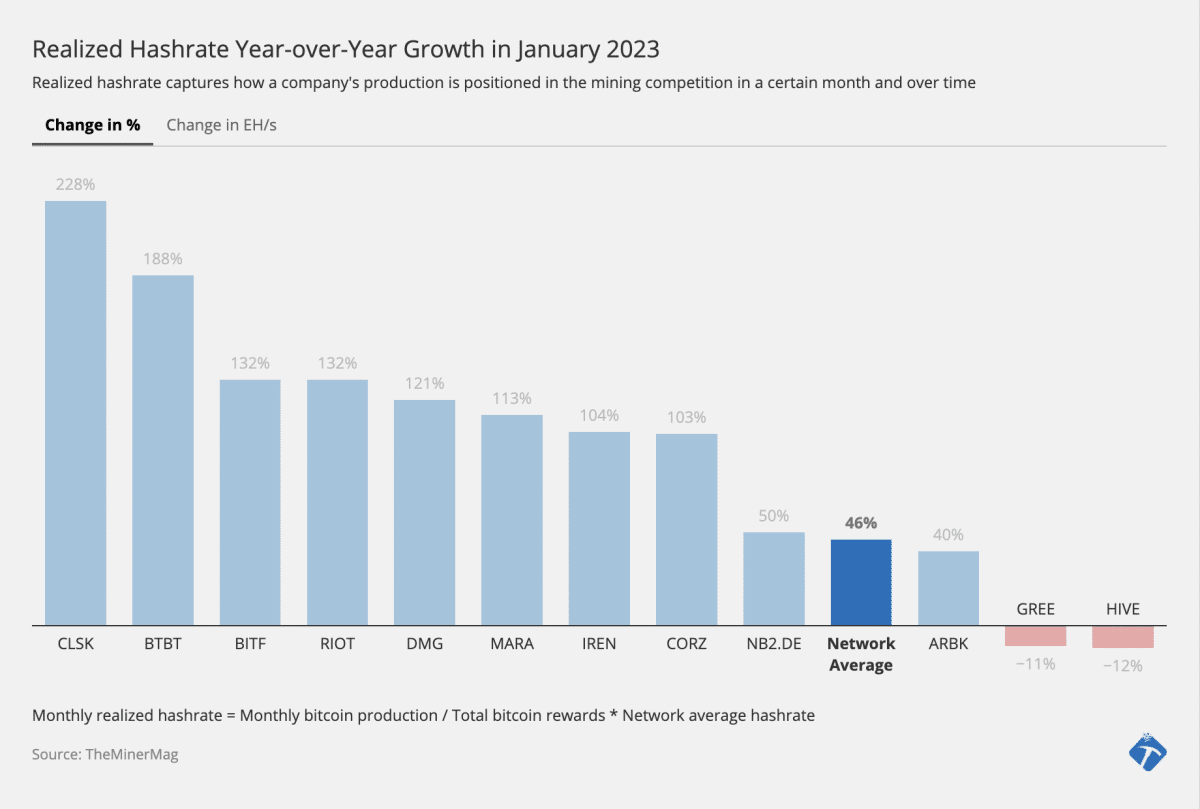

As most publicly listed bitcoin mining companies have updated January 2023 productions, it is worth taking a look at their growth year-over-year (YoY) after a bearish 2022.

Often, the metrics of bitcoin production or deployed hashrate are used to evaluate the growth of public mining firms over time.

But there is a catch: Regardless of the number of deployed or energized mining rigs, the actual amount of bitcoin that one can mine in a month is what is generating potential profits for shareholders and stimulates future growth. And mining bitcoin in January 2022 is not the same as mining the same amount of bitcoin in January this year because the network’s hashrate has changed dramatically.

Because bitcoin mining is a dynamic game, what matters is not only the growth of production but also whether production can outgrow competitors and the network’s average hashrate.

Despite a market downturn in 2022, bitcoin’s average hashrate in January 2023 has increased significantly YoY. So which public mining companies have managed to outgrow their peers and the network’s hashrate (and to what extent) through the bear?

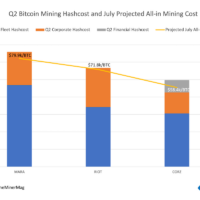

As the chart indicates, bitcoin’s average hashrate in January 2023 reached 273 EH/s, up 46% YoY. CleanSpark has had the fastest growth by percentage and Core Scientific had the most significant increase by realized hashrate value, which was essentially funded by the leveraged hodl strategy that led to its bankruptcy protection proceeding.

The YoY growth of each mining company above in January 2023 is computed based on the changes in their realized hashrate, instead of installed hashrate.

The Realized Hashrate metric captures how one’s actual performance is positioned in the mining competition landscape during a particular month and also over time because it factors in the change of the network’s hashrate. Here’s a more detailed explainer of the metric.

Below is a by-month breakdown of each major mining firm’s realized hashrate from January 2022 to January 2023.

Most of the public mining firms analyzed by TheMinerMag had outgrown the network’s hashrate, although there are a few exceptions. It's worth noting, however, that the realized hashrate of HIVE in January 2022 included the production of BTC equivalent from their respective Ethash mining operations, which has been diminished significantly after Ethereum’s switch to proof-of-stake in 2022.

Another metric that goes hand-in-hand with realized hashrate is the realization rate, which represents the share of one’s realized hashrate over what has been operated. It can be taken as a reference to understand a mining operation’s uptime over time and hence hashrate performance.

Per the chart above, it appears that companies adopting the proprietary mining or self-mining model tend to achieve a higher and more consistent realization rate — perhaps due to better control of their fleet deployment and energization schedule as well as day-to-day maintenance.

For Bit Digital and Marathon, the two public mining companies still relying on the asset-light model, they both had bumpy months throughout 2022 as their colocation providers struggled to energize mining equipment on time due to unexpected human or natural events. In January 2023, Marathon’s hashrate realization rate finally climbed up to over 85% after suffering from several months of significant downtime in 2022. That was the highest in more than 12 months.

As the industry consolidates into the next bitcoin halving, hashrate and performance maximization remain crucial differentiators among public mining firms due to the foreseeable continuous margin squeeze in bitcoin mining.

Share This Post: