Miner Weekly: Mining Stocks About to Pump? Here’s What History Says

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

In a historic moment, Bitcoin set an all-time high this week after more than 840 days. Mining stocks, on the other hand, have remained on the sidelines. Let’s see how likely they are to follow BTC’s suit.

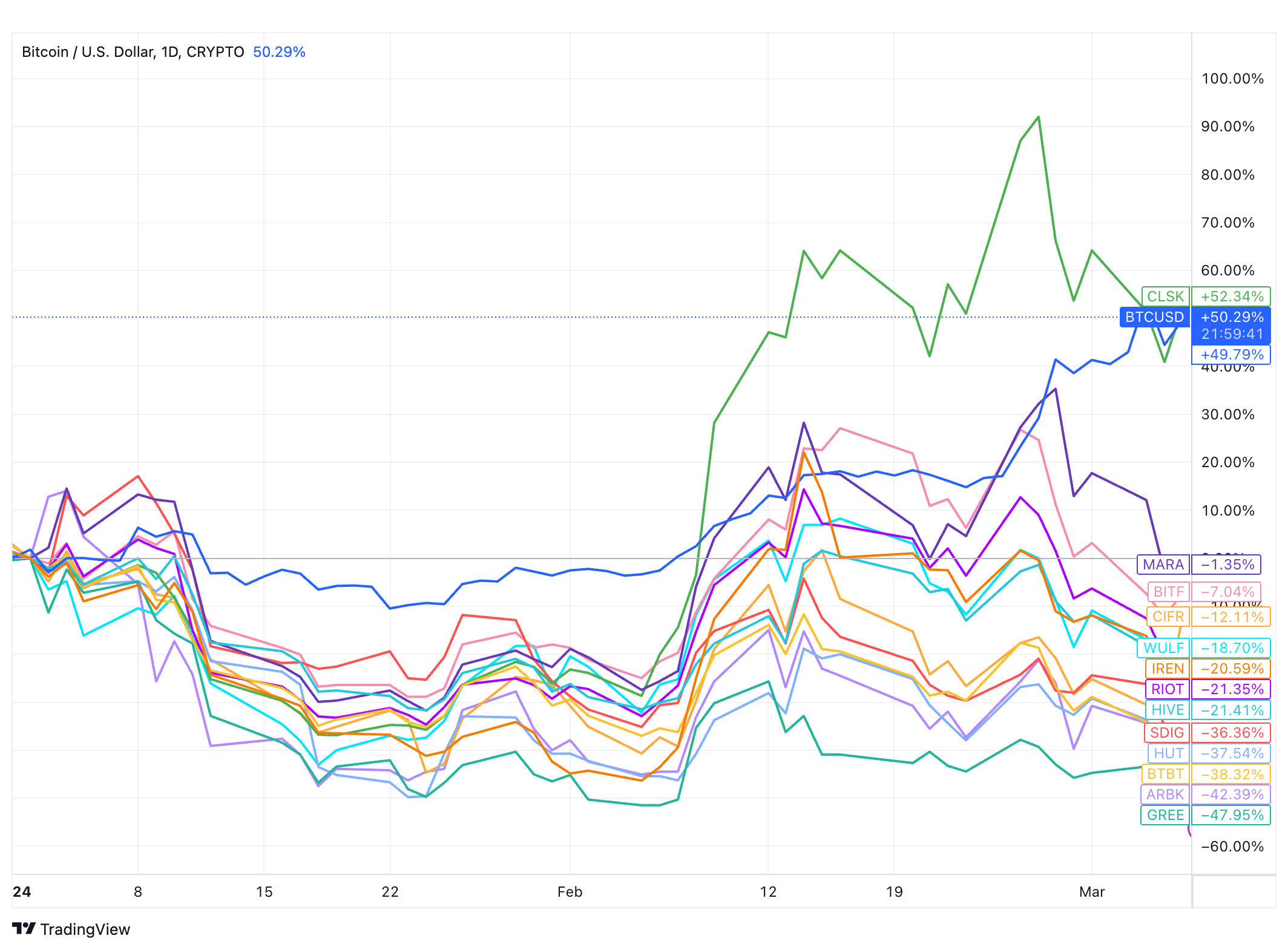

Bitcoin started the New Year at around $42,000. It recorded a gain of 50% year-to-date as of Mar. 6. The chart below shows that mining stocks largely underperformed compared to bitcoin, except for CleanSpark matching up with bitcoin’s rally.

