Miner Weekly: When All-Time High for Bitcoin Mining Stocks?

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

ICYMI: Over the weekend, reports surfaced that TSMC had cut ties with Bitmain co-founder Micree Zhan’s AI chip company, as part of a U.S. investigation into TSMC’s potential sanctions violation with Huawei. This development holds serious implications for Bitmain’s bitcoin mining ASIC business, as it relies heavily on access to TSMC’s advanced chip fabrication facilities. Notably, Bitmain’s current partnership with TSMC could be in jeopardy, affecting numerous Antminer orders from major U.S.-based mining companies.

To clarify its position, Bitmain swiftly issued a statement Monday denying any involvement in the U.S. investigation into TSMC and Huawei. (Catch up on the full story here)

A Side Note on the Saga: According to a former Bloomberg journalist in Taiwan, TSMC was reportedly preparing to fabricate ASICs for Bitmain in Arizona by early next year. Despite reaching advanced pre-production stages over the summer, the plan was abandoned in the end.

Bitcoin Nears Record High, Yet Mining Stocks Lag Behind

Bitcoin recently soared past $73,000, peaking at $73,620—close to its all-time high of $73,777 set this past March, as TradingView data shows.

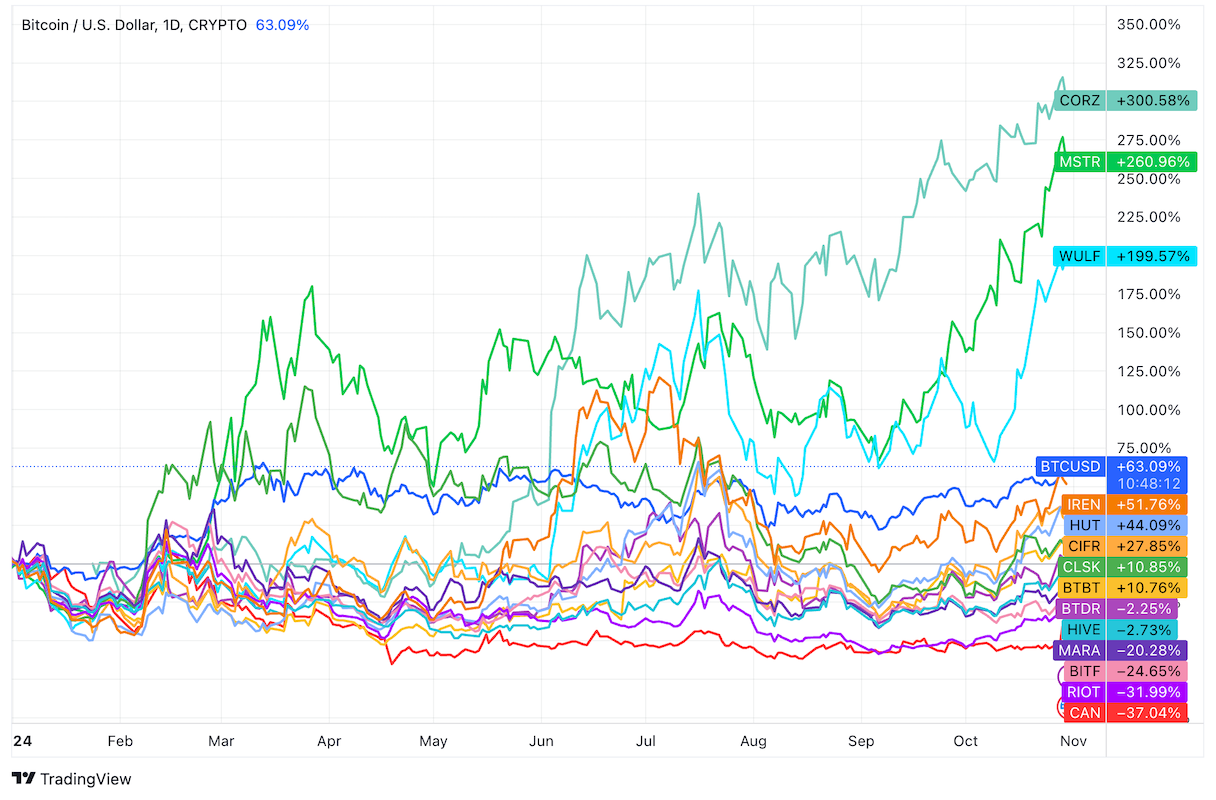

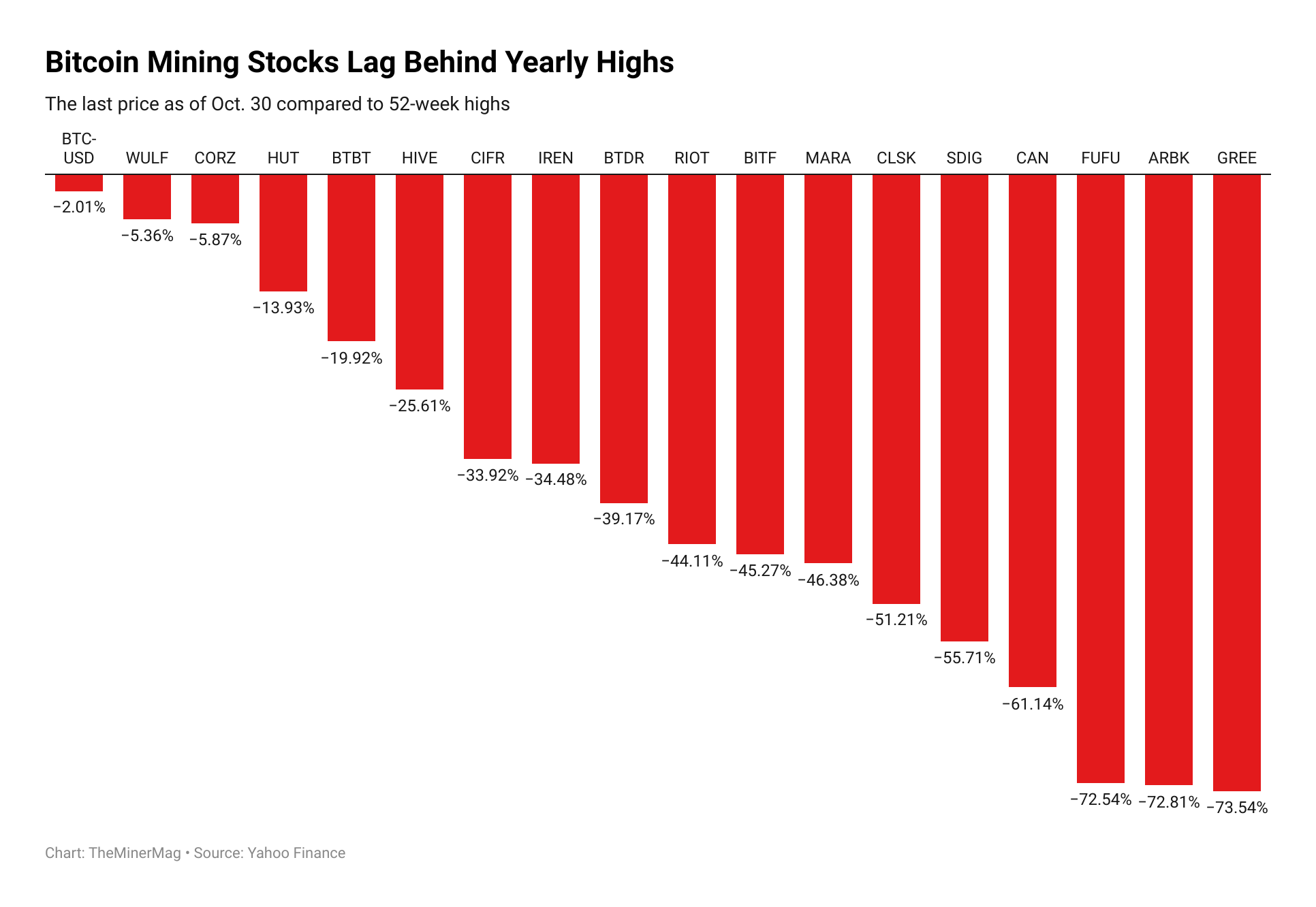

Year-to-date, bitcoin has significantly outperformed most mining stocks, as the chart below illustrates. Despite bitcoin’s price nearing all-time highs, many mining companies remain far from their 52-week highs, especially those focused on holding bitcoin on their balance sheet. These companies have largely been overshadowed by those that have pivoted to Artificial Intelligence or High-Performance Computing, such as Core Scientific and Terawulf, which have no bitcoin holdings, and MicroStrategy, which is a levered play on bitcoin without exposure to bitcoin’s hashprice squeeze post-halving.

