Miner Weekly: Coinmint’s Mining Pivot Backfires with $14M Verdict

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

New York-based mining colocation provider Coinmint will pay $14 million to an upstart bitcoin mining chip maker, fulfilling its contractual obligation from 2021, according to the American Arbitration Association’s (AAA) ruling on Feb. 9.

The 110-page ruling from the AAA sheds light on how Coinmint’s bull market dream in bitcoin mining has popped and subsequently turned into a liability.

Coinmint runs colocation data centers, providing hosting services for bitcoin mining companies such as CleanSpark and Bit Digital but does not own proprietary miners. It was founded in 2016 by Ashton Soniat and Prieur Leary, who were childhood friends from New Orleans. They went into legal disputes in 2020 when one wanted to dissolve the firm while accusing the other of doing something behind his back.

Perhaps after witnessing the lucrative exit of bitcoin mining in 2021, Coinmint’s management sought to substantially build up proprietary mining hashrate to have a better shot at going public or raising external capital.

It first reached out to Bitmain, but expectedly was told the production capacity was all booked during the 2021 bull run. Through contacts, Coinmint then got in touch with an upstart fabless bitcoin mining chip team called Katena about its K 10 bitcoin mining chip.

The initial discussion between the two parties was a purchase order of $100 million for 1.6 EH/s in May 2021. Katena asked 50% as a down payment — it needed a significant payment upfront to secure chips from its fabrication processor TSMC.

So, Coinmint made a revised proposal to buy $150 million worth of K 10 miners. The down payment was reduced to 25%, or $37.5 million, but it would be due within three days of signing the contract. The contract was signed on May 13, 2021.

However, Coinmint failed to pay $37.5 million on time despite having made the impression that it had the cash in hand. Instead, according to undisputed facts detailed in the arbitration ruling, Coinmint made a total payment of $23.4 million to Katena between June and November 2021.

The two parties then went into a dispute as Katena voided the contract due to Coinmint’s failure to pay the initial installment on time and in full. In response, Coinmint brought up a lawsuit against Katena in 2023 while the arbitration was ongoing, accusing Katena of fraud and demanding a refund of $23.4 million.