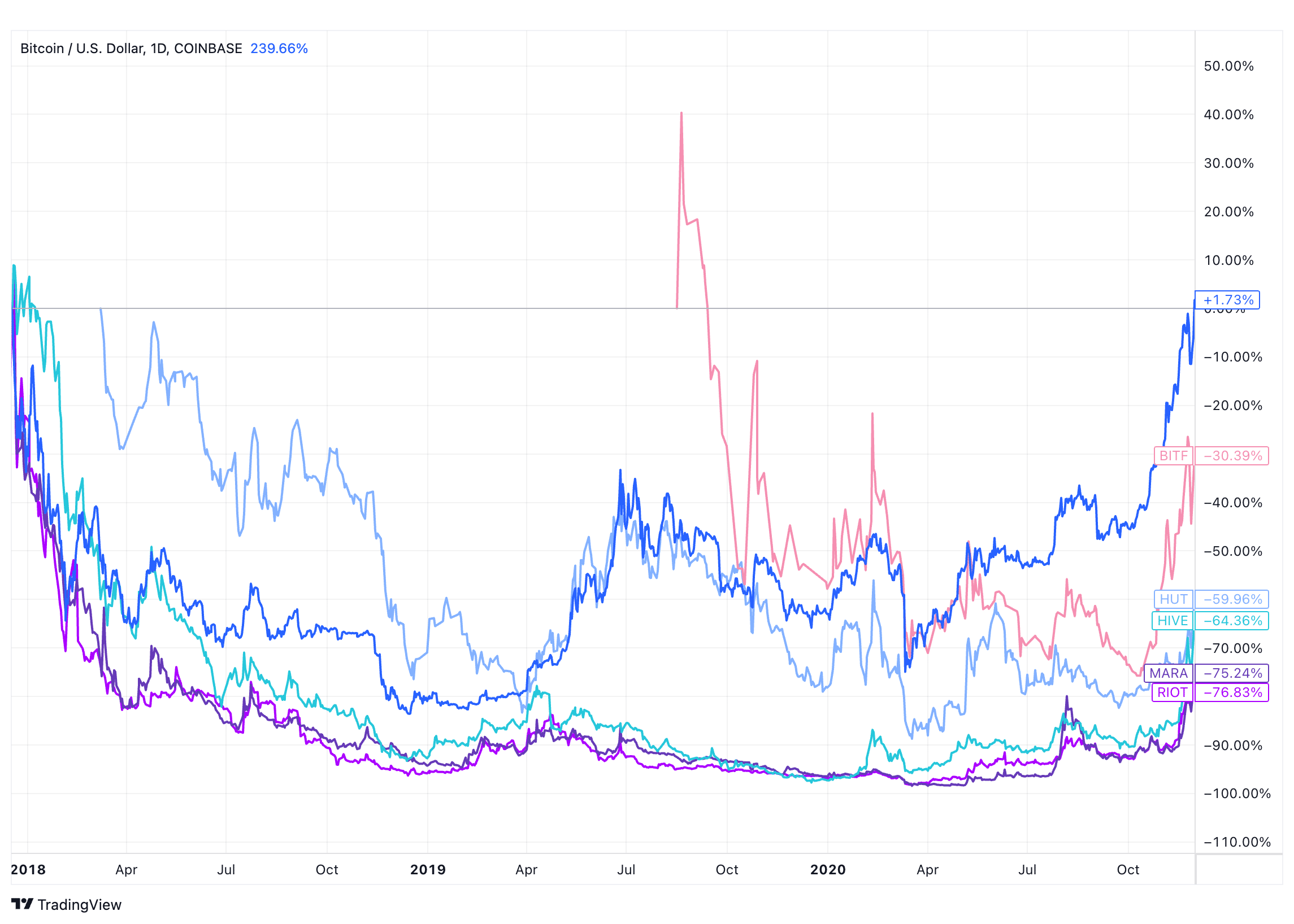

But zooming out, it is notable that none of the mining stocks is even close to the highs they set around Nov. 8, 2021, when bitcoin briefly touched $69,000. Almost every mining stock is still down more than 60% compared to their November 2021 highs, as the chart below shows.

One of the potential reasons behind this disconnect is that investors might be rotating to spot ETFs now that they can directly be exposed to bitcoin without using mining stocks as a proxy. Notably, they could rotate back into mining stocks seeking higher volatility once the bull market signal becomes too obvious to stay on the sidelines.

Either way, historical trading data shows that this is not the first time that mining stocks have lagged behind bitcoin’s return to an all-time high.

In December 2017, Bitcoin touched the $19,500 mark for the first time ever and did not regain that level until December 2020. During those three years, there were only five public mining stocks in North America: Marathon, Riot, Hut 8, HIVE, and Bitfarms. Similarly, they all underperformed compared to bitcoin at the time.

What’s interesting, though, is what happened in the year afterward.

Bitcoin started a bull run from $19,500 in December 2020 to $69,000 in November 2021. During those 11 months, the five mining stocks that existed before December 2020 all managed to outrun bitcoin by notable margins.

