DMG Pledges 238 BTC for Loan Funding Bitcoin Miner Purchases

Canadian bitcoin mining firm DMG Blockchain has secured a $9 million credit facility with Swiss crypto-friendly Sygnum Bank.

DMG said on Thursday that the loan proceeds will be used to fund the purchase of 4,550 units of Bitmain’s Antminer T21 totaling $12.1 million. The first tranche of $5.6 million has already been disbursed to meet part of its payment obligation to Bitmain.

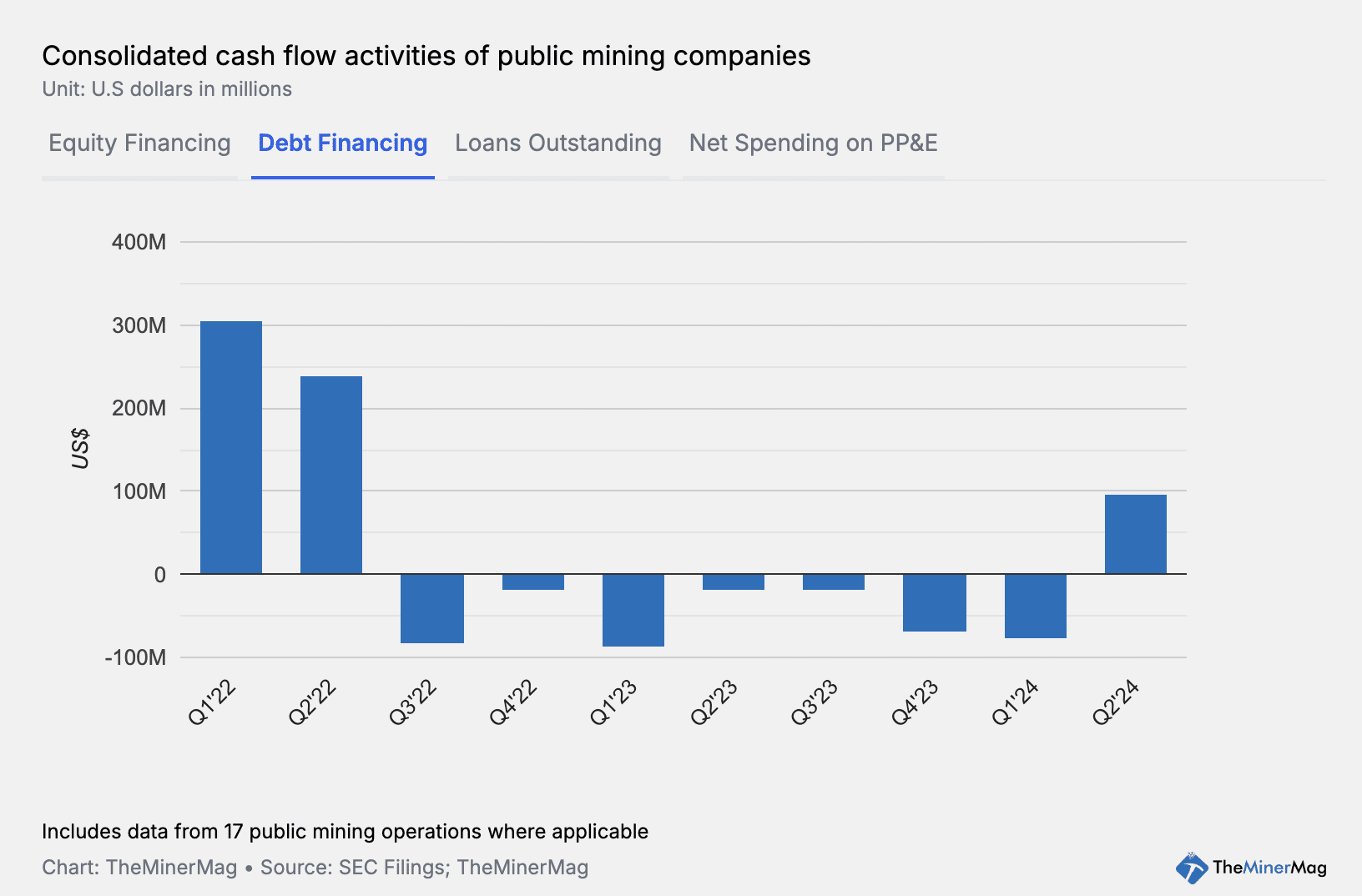

The transaction marks an early sign of the recovery of mining hardware loans as industry participants join an arms race to upgrade their equipment ahead of the halving event in April.

The loan carries an annual interest rate of 7.8% for an indefinite term, secured by 237.8 BTC on DMG’s balance sheet, which has been pledged and deposited with Sygnum.

Based on bitcoin’s market price of $52,000 on Thursday, DMG’s loan-to-value (LTV) rate is estimated to be around 75%. It is not clear what the minimum LTV is to trigger margin calls for DMG.

DMG has been mining between 50 to 100 BTC every month for the past year while steadily increasing its bitcoin reserves. As of Jan. 31, the company had 468 BTC on its balance sheet, worth $24.3 million at the moment.

As reported in December, DMG was among a list of public mining companies committing more than $600 million in equipment investment to expand their hashrate and improve their fleet efficiency.