A List of Recent Insider Transactions of Bitcoin Mining Stocks

Executives of public mining companies have made frequent insider transactions over the past few months amid the market rally with the latest carried out by CleanSpark’s chairman Matthew Schultz.

According to a Form-4 filing on Wednesday, Schultz sold 367,000 shares of CLSK at an average price of $23.07, netting about $8.5 million in gross proceeds. The transaction comes a month after he sold another 322,400 shares for $6.75 million in February.

CleanSpark’s CEO Zachary Bradford also sold 443,000 CLSK shares last week after liquidating 363,900 shares in February, worth $16 million in total.

The two most recent transactions by Bradford and Schultz were made in accordance to their respective prearranged 10b5-1 trading plans, as indicated in their Form-4 filings.

The SEC’s Rule 10b5-1 allows insiders of publicly traded companies to make a trading plan as to when and how they want to execute transactions under the plan at a later time. The goal is to prevent insider trading with non public material information. Executives must make public disclosures when they execute such transactions but are generally not required to publicly disclose the exact terms of the prearranged plans.

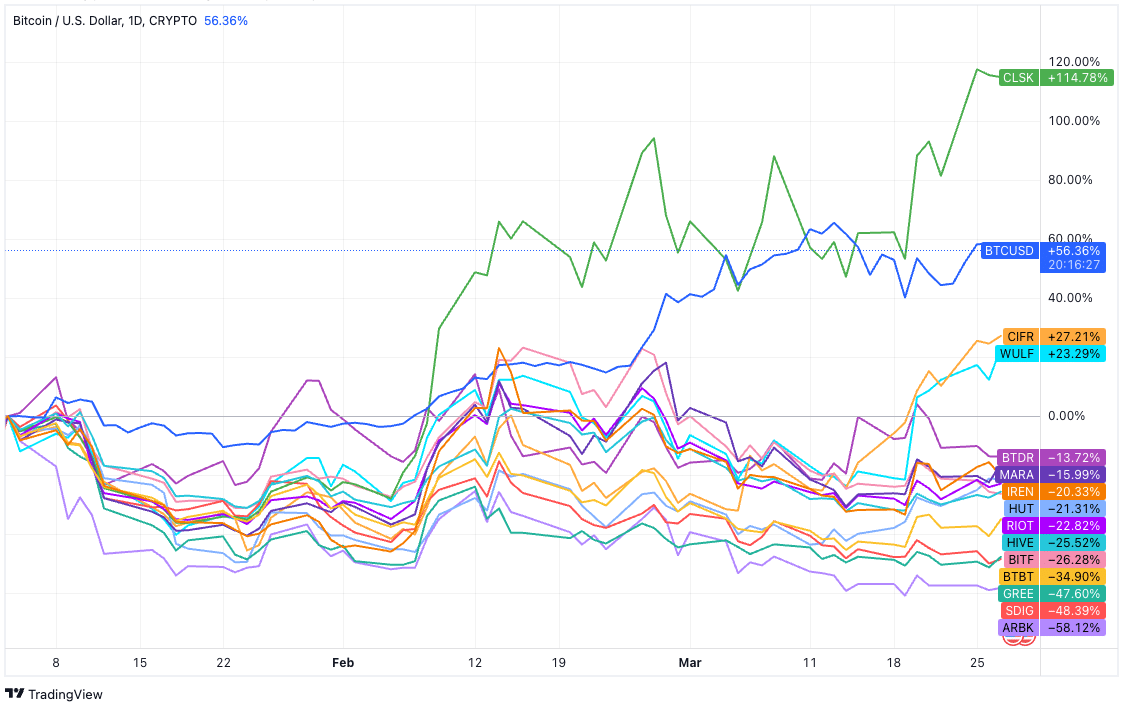

CleanSpark’s share price has experienced a notable rally this year, being the only bitcoin mining stock that has outperformed bitcoin year-to-date, as the chart below shows.

Cipher and Terawulf are the only two other stocks that recorded gains so far despite bitcoin appreciating by over 50% to over $70,000. Other long-time major mining stocks like Marathon and Riot are all trending down by double digits after significantly outperforming bitcoin throughout 2023.

CleanSpark is not the only mining firm whose management team has reported insider transactions. The table below summarizes some recent sales and purchases among executives of U.S-listed mining companies.

Notably, Core Scientific’s CEO, as well as four other board directors, purchased $1.2 million worth of CORZ stocks combined earlier this month in a move demonstrating their confidence in Core’s future after halving. Core regained the position as the largest public bitcoin mining firm by proprietary production in February as its main competitor Marathon Digital experienced material downtime.

Meanwhile, Stronghold Digital’s CEO, CFO, and co-founder have been liquidating some of the stakes since December, receiving proceeds totaling about $3.1 million. Iris Energy’s two co-founders also sold 1 million shares each of their IREN stocks in December worth nearly $10 million in total.

Northern Data’s CEO Aroosh Thillainathan, on the other hand, has executed prearranged plans since January to buy €30 million worth of Northern Dat shares and has increased his stake to 7.15%.