Iris Energy Preorders Enough Bitcoin Miners to Fulfill 10 EH/s Goal

Bitcoin mining firm Iris Energy has secured enough un-levered preorders of bitcoin miners to reach 10 EH/s in North America by Q2 2024 – a goal that was previously set for “early 2023.”

The company announced on Friday another purchase of 1.6 EH/s of Bitmain’s Antminer T21 equipment valued at $22.3 million, scheduled for shipping in Q2 amid bitcoin’s halving event.

The contract follows Iris Energy’s previous purchase of 1.4 EH/s in Bitmain’s S21 model in October and an additional 1.3 EH/s in the T21 model in November, both anticipated for shipment in Q1.

Iris Energy is also in the process of building out an additional 80 megawatts of infrastructure capacity in Texas to power the newly signed bitcoin miners, which is part of an arms race among public mining companies. As previously reported, top mining companies have committed $1.2 billion in equipment purchases year-to-date and are planning for power expansions in hundreds of megawatts.

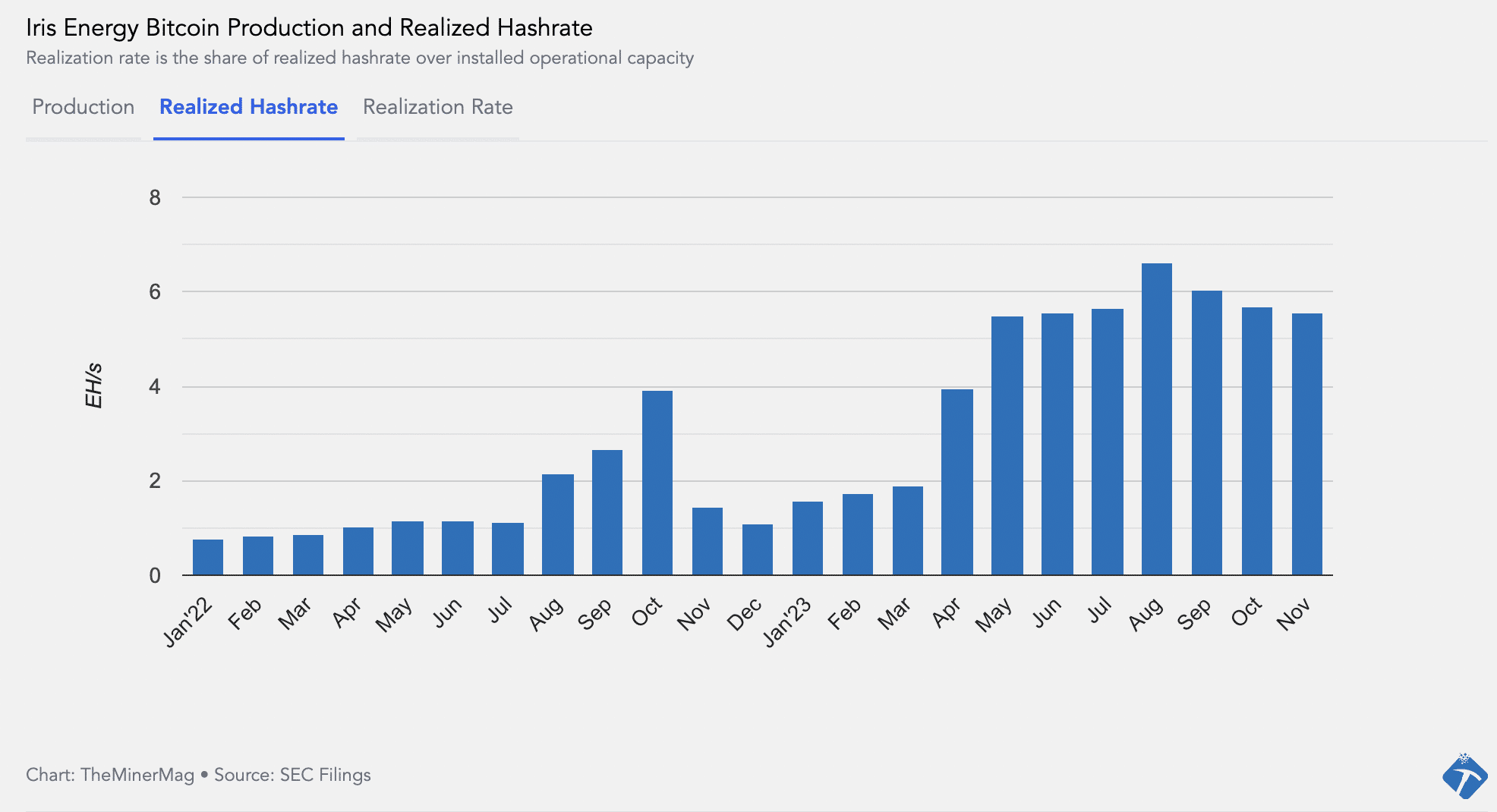

With the accumulation of new preorders totaling 4.3 EH/s at $60 million, combined with 5.6 EH/s already operational, Iris Energy expects to hit the 10 EH/s goal by Q2. That has been significantly delayed from its initial roadmap.

Iris Energy’s bitcoin production capacity took a notable hit in late 2022 as the company defaulted on two equipment financing loans totaling $105 million, which had approximately 3.7 EH/s of miners as collateral. These loans were borrowed from NYDIG in 2021 and early 2022.

In February 2022, Iris Energy said in an announcement that 10 EH/s was “expected to be operational by early 2023” with financed miners as a result of the 2021 market euphemism.

As the broader crypto market worsened in November 2022, Iris Energy defaulted on the miner financing loans and switched off about 37,000 units of S19j Pros. It has since then been involved in a legal dispute with NYDIG.

Iris Energy’s stock price has one of the best performances among its public peers, up by over 300% year-to-date.