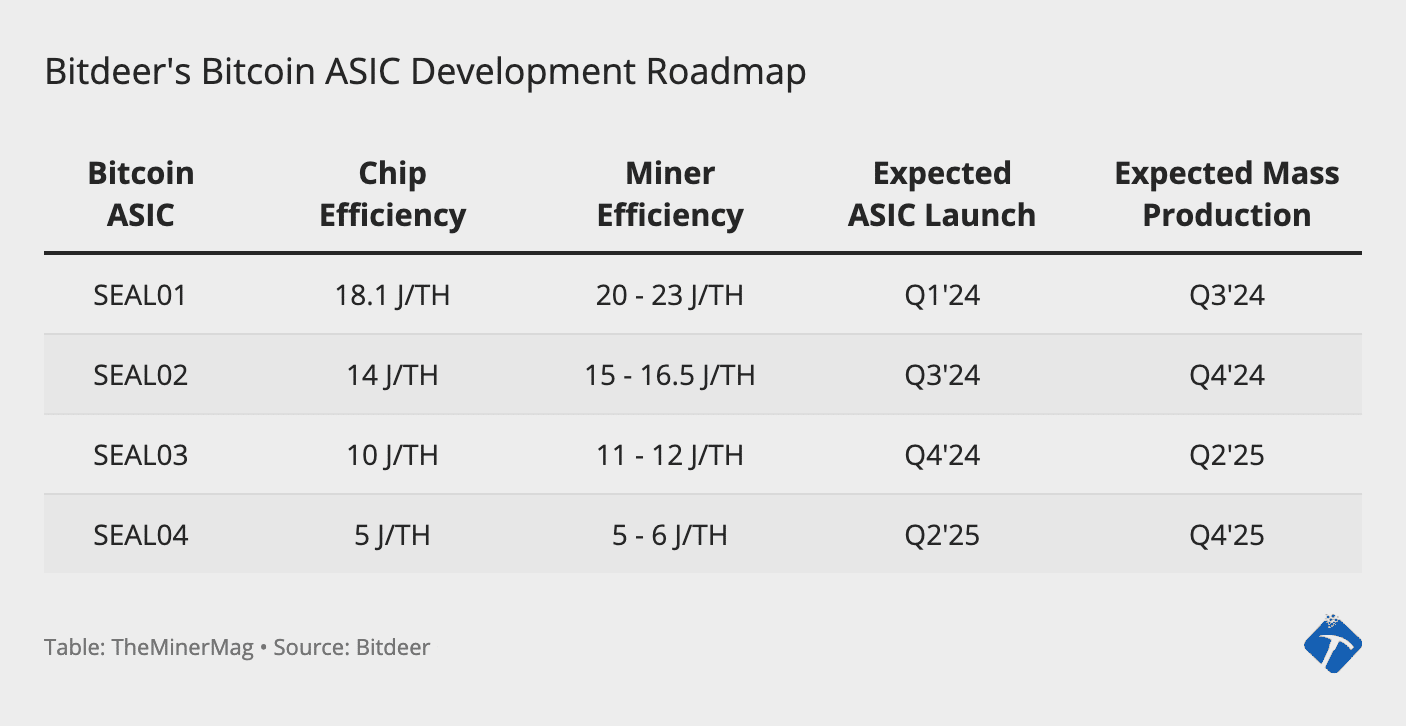

Bitdeer announced SEAL01 earlier this year, the first generation of its proprietary bitcoin ASIC design, touting a chip efficiency of 18.1 J/TH.

According to Bitdeer’s roadmap on Wednesday, the SEALMINER A1, which runs on its first generation of ASIC, has a wall-mount efficiency between 20 J/TH and 23 J/TH and is expected to hit mass production and delivery in Q3.

Bitdeer said its second and third generation of bitcoin ASICs, dubbed SEAL02 and SEAL03, is planned for launch in Q3 and Q4, respectively, with an expected chip efficiency of 14 J/TH and 10 J/TH. Accordingly, the SEALMINER A2 and A3 are expected to achieve an efficiency of around 16.5 J/TH and 12 J/TH, respectively.

In addition, Bitdeer intends to roll out SEAL04 in Q2 next year with a target efficiency of 5 J/TH. Below is a recap of its ASIC roadmap based on the release on Wednesday.

On Thursday, Bitdeer said it is acquiring DesiweMiner, a fabless bitcoin ASIC design company, in an all-stock deal valued at $140 million. Bitdeer recently raised $100 million from Tether in a private placement to fund its chip development and for corporate working capital. The deal also offered Tether a warrant to purchase up to an additional $50 million of Bitdeer’s stocks listed in the U.S.

Bitdeer reported research and development expenses of $21.2 million in Q1 this year, including a “$14.1 million one-off incremental development expense related to the SEAL01 chip.”

For context, Bitmain’s Antminer S21 Pro, its latest generation of bitcoin ASIC miner on the market, boasts an efficiency of 15 J/TH. At an energy rate of $0.07/kWh, an S21 Pro’s breakeven hashprice is estimated to be $25.2/PH/s.

The lack of transparency around inventory planning or new product launches from ASIC miner manufacturers has long plagued bitcoin mining companies, complicating purchase planning, risk assessment, and business strategy development.