Miner Weekly: Equity Investment is Flooding into Mining Stocks

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

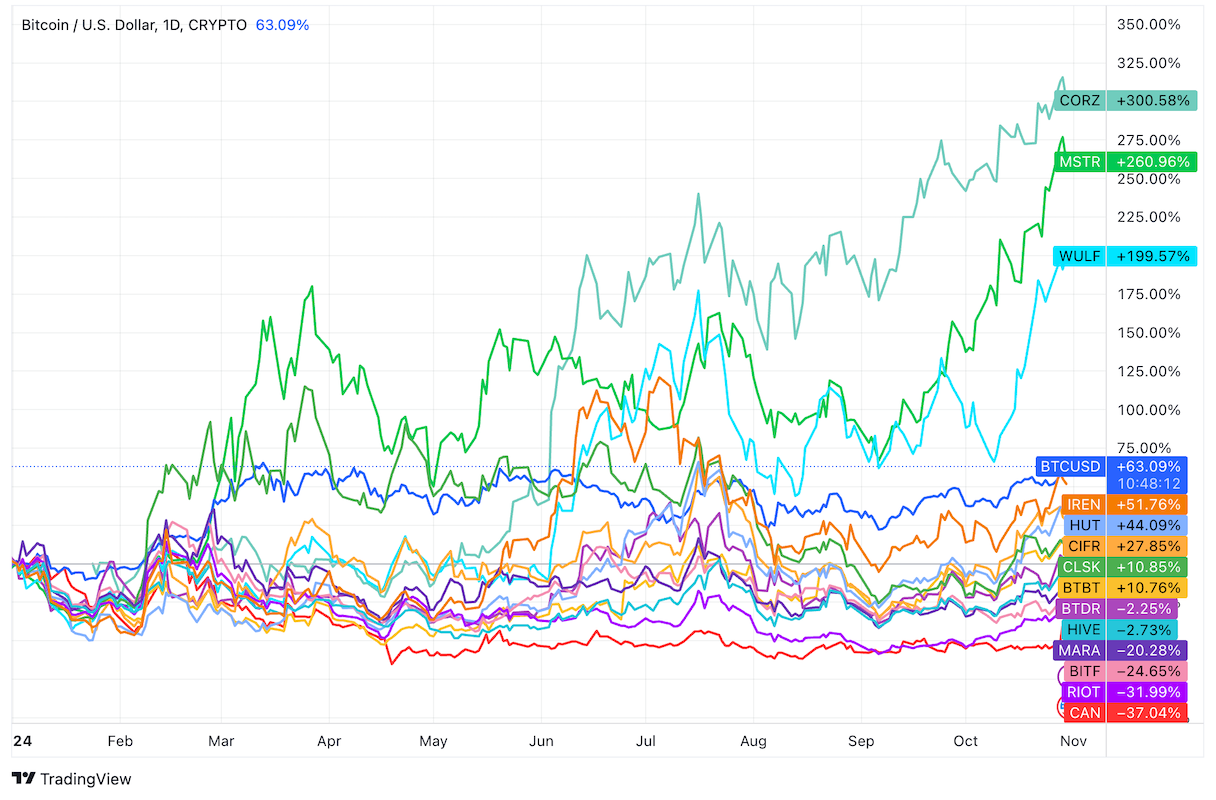

Although only three major public bitcoin mining companies have released Q4 earnings reports so far, it seems clear already that equity investment is flooding into bitcoin mining stocks.

