If the Supreme Court of British Columbia approves an auction proposal in a hearing set for mid-June, about 37,800 units of the AntMiner S19 series could soon hit the hardware market.

The machines come from the equipment financing loans that Iris Energy (IREN) defaulted on its lending partner NYDIG, resulting in the collateralized equipment sitting idle for months after IREN unplugged them in November from its sites in British Columbia, Canada.

Per the proposed schedule by PricewaterhouseCoopers (PwC), the appointed receiver and manager of the collateral assets, the auction process could start as soon as late June and be completed by early September. If the court allows it, Foundry Digital will facilitate the bidding process.

Auction aside, the default also led to escalated disputes regarding, among many things, whether the mined bitcoin with the financed equipment and the corresponding proceeds should be part of the collateral secured against NYDIG. This article summarizes the case based on court materials which offer a rare look into the inner workings of parties involved in the relatively nascent miner financing market.

Unplug

One of the top five publicly traded mining companies by monthly production, IREN borrowed about $105 million from NYDIG between 2021 and 2022 to purchase around 37,800 units of the AntMiner S19 series from Bitmain.

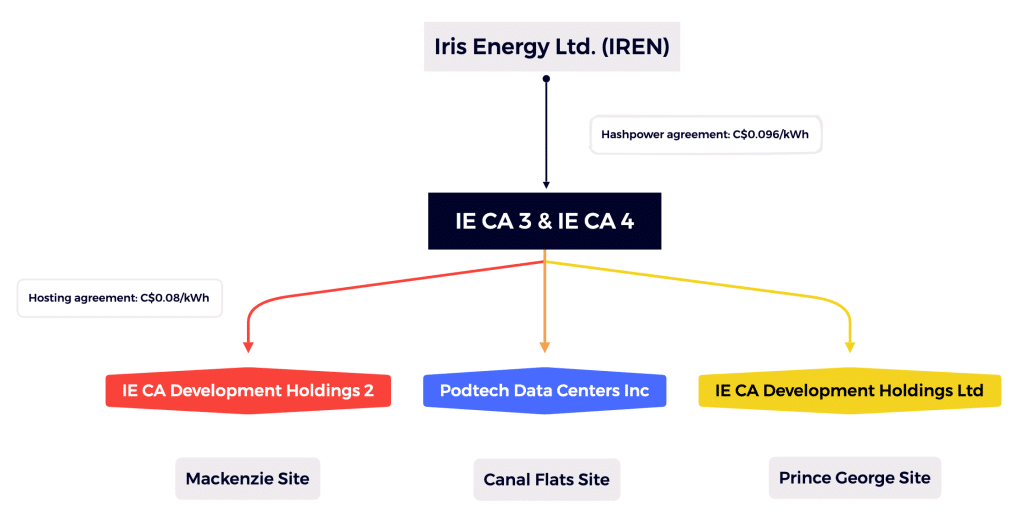

IREN set up two special purpose vehicles (SPVs) – IE CA 3 and IE CA 4 – to ink the lending deals. According to IREN, the nature of this setup means the SPVs have “no parent company guarantee or recourse.” But it is the business structure of these two SPVs that later becomes the center of the dispute with NYDIG.

In November 2022, IREN said the two SPVs were generating “an indicative $2 million of bitcoin mining monthly gross profit” and were not able to pay NYDIG the required monthly principal and interest payment obligations of $7 million. It soon defaulted on the loans and unplugged the financed equipment. Amid bitcoin’s price slump throughout 2022, the market value of the 37,800 miners declined to a steep discount compared to the $114 million that NYDIG said it was owed.

In January, NYDIG filed to the Supreme Court of British Columbia, seeking the appointment of PwC as the receiver and manager of its secured collateral, which was approved by the court. PwC faced initial obstacles as the financed miners were all packaged by IREN after the unplugging. By the time PwC inspected the sites in February, it couldn’t exactly test the equipment or check their serial numbers to properly audit the assets.

After several months of delays and back-and-forth communications, PwC completed the test and said in its third report filed to the court on June 7 that it is proposing an auction to sell the collateralized miners on an “as is, where is” basis. (Proposed auction schedule is on Page 7 of the third PwC report)

Bitcoin collateral dispute

What’s interesting in the first and second reports that PwC submitted over the past months is how the two IREN SPVs did business with the financed equipment, which we visualized in the diagram below based on PwC’s description.