Should the full bull run return, history could very well repeat itself. The main difference this time, though, is the spot bitcoin ETFs and the fact that bitcoin has returned (albeit briefly) to its all-time high even before the imminent halving. In 2016 and 2020, that did not happen until months after the halving event. What does that mean for mining stocks? The answer lies in the months ahead.

Regulation News

- U.S. Department of Energy Will Start Comment Period on Miner Survey Proposal – CoinDesk

Hardware and Infrastructure News

- Hut 8 Closes Alberta Bitcoin Mining Site Ahead of Halving – TheMinerMag

- Argo Sells Bitcoin Mining Site for $6.1M to Repay Galaxy Debt – TheMinerMag

- Digihost to Host 700 PH/s of S19XPs for ‘Leading’ Bitcoin Miner Manufacturer – TheMinerMag

- Argo Sells Bitcoin Mining Site for $6.1M to Repay Galaxy Debt – TheMinerMag

- Bitdeer Touts 18.1 J/TH Efficiency in Proprietary Bitcoin ASIC – TheMinerMag

- Core Scientific Signs Multi-Year Hosting Contract with CoreWeave for AI and HPC Capacity – Link

Corporate News

- Bitmain-Backed BitFuFu Lists on Nasdaq via SPAC Merger – TheMinerMag

- Marathon’s Slipstream Mines Largest Bitcoin Block on Record – Unchained Crypto

Market News

- Bitcoin Miners Are Struggling After ETF Launch—Except One – Decrypt

- Bitcoin Sets Lifetime Highs Above $69,000 – TheMinerMag

- Applied Digital Secures $16 Million Loan for $10MW HPC Data Center – Link

- BIT Mining Completes Sale of BTC.com’s Mining Pool Business – Link

Feature

- Bitcoin halving euphoria masks an existential threat – DLNews

- Bitcoin Soared to an All-Time High. So Why Aren’t Miners Blasting Off, Too? – CoinDesk

- ZK ASIC Miners With Michael Gao and Nazar Khan – The Mining Pod

- Elizabeth Warren Is Targeting Bitcoin Miners – The Mining Pod