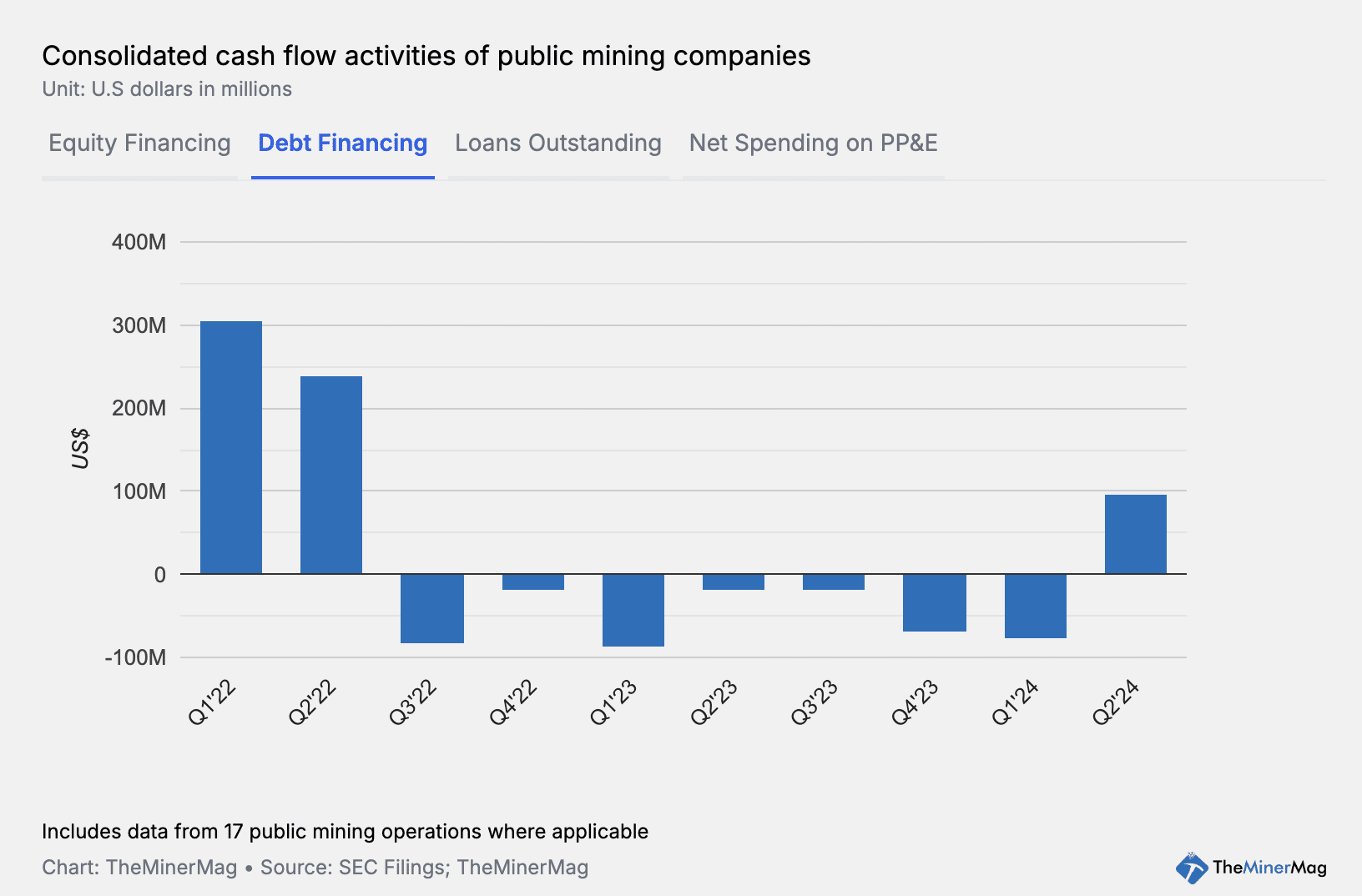

Our latest research report shows that Iris Energy, CleanSpark, HIVE combined raised nearly $350 million through stock offerings in the second half of last year. That significantly dwarfed previous periods since 2022 and is a main factor driving down their fleet hashcost ahead of the halving.

In addition, in their earnings reports for the last quarter filed over the past two weeks, all three companies noted that they have continued to raise more proceeds through stock offerings after Dec. 31, as the chart above shows.

For perspective, Iris Energy raised $93 million in gross proceeds between Dec. 31 and Feb. 15, when it filed the latest quarterly report. That was more than what it raised between July and December. Meanwhile, CleanSpark raised $146.3 million and $93.8 million in Q3’23 and Q4’23 via stock offerings, respectively. Following the New Year, it continued to net another $122 million.

As of Feb. 21, the stocks of HIVE, Iris Energy and CleanSpark were trading at a market capitalization of $377 million, $690 million, and $3.06 billion, thanks to the market rally and equity issuance since mid-2023.

Interestingly, both Iris Energy and CleanSpark indicated in their earnings calls this month that there is a decent probability this year that they will exercise at least part, if not the entirety, of the options to buy additional Antminer S21s from Bitmain.

If they do exercise all of their options, that means an additional capital investment of nearly $450 million. It seems that equity financing for public mining companies overall is set to surge in the coming months as many companies announced preorders for the latest generation of equipment in December.

As outlined in a previous issue, various subsidiaries of BlackRock have increased their positions in Marathon, Riot and CleanSpark during the second half of 2023. Recent filings show that BlackRock also loaded up on stocks of Bit Digital, owning 8.2% of the New York-based mining company.

Hardware and Infrastructure News

- Hut 8 Completes Transaction to Acquire 310 MW Power Plants with Macquarie – Link

- Denton Municipal Electric in Talks with Mysterious Crypto Mining Operation about Setting up Shop – Denton Record Chronicle

- Oklahoma-based Polaris Technologies is Building a 200 MW Cryptocurrency Mining Facility in Muskogee – NewsOn6

- Growth of Local Cryptocurrency Mining Operation in Tazewell, VA, Hindered by Electricity Rates – WVVA

- HIVE Retiring Old Bitcoin Miners as Hashcost Hovers $50/PH/s Ahead of Halving – TheMinerMag

Corporate News

- Angry Texans Fight Bitcoin Mine’s 80000 Noisy Machines in Test for Industry – DLNews

- Marathon is ‘Shopping Around’ for Acquisitions Ahead of Halving – DLNews

- Cormint Boasts $9.2k in Bitcoin Production Cost for 2023 – TheMinerMag

Financial News

- DMG Pledges 238 BTC for Loan Funding Bitcoin Miner Purchases – TheMinerMag

- Stronghold Pledges 5k Bitcoin Miners as Loan Collateral – TheMinerMag

Feature

- Justin Sun Has Bitcoin Ambitions – The Mining Pod

- TAKEOVER: The Return of the GigaChad – The Mining Pod