In a nutshell, the two SPVs work like this: they entered hosting agreements with three other IREN subsidiaries to host and manage the financed miners at a cost of C$0.08/kWh; they also signed a hashpower agreement with IREN, selling the parent entity hashpower services for a fee of C$0.096/kWh. From IREN’s perspective, the two SPVs generated income not by exactly bitcoin mining but rather from selling hashrate to IREN. In IREN’s own arguments: “At no time has IE CA 3 or IE CA 4 ever mined, owned or possessed bitcoin.”

Following the first and second reports submitted by PwC, NYDIG filed an application to the court in May, seeking court orders to declare that the bitcoin mined by the financed equipment and the proceeds constitute “collateral” as defined in the miner financing agreements.

In addition, NYDIG petitioned the court to declare that IE CA 3 and IE CA 4 “legally and/or beneficially owned, controlled, and/or possessed the hashpower produced, and bitcoin mined” by the financed equipment prior to it being transferred to IREN. Essentially, NYDIG wants the court to side with its argument that the two SVPs effectively used the financed equipment to mine bitcoin and estimated that $82 million worth of bitcoins were “created by the hashrate produced by the financed equipment during the relevant period.

In another petition entitled “Substantive Consolidation,” NYDIG requested the court to declare that the assets and liabilities of the two SPVs should be “substantively consolidated” with that of Iris Energy. If the court sides with that, then the parent group will likely assume joint liabilities.

Subsequently, IREN filed to the court with responses that opposed the lender’s requests, arguing that NYDIG was aware of the SPVs’ business structure before advancing the loans. In short, IREN believed that NYDIG’s collateral is limited to the assets currently in the possession of PwC, which does not include digital assets. It argued that NYDIG’s application “made misleading statements and attempted to pierce the corporate veil of Iris Energy or otherwise gain access to assets because of dissatisfaction with the deal that was struck.”

Whether the proceeds from the sales of bitcoins that were mined with the financed equipment should be part of the collateral is yet to be determined. But in either case, IREN said the $82 million estimation was “grossly inflated” by NYDIG because it factored in a period when the financed equipment wasn’t operational. Instead, IREN said the hashpower revenue that the two SPVs made during the relevant period was less than $30 million.

PwC’s notes

Also interesting in the case are PwC’s comments after dealing with the assets and communicating with the parties involved, many of which appeared to be in favor of NYDIG since its appointment. In the third report, PwC wrote that based on the SPVs’ receivables from the hashpower agreements and the payables from the hosting agreements, they were not generating sufficient profits to fund the monthly loan payments of $7 million to NYDIG, adding:

“If, as Iris Energy submits, the Debtors (the two SPVs) were never in possession of or had any entitlement to bitcoin generated from the mining equipment, then the Debtors were insolvent from the moment NYDIG advanced the NYDIG loans.”

Additionally, PwC said that based on the information reviewed thus far, it believed the compensation structure under the hashpower agreement and the hosting agreement was not commercially reasonable in that the SPVs were under-compensated to meet its financial obligations, to begin with.

However, it is unclear how IREN determined that the SPVs would pay a cost of C$0.08/kWh to other IREN subsidiaries for hosting while receiving a service fee of C$0.096/kWh. Below is IREN’s self-disclosed monthly electricity cost per bitcoin mined, which was mostly around $10,000 throughout 2022. Even at an assumed overall fleet efficiency of 40J/TH, an electricity cost of $9,304 in October per bitcoin mined would translate to an estimated energy rate of $0.035 per kWh.

Another noteworthy comment that PwC wrote in the third report was regarding NYDIG’s “substantive consolidation” request. Listing out various observations from the experience dealing with IREN, PwC said that it appears the Iris Energy Group was structured to have separate corporate entities for tax efficiency reasons but business activities were conducted as if it was operating as one entity. (Details are on Page 26 of the third report.)

Part of PwC's proposed activities in its latest report is also seeking the court to assign the two SPVs to bankruptcy and to give PwC "enhanced powers available to a trustee in bankruptcy" in an effort to further investigate transactions and dealings between the SPVs and the IREN Group prior to the case.

It remains to be seen how the court will decide on the various disputes including the bitcoin collateral and joint liability. Updates on the case can be found on PwC’s page here.