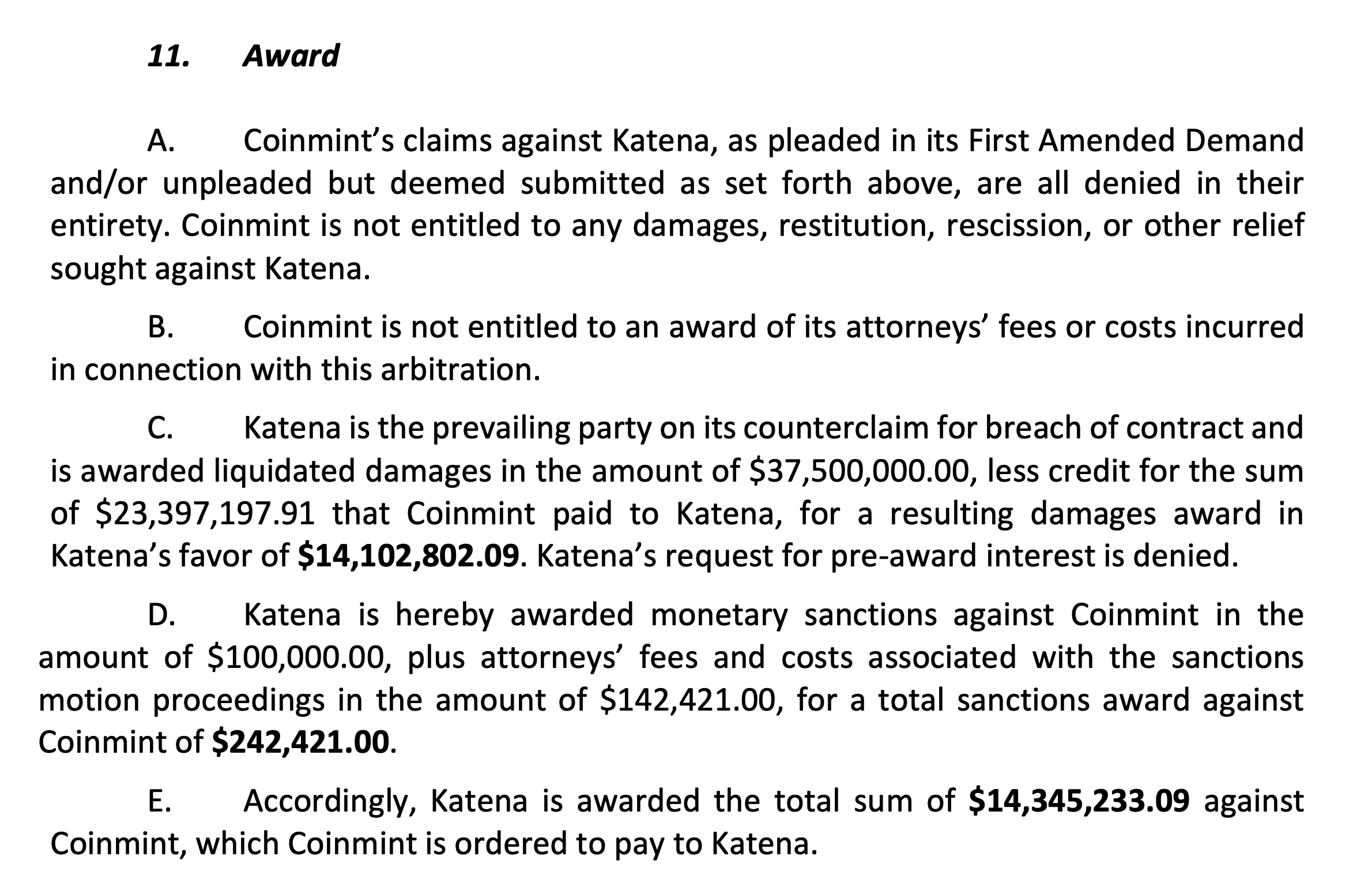

Katena, on the other hand, accused Coinmint of a breach of contract and demanded that Coinmint should pay liquidated damages of $37.5 million. That, after factoring in the $23.4 million that Coinmint already paid, would mean another $14 million.

The arbitration panel overseeing the dispute summoned hearings with key executives from both sides involved in the contract as well as external hardware experts who were hired by Coinmint to run test reports of the K10 chips during their negotiation process.

Based on the evidence gathered over the past year, the panel found that the Katena team had what it needed to start making the hardware for Coinmint because the K10 mining chips were close to the final tape-out in May 2021. Hence, the panel ruled that Katena is entitled to liquidated damages of $14 million.

Below is the full document of the AAA’s ruling on the case of Coinmint LLC v.s. Katena Computing.

Regulation News

- Alberta Electricity Generator Selling Power to Bitcoin Miner Fined for Bypassing Regulatory Approvals – CBC.ca

Hardware and Infrastructure News

- Greenidge Generation Announces $6 Million Investment to Support Ongoing Business Transformation – Link

- Iris Energy Triples AI Cloud Services Business to 816 NVIDIA H100 GPUs – Link

Corporate News

- Marathon’s Bitcoin Mining Host Reports Complete Power Outage – TheMinerMag

- New Hut 8 CEO Prepared to Make ‘Hard Decisions’ to Nix Inefficiencies – Blockworks

Financial News

- Jane Street Increases Marathon Ownership to 6.5%, Worth $334M – TheMinerMag

- Bitcoin Miner Shares Offer Good Entry Point Ahead of Halving Event: Bernstein –CoinDesk

- Canaan Leads Bitcoin Mining Stocks Rally with 21% Gains – TheMinerMag

Feature

- BitDigital’s AI Play With Sam Tabar – The Mining Pod

- Are The Feds Coming After Bitcoin Miners? – The Mining Pod