However, recent trends hint at a comeback for mining companies holding bitcoins. In the past month, seven out of ten stocks that outpaced bitcoin’s price rise—Hut 8, Riot, Cipher, HIVE, Canaan, CleanSpark, and Bit Digital—held a collective 33,500 bitcoins as of September 30. With the Nasdaq nearing new highs and the U.S. election on the horizon, the coming months promise plenty of market action.

Regulation News

- Draft of proposed Arkansas crypto mine rules awaits governor’s approval, then public comments – Northwest Arkansas Democrat-Gazette

Hardware and Infrastructure News

- Bitdeer Debuts SEALMINER A2 Bitcoin Miner with 16.5 J/TH Efficiency – TheMinerMag

- Compass to Colocate 10 MW of Bitcoin Miners with Cathedra – TheMinerMag

- Company with Glencoe crypto mining operation has plans to move away from residents, transition to AI – The Minnesota Star Tribune

- Bitfarms to Host Another 2.2 EH/s with Stronghold Amid Merger – TheMinerMag

Corporate News

- TSMC Cut Off Bitmain Co-Founder’s Chip Firm Amid U.S. Huawei Probe: Report – TheMinerMag

- DMG Announces Purchase of Reactor.xyz to Offer Hashrate Contracts – Link

- Bitfarms Nominates Former Paxos COO to Board of Directors – TheMinerMag

- NY Judge to Rule on Greenidge’s Bitcoin Mining Permit by Nov 14 – TheMinerMag

- Court Dismisses Former Staffers’ Suit against Northern Data – TheMinerMag

Financial News

- Riot Platforms cuts hash rate outlook, posts $154 million net loss in Q3 earnings – The Block

- Applied Digital to Raise $375M in Convertible Notes Issuance – TheMinerMag

Feature

- Russia’s Bitcoin Economy, Coinmint’s Expansion, and Core Scientific’s $8.7B AI Deal – The Mining Pod

- Trump or Kamala? Bitcoin Mining’s 2024 Presidential Stakes – The Mining Pod

- Inside the Bitcoin miner trade fighting to keep Satoshi’s dream alive – DLNews