CoreWeave Reports $1.9B AI Revenue in IPO with 62% Margin

Crypto-mining-turned-AI cloud provider CoreWeave has filed for an initial public offering (IPO) in the U.S., reporting a revenue of $1.9 billion for 2024, with a cash-based operating margin of 62%.

The former Ethereum mining firm submitted its S-1 form to the SEC on Monday, seeking to raise $4 billion at a valuation of $35 billion. According to the prospectus, CoreWeave’s revenue surged from $15.8 million in 2022 to $229 million in 2023, and $1.92 billion in 2024.

For 2024, CoreWeave reported total operating costs of $1.6 billion, which include $493 million in cost of revenue, $960 million in technology and infrastructure, $18.4 million in sales and marketing, and $118 million in general and administrative expenses.

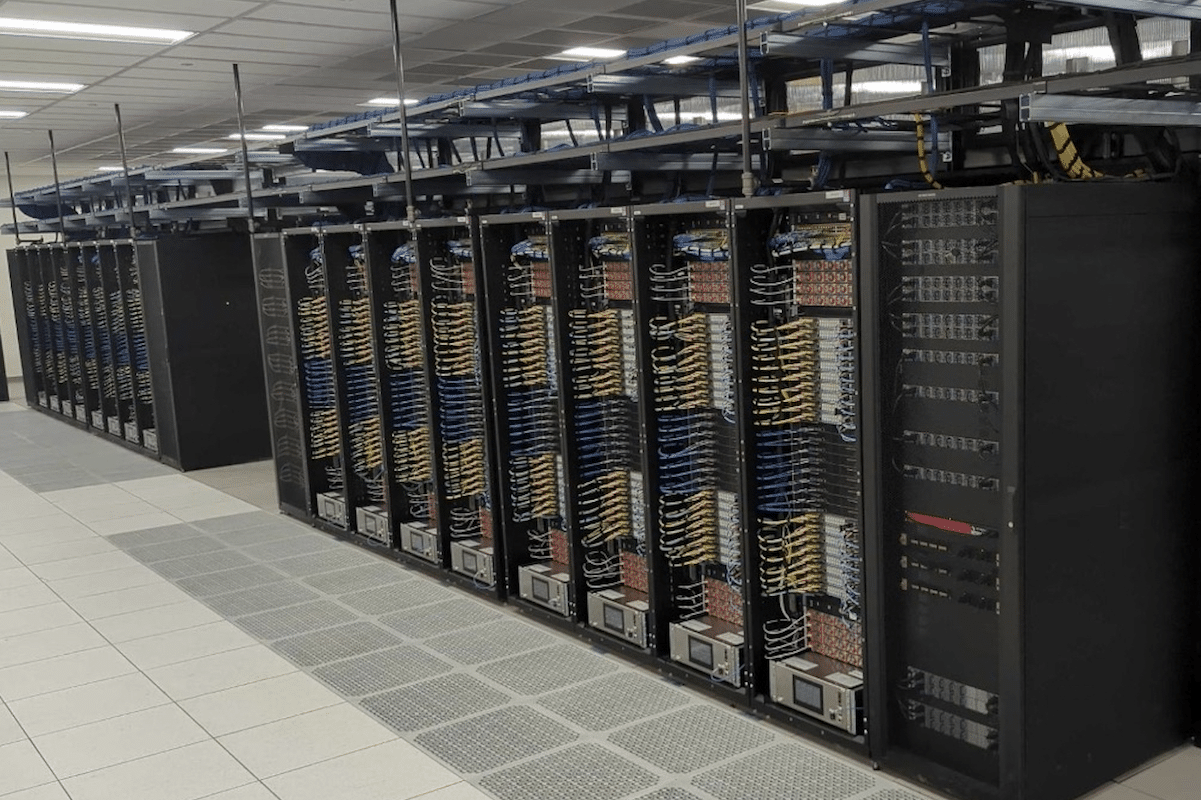

The cost of revenue covers data center rental, power and personnel expenses. As of December 31, CoreWeave had over 360 megawatts of active power and approximately 1.3 gigawatts of contracted capacity. Bitcoin mining and data center operator Core Scientific alone has agreements in place for a total supply of 500 MW.

Notably, the $1.6 billion in costs includes non-cash infrastructure depreciation and amortization of $843 million, as well as $31.5 million in stock-based compensation.

Excluding these non-cash expenses, CoreWeave would report a 62% operating margin before tax and interest expenses.

In 2024, the company incurred a net interest expense of $360 million, resulting from current and long-term loans of $2.5 billion and $5.5 billion, respectively. As of December 31, CoreWeave’s debt-to-equity ratio stood at 1262.8%.

The company also had a net cash inflow of $7.5 billion from financing activities in 2024, with about $7 billion of that from debt financing. Meanwhile, it invested $8.7 billion in the purchase of property, equipment, and capitalized internal-use software.

CoreWeave noted that it discontinued Ethereum mining in 2022 following the network’s transition to proof-of-stake. That year, the company generated $9.7 million in revenue from Ethereum mining, accounting for 61% of its total